Business Aircraft Market Overview

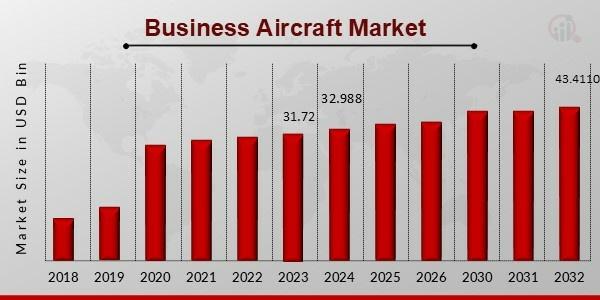

The business aircraft market is undergoing significant transformations, fuelled by emerging technologies and the changing dynamics of global commerce. In 2023, the market was valued at USD 31.72 billion, and projections suggest that by 2032, it will grow to USD 43.41 billion, registering a compound annual growth rate (CAGR) of 3.49% between 2024 and 2032. As companies continue to prioritize efficiency, connectivity, and sustainability, business aviation is increasingly seen as an essential asset for growth. This article explores the key drivers, trends, and opportunities shaping the business aircraft market in the years to come.

Business aircraft market companies, often referred to as corporate jets, are specially designed to facilitate corporate travel, business meetings, and personal connectivity across global markets. Unlike commercial aviation, business aviation offers unparalleled flexibility, enabling companies to bypass congested airports, optimize schedules, and conduct meetings in-flight. This capability has turned business jets into a critical tool for CEOs, executives, and high-net-worth individuals (HNWIs).

In 2023, the industry rebounded strongly from the COVID-19 pandemic, with a surge in demand for private travel driven by health concerns, time savings, and connectivity. By 2032, the market is anticipated to further expand as companies adopt sustainable aviation solutions, replace aging fleets, and explore innovative aircraft technologies, including electric vertical take-off and landing (e-VTOL) aircraft.

Key Market Drivers

Several factors are accelerating the growth of the business aircraft market.

1. Emergence of e-VTOL Aircraft

The introduction of electric vertical take-off and landing (e-VTOL) aircraft is one of the most groundbreaking advancements in aviation. These aircraft offer the ability to operate in urban environments, requiring minimal infrastructure such as helipads. With the growth of smart cities and urban air mobility (UAM) initiatives, e-VTOLs are poised to revolutionize short-distance travel.

Companies like Joby Aviation, Lilium, and Vertical Aerospace are at the forefront of developing e-VTOL aircraft, targeting corporate travelers looking for faster, more sustainable options to navigate congested cities. This trend aligns with the broader push for decarbonization in aviation, as e-VTOL aircraft emit significantly fewer greenhouse gases compared to traditional jets.

2. Fleet Replacement Programs

Many corporations and charter operators are actively upgrading their fleets, replacing older models with newer, more fuel-efficient aircraft. This trend is particularly strong in North America and Europe, where the demand for next-generation jets with advanced avionics, improved cabin designs, and lower operating costs is high.

Manufacturers like Bombardier, Gulfstream, and Dassault Aviation are leading the charge, offering cutting-edge business jets that prioritize passenger comfort, connectivity, and environmental performance.

3. Rising Demand for Private Travel

The pandemic reshaped global travel habits, with a significant shift towards private aviation due to safety concerns and the desire for flexibility. Even as commercial travel rebounds, many corporations and affluent individuals are opting to continue using business aircraft for the convenience, security, and privacy they provide.

4. Economic Growth and Globalization

Emerging markets, particularly in Asia-Pacific, the Middle East, and Africa, are witnessing rapid economic growth, leading to an increase in corporate travel demand. As global supply chains expand and businesses establish international offices, the need for reliable and efficient business aviation solutions will continue to rise.

5. Advancements in Connectivity

The integration of high-speed inflight Wi-Fi and other connectivity solutions has made business jets more attractive for companies. Executives can now hold video conferences, access real-time data, and stay connected to their teams while in the air, enhancing productivity.

Segmentation Analysis

The business aircraft market can be segmented based on aircraft type, application, and region.

1. By Aircraft Type

- Light Jets: Known for their cost-efficiency and agility, light jets are ideal for short-haul flights. Popular models include the Embraer Phenom 300 and the HondaJet.

- Midsize Jets: Offering more cabin space and range, midsize jets cater to medium-haul travel. Key models include the Bombardier Challenger 3500 and the Cessna Citation Longitude.

- Large Jets: Designed for long-haul travel, these aircraft offer luxurious cabins and advanced features. Examples include the Gulfstream G700 and Dassault Falcon 10X.

2. By Application

- Corporate Travel: The largest segment, driven by multinational corporations and charter operators.

- Leisure Travel: Increasingly popular among HNWIs seeking personalized travel experiences.

- Special Missions: Business jets are also used for medical evacuations, government missions, and disaster response.

3. By Region

- North America: Dominates the market due to the presence of leading manufacturers and a high concentration of corporate clients.

- Europe: A growing market driven by economic recovery, sustainability initiatives, and increasing demand for charter services.

- Asia-Pacific: Rapidly expanding due to rising HNWIs and the growing adoption of business aviation in countries like China and India.

- Middle East & Africa: High demand from oil and gas companies, government officials, and luxury travelers.

Competitive Landscape

The business aircraft market is highly competitive, with key players investing in R&D, sustainability, and customer experience.

1. Bombardier

Known for its flagship Global 7500 and Challenger series, Bombardier is a leader in the large and midsize jet segments. The company focuses on innovation, including the introduction of EcoJet, a concept aimed at reducing emissions.

2. Gulfstream Aerospace

Gulfstream’s G700 and G800 models set benchmarks in speed, range, and cabin experience. The company is also a pioneer in integrating advanced avionics and green aviation technologies.

3. Dassault Aviation

Dassault’s Falcon series offers a blend of performance, luxury, and efficiency. The upcoming Falcon 10X is expected to redefine the large business jet market.

4. Embraer

Specializing in light and midsize jets, Embraer is known for its Praetor and Phenom series, which deliver exceptional value for short and medium-haul operations.

5. Textron Aviation

Textron’s Cessna Citation series remains popular among charter operators and small businesses due to its reliability and cost-effectiveness.

Trends Shaping the Future

1. Sustainability in Aviation

Sustainability is no longer optional; it is a necessity. Manufacturers are exploring alternative fuels, such as sustainable aviation fuel (SAF), and hybrid-electric propulsion systems to reduce carbon footprints.

2. Urban Air Mobility (UAM)

The integration of e-VTOL aircraft into urban environments could redefine short-haul business travel, offering faster and greener solutions.

3. Digital Transformation

Advancements in predictive maintenance, artificial intelligence, and digital twins are improving aircraft efficiency, reducing downtime, and enhancing safety.

4. Rise of Fractional Ownership and Charters

As the cost of owning a business jet remains high, fractional ownership models and on-demand charter services are gaining popularity. Platforms like NetJets and VistaJet are capitalizing on this trend.

Challenges Facing the Market

Despite its growth potential, the business aircraft market faces challenges, including:

- High Operating Costs: Maintenance, fuel, and crew costs remain significant barriers for small businesses.

- Regulatory Hurdles: Stringent aviation regulations and infrastructure limitations, particularly in emerging markets, could slow adoption.

- Environmental Concerns: The aviation industry is under pressure to address emissions and achieve carbon neutrality.

Conclusion

The business aircraft market is poised for sustained growth, driven by technological innovations, fleet modernization, and the rise of sustainable aviation practices. By 2032, the market is expected to reach USD 43.41 billion, reflecting its critical role in global commerce and connectivity.

As companies navigate a rapidly evolving business landscape, business aircraft will remain a cornerstone of efficient and strategic decision-making. With the emergence of e-VTOL aircraft, advancements in connectivity, and a focus on sustainability, the future of business aviation is brighter than ever.

For businesses and investors, this is a pivotal time to capitalize on the opportunities within the business aircraft market, shaping a new era of corporate mobility.

About US

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis with regard to diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact US

Market Research Future (part of Wants tats Research and Media Private Limited),

99 Hudson Street,5Th Floor New York 10013, United States of America

Sales: +1 628 258 0071 (US) +44 2035 002 764 (UK)

Email: Sales@marketresearchfuture.com