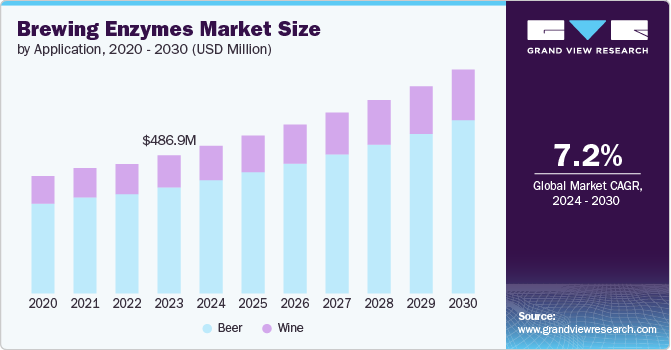

The global brewing enzymes market size was estimated at USD 486.9 million in 2023 and is estimated to grow at a CAGR of 7.2% from 2024 to 2030.Brewing enzymes play an important role in the production of alcoholic beer and wine and are essential for the aroma and flavor of the product. Commercial brewing enzymes have aided in the development of new products and is driven by increased consumer interest in brewery. Brewing is defined as the process of alcoholic production in which the sugars in starch are fermented to ethyl alcohol by using yeast. Commercial enzymes are used to hasten the brewing process and produce finer textures.

Competition amongst various end users across the world in capturing market share is attributed to the growing younger generation reaching the legal drinking age and the emerging cocktail trend. Beer and wine find a higher per capita rate of consumption per population category. With consumers showing increased preference towards value-based drinking, the emergence of specialized breweries that use artificial brewing enzymes have become popular. This is anticipated to drive the market over the coming years. Owing to the various market drivers, players have been capitalizing on existing markets and tapping into new markets. Increasing their capacity has become more cost efficient and convenient owing to the use of brewing enzymes. These are used as a supplement to the mash containing barley for beer production. This enhances the brewing performance, and reduces dependence on malt, hence assisting in balancing production costs.

Gather more insights about the market drivers, restrains and growth of the Global Brewing Enzymes Market

The low cost of malt is a key restraint for the growth of the brewing enzymes market. Traditional brewers widely prefer malt mash as the key ingredient for beer production. Hence, brewing enzymes directly compete with the traditional perception of home-brewed beer, and the population directly seeks naturally produced beer in favor of chemically produced types.

Key Brewing Enzymes Company Insights

- Some of the key players operating in the market include Air Liquide and Total Energies

- India-based Advanced Enzyme Technologies was founded in 1989 and is a manufacturer of enzymes and probiotics. It is one of the largest producers of brewing enzymes in the Asia Pacific region.

- S.-based DuPont de Nemours, Inc. was founded in 1802 and is a global chemicals producer that is also engaged in the production of brewing enzymes.

Regional Insights

APAC dominated the global market and accounted for about 46.0% revenue share of the global market in 2023. This growth is anticipated to continue over the forecast period owing to the increasing number of artisan breweries that cater to a customer base that prefers value to volume-based drinking. Further, to balance raw material cost, various enzymes are utilized by breweries.

Key Brewing Enzymes Companies:

The following are the leading companies in the brewing enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- B. Enzyme Inc.

- Advanced Enzyme Technologies

- Associated British Food plc

- AumEnzymes

- BASF SE

- CBSBREW

- DSM-Firmenich

- DuPont de Neymours, Inc.

- Kerry Group plc

- Lesaffre

- LEVEKING

- Megazyme Ltd

- Nagase America LLC

- Novozymes A/S

- SternEnzym GmbH & Co. K.G.

Order a free sample PDF of the Brewing Enzymes Market Intelligence Study, published by Grand View Research.