U.S. Prostate Cancer Treatment Device Industry Growth, Development and Demand Forecast to 2030

The Centers for Disease Control and Prevention (CDC) states that 211,894 new cases of prostate cancer were diagnosed and 31,488 men lost their lives due to this cancer in the U.S. in 2018. Further, the American Cancer Society (ACS) estimates that around 1 in 8 men in the U.S. will be diagnosed with prostate cancer during their lifetime. As per the ACS, non-Hispanic Black men and men aged 65 years or more in the U.S. are more likely to develop this disease during their lifetime.

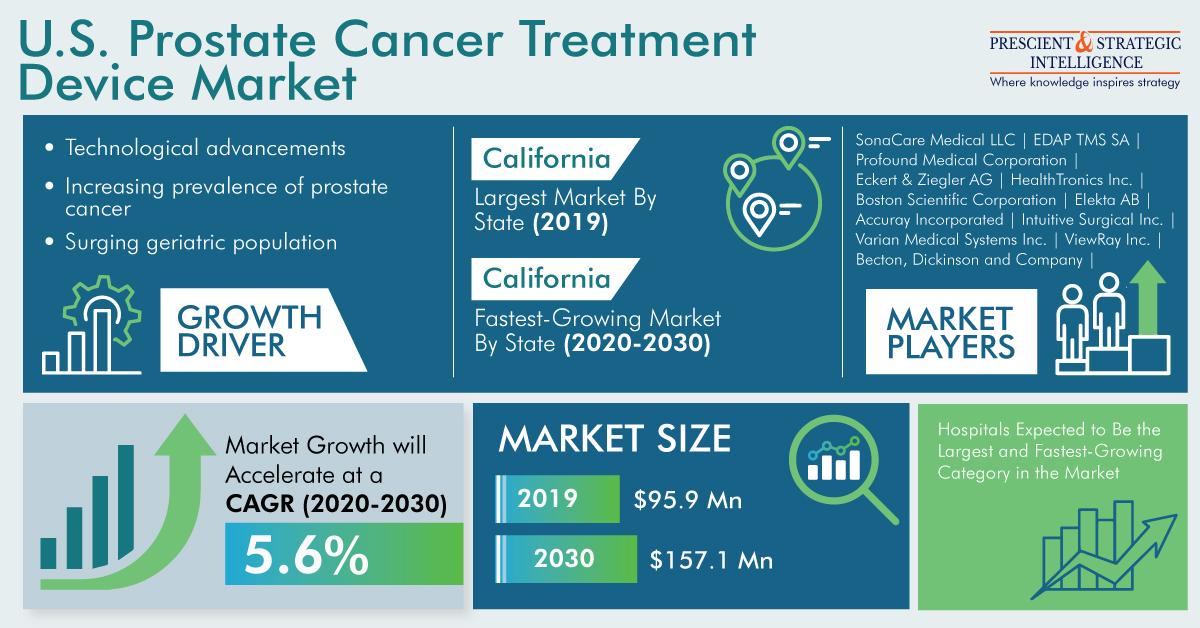

The surging prevalence of prostate cancer is, therefore, expected to fuel the U.S. prostate cancer treatment devices market at a CAGR of 5.6% during 2020–2030. The market revenue stood at $95.9 million in 2019, and it will reach $157.1 million by 2030. To offer better treatment to prostate cancer patients, healthcare facilities in the U.S. are increasingly opting for robot-assisted radical prostatectomy (RP), as it is a minimally invasive surgical procedure that uses surgical robotic equipment to remove the prostate and causes less pain.

Moreover, the advent of precise forms of treatments, such as brachytherapy, image-guided radiation therapy (IGRT), and stereotactic radiosurgery (SRS) and availability of advanced, efficient and automated clinical tools, on account of the constant technological advancements in the healthcare and medical device industries, will also encourage the adoption of prostate cancer treatment devices in the U.S. For instance, in June 2020, CyberKnife S7 System, a next-generation CyberKnife platform, was introduced by Accuray Incorporated to treat benign and cancerous tumors throughout the human body, including prostate glands.

Nowadays, hospitals and specialty centers in the U.S. are using cryotherapy, high-intensity focused ultrasound (HIFU), radiation, and surgery prostate cancer treatment devices to treat prostate cancer patients. In the coming years, radiation prostate cancer treatment devices will be adopted in considerable quantity, owing to the surging acceptance and adoption of radiotherapy in the country. In the U.S., hospitals are the prominent users of such devices as the treatment and diagnosis of prostate cancer are primarily carried out in hospitals in the U.S.

Download sample pages of this report: https://www.psmarketresearch.com/market-analysis/us-prostate-cancer-treatment-device-market-revenue/report-sample

In recent years, prostate cancer treatment device manufacturers have focused on product launches and business partnerships to cater to the burgeoning needs of hospitals and specialty centers. For example, in November 2019, Profound Medical Corporation introduced the Health Canada approved TULSA-PRO system for the removal of low-to-intermediate risk organ-confined prostate cancer. Other medical device manufacturers such as Eckert & Ziegler AG, SonaCare Medical LLC, Theragenics Corporation, Becton, Dickinson and Company, Boston Scientific Corporation, Accuray Incorporated, and ViewRay Inc., are also developing new prostate cancer treatment devices to improve treatment.

According to P&S Intelligence, California dominated the U.S. prostate cancer treatment devices market in the last few years, and it will retain its lead in the forthcoming years as well. The dominance of California can be ascribed to the presence of umpteen hospitals and a vast number of prostate cancer patients in the state. The Cancer Statistics Center of the ACS estimates that 187,140 new cases of prostate cancer will be diagnosed and 61,860 deaths will be caused due to this cancer in California in 2021.

Thus, the growing prevalence of prostate cancer will accelerate the adoption rate of prostate cancer treatment devices in the U.S.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology