Live Cell Imaging Market worth $2.8 billion by 2025 at a CAGR of 8.8%

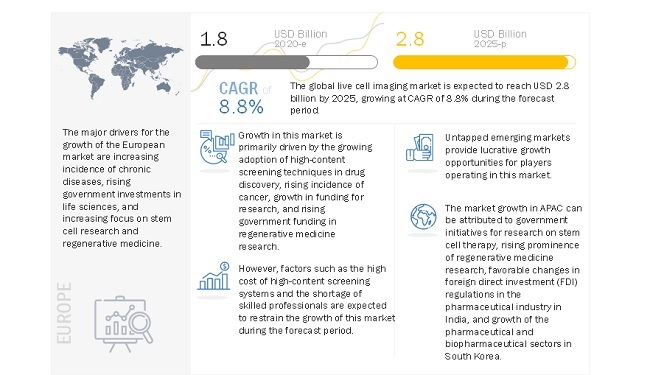

The global live cell imaging market in terms of revenue was estimated to be worth $1.8 billion in 2020 and is poised to reach $2.8 billion by 2025, growing at a CAGR of 8.8% from 2020 to 2025.

Growing adoption of high-content screening techniques in drug discovery and rising incidence of cancer primarily drives the market for live cell imaging. The growth in research funding and rising government funding and investment in regenerative medicine research will also support the market growth in the coming years. However, the high cost of high-content screening systems is limiting the overall adoption of these products.

The traditional method of toxicity and drug safety studies involves the screening of large libraries through high-throughput screening. This method is expensive, has a low success rate, and is resource- and time-consuming. To overcome these challenges, pharmaceutical companies are increasingly adopting high-content screening (HCS) cell-based assays for identifying the effects of toxicity in drug development studies (cell-based imaging enables the monitoring of drug toxicity mechanisms, such as oxidative stress, micronuclei, mitochondrial dysfunction, steatosis, and apoptosis).

The use of HCS makes the drug development process more time- and cost-efficient. Owing to these factors, the adoption of high-content screening for toxicity studies is expected to increase during the forecast period. This, in turn, is expected to drive market growth as live cell imaging is used in HCS to identify meaningful information from complex systems such as in vitro, in vivo, and ex vivo systems.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=163914483

By technology, the high-content screening (HCS) segment is expected to grow at the highest CAGR during the forecast period.”

Based on technology, the live cell imaging market is segmented into fluorescence resonance energy transfer (FRET), time-lapse microscopy, fluorescence recovery after photobleaching (FRAP), high-content screening (HCS), and other technologies. High-content screening (HCS) segment is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing studies on cell behavior and the need to correlate multiple events and markers with cell morphology.

“North America to hold the largest regional market share in 2019.”

North America is expected to account for the largest share of the live cell imaging market in 2019, followed by Europe. The large share of North America can be attributed to factors such as the availability of government funding for life science research, drug development regulations, advances in live-cell imaging techniques, growth in the biotechnology and pharmaceutical industries, and the rising incidence of cancer.

The prominent players in this market are Danaher Corporation (US), Carl Zeiss AG (Germany), Nikon Corporation (Japan), Olympus Corporation (Japan), PerkinElmer, Inc. (US), GE Healthcare (US), Bruker Corporation (US), Thermo Fisher Scientific Inc. (US), Sartorius AG (Germany), Oxford Instruments (UK), BioTek Instruments (US), Etaluma, Inc. (US), CytoSMART Technologies (Netherlands), NanoEnTek Inc. (Korea), Phase Focus Limited (UK), Tomocube, Inc. (South Korea), Phase Holographic Imaging PHI AB (Sweden), BD Biosciences (US), Sony Biotechnology, Inc. (US), Merck KGaA (Germany), KEYENCE Corporation (Japan), ibidi GmbH (Germany), Bio-Rad Laboratories (US), Logos Biosystems (South Korea), and Nanolive SA (Switzerland).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology