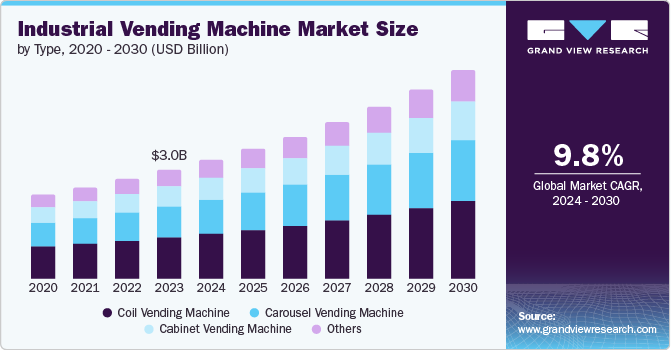

The global industrial vending machine market size is expected to reach USD 5.77 billion by 2030, registering to grow at a CAGR of 9.8% from 2024 to 2030 according to a new report by Grand View Research, Inc. Technological improvements in vending machines have made it possible for businesses to increase the effectiveness of inventory management and track inventory consumption with real-time data analysis, which has led to market growth.

Due to their cost effectiveness, which would allow enterprises to raise their revenue, industrial vending machine use is anticipated to rise in the coming years. Also, a greater focus on worker safety encourages the usage of personal protective equipment (PPE), which in turn leads to a rise in the use of industrial vending machines for PPE. The use of personal protective equipment, MRO tools, and other consumables and durables heavily depends on the growth of key industry sectors like automotive, construction, aviation, manufacturing, and oil and gas.

The need for industrial vending machines is anticipated to increase as these industries continue to expand due to industrialization and globalization. The continuous technological transformation in the vending sector boosts market expansion. The integration of RFID and cloud infrastructure in vending systems have made it possible to track and monitor inventory to stop fraud, including misuse and theft, further fueling the market growth for industrial vending machines.

Gather more insights about the market drivers, restrains and growth of the Industrial Vending Machine Market

Detailed Segmentation:

Type Insights

The coil vending machine held the largest market revenue share of 37.8% in 2023. The demand is rising primarily due to its versatility and efficiency in managing a wide range of small-to-medium-sized items, such as tools, safety gear, and personal protective equipment (PPE). These machines are particularly valued in industries where space optimization and quick access to inventory are critical. The coil design allows for precise control over inventory, minimizing wastage and reducing downtime by ensuring that essential items are always available. Additionally, the ease of customization in coil vending machines to accommodate various product sizes enhances their functionality across different industrial applications, driving increased adoption in manufacturing, healthcare, and logistics sectors.

Product Insights

The PPE segment held the largest market revenue share in 2023. The increasing demand is due to heightened safety regulations and the growing emphasis on workplace safety across various industries. Companies are increasingly adopting PPE vending machines to ensure their employees have easy and immediate access to essential safety gear, such as gloves, masks, and helmets. These machines help maintain compliance with safety standards by automating inventory management, reducing waste, and ensuring that PPE is available on demand. Additionally, the convenience of tracking and managing PPE usage through these vending machines helps organizations optimize costs and minimize downtime, further driving the demand in this segment.

End-use Insights

The manufacturing segment held the largest market revenue share in 2023. Manufacturing environments often require various tools, parts, and personal protective equipment (PPE) to be readily available to workers to minimize downtime. Industrial vending machines provide a convenient and automated way to manage these supplies, ensuring they are available on-demand while reducing wastage and inventory costs. Additionally, the integration of advanced technologies like IoT in these vending machines allows for real-time tracking and inventory monitoring, further enhancing productivity and reducing the risk of stockouts.

Regional Insights

North America held the largest market revenue share of 34.9% in 2023. The region's strong focus on improving operational efficiency across various industries, such as manufacturing, aerospace, and automotive, drives market growth. Companies are increasingly adopting industrial vending machines to reduce inventory management costs, minimize downtime, and ensure the availability of critical supplies such as personal protective equipment (PPE) and maintenance, repair, and operations (MRO) tools. Additionally, the rising emphasis on workplace safety and compliance with regulations has pushed organizations to invest in automated systems that provide controlled access to essential items, thereby reducing waste and unauthorized usage. The region's well-established infrastructure and technological advancements also facilitate the integration of these machines into existing systems, further fueling their adoption.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

• The global polymer filler market size was valued at USD 57.33 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030.

• The global vacuum insulation panel market size was valued at USD 8.25 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030.

Key Industrial Vending Machine Company Insights

Some of the key companies in the global industrial vending machine market include Apex Industrial Technologies, LLC, AutoCrib, Inc., Brammer and others.

• Apex Industrial Technologies is a manufacturer in the industrial vending machine market known for its innovative and technology-driven solutions. The company provides intelligent vending systems to streamline inventory management and enhance operational efficiency across various industries. Apex offers a range of products tailored to specific needs, including coil-based vending machines, locker systems, and automated storage solutions. These products cater to the efficient distribution and management of personal protective equipment (PPE), maintenance, repair, and operations (MRO) supplies and other critical industrial tools.

Key Industrial Vending Machine Companies:

The following are the leading companies in the industrial vending machine market. These companies collectively hold the largest market share and dictate industry trends.

• Apex Industrial Technologies, LLC

• AutoCrib, Inc.

• Brammer

• IMC Group

• SecuraStock

• CribMaster

• Fastenal Company

• Airgas Inc.

• IVM, Inc.

Industrial Vending Machine Market Segmentation

Grand View Research has segmented the global industrial vending machine market based on type, product, end-use, and region:

Industrial Vending Machine Type Outlook (Revenue, USD Million, 2018 - 2030)

• Carousel Vending Machine

• Coil Vending Machine

• Cabinet Vending Machine

• Others

Industrial Vending Machine Product Outlook (Revenue, USD Million, 2018 - 2030)

• MRO Tools

• PPE

• Others

Industrial Vending Machine End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Manufacturing

• Oil & Gas

• Construction

• Aerospace

• Others

Industrial Vending Machine Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East & Africa (MEA)

o UAE

o Saudi Arabia

o South Africa

Order a free sample PDF of the Industrial Vending Machine Market Intelligence Study, published by Grand View Research.

Recent Developments

• In May 2021, CribMaster announced the launch of a new vending machine named FlipTop. This new vending machine is designed specifically for high-value tools and accessories. This drawer-based machine has a capacity of up to 1,782 bins and it is available in three sizes.