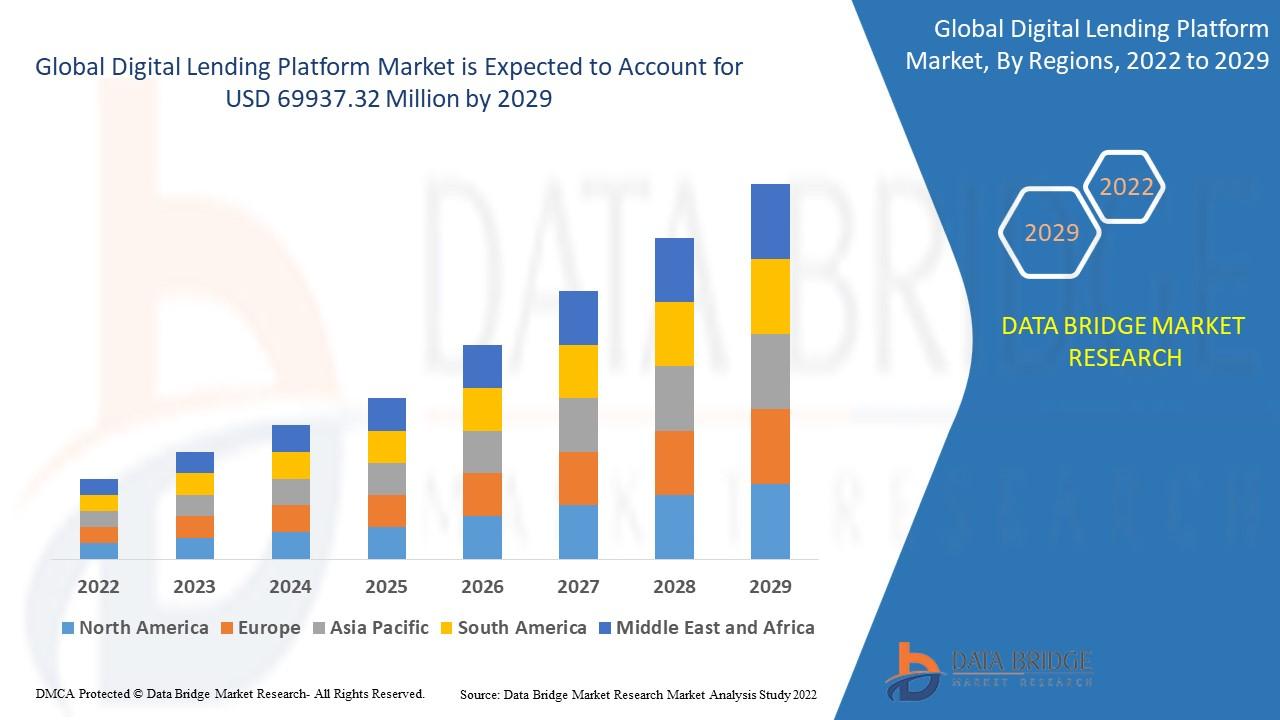

Digital Lending Platform Market Growth to Record CAGR of 19.4% up to 2029

Global Digital Lending Platform Market, By Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations) – Industry Trends and Forecast to 2029

Market Analysis and Size

· Several companies are currently introducing next-generation, end-to-end cloud-based lending platforms. Furthermore, advances in payment trends are encouraging financial institutions to implement DLP in order to improve productivity, increase revenue, and provide quick services.

· Data Bridge Market Research analyses that the digital lending platform market was valued at 16930.68 million in 2021 and is expected to reach the value of USD 69937.32 million by 2029, at a CAGR of 19.4% during the forecast period of 2022 to 2029.

Market Definition

· The digital lending platform enables lenders and borrowers to lend money in a digital or electronic format, resulting in greater ease of use, a better user experience, and lower overhead due to client verification time savings. User registration is the first step in the process, which is followed by online documentation collection, client authentication and verification, loan approval, loan distribution, and loan recovery.

COVID-19 Impact on Digital Lending Platform Market

· The outbreak of the COVID-19 pandemic has benefited the digital lending platform market. In the aftermath of the pandemic, credit unions and banks are enhancing their digital banking offerings to better meet their customers' needs. Furthermore, in COVID-19, banks have begun to increasingly use digital channels for lending loans under the Pay check Protection Program. In the United States, the Pay check Protection Program provides funds to small businesses for up to 8 weeks. According to Numerated, a digital lending platform provider, 82 percent of businesses in the United States choose to apply for PPP loans online rather than through traditional channels during COVID-19.

Recent Development

· Newgen Software will launch its new digital transformation platform, NewgenONE, in July 2021. The platform aids in the management of unstructured data and the enhancement of customer engagement.

· In June 2021, TPBank of Vietnam will collaborate with Nucleus Software to enhance its digital commerce. FinnOne Neo assisted TPBank in providing instant digital loans, increasing process efficiency, and improving credit assessments.

· Fiserv acquired Ondot Systems Inc., a provider of digital experience platforms, in January 2021. This would enable Fiserv to expand its digital solutions portfolio.

· ICE Mortgage Technology will acquire Ellie Mae, a leading digital lending platform provider, in September 2020. The acquisition aided ICE in speeding up the automation of mortgage processes.

Global Digital Lending Platform Market Scope

· The digital lending platform market is segmented on the basis of component, deployment model, loan amount size, subscription type, loan type and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

· Software

· Services

Loan amount size

· Less than US$ 7,000

· US$ 7,001 to US$ 20,000

· More than US$ 20,001

Organization size

· Large Organization

· Small & Medium Organization

Deployment

On-premise

Cloud

Subscription type

· Free

· Paid

Loan type

· Automotive Loan

· SME Finance Loan

· Personal Loan

· Home Loan

· Consumer Durable

· Others

Vertical

· Banking

· Financial Services

· Insurance Companies

· P2P (Peer-to-Peer) Lenders

· Credit Unions

· Saving

· Loan Associations

Request-a-sample

Digital Lending Platform Market Regional Analysis/Insights

The digital lending platform market is analysed and market size insights and trends are provided by country, component, deployment model, loan amount size, subscription type, loan type and vertical as referenced above.

· The countries covered in the digital lending platform market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Switzerland, Netherlands, Russia, Turkey, Belgium, Rest of Europe, Japan, China, South Korea, India, Australia & New Zealand, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America

Competitive Landscape and Digital Lending Platform Market Share Analysis

· The digital lending platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital lending platform market.

Some of the major players operating in the digital lending platform market are:

· General Electric (US)

· IBM (US)

· PTC (US)

· Microsoft (US)

· Siemens AG (Germany)

· ANSYS, Inc (US)

· SAP SE (Germany)

· Oracle (US)

· Robert Bosch GmbH (Germany)

· Swim.ai, Inc. (US).

· Atos SE (France)

· ABB (Switzerland)

· KELLTON TECH (India)

· AVEVA Group plc (UK)

· DXC Technology Company (US)

· Altair Engineering, Inc (US)

· Hexaware Technologies Limited (India)

· Tata Consultancy Services Limited (India)

· Infosys Limited (Bengaluru)

· NTT DATA, Inc. (Japan)

· TIBCO Software Inc. (US)

Full Access of Report @

https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market

MAJOR TOC OF THE REPORT

· INTRODUCTION

· MARKET SEGMENTATION

· EXECUTIVE SUMMARY

· PREMIUM INSIGHTS

· MARKET OVERVIEW

· QUESTIONNAIRE

Get TOC Details

https://www.databridgemarketresearch.com/toc/?dbmr=global-digital-lending-platform-market

Related Reports:

· alcohol ingredients Market to Obtain Overwhelming Growth of, Size, Share, Trends, Growth Forecast, Opportunities and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-alcohol-ingredients-market

· artificial ventilation and anesthesia mask Market to Exhibit a Striking Size, Share, Trends, Competitive Scenario, Challenges and Industry Growth Analysis https://www.databridgemarketresearch.com/reports/global-artificial-ventilation-and-anesthesia-mask-market

· Bathroom Furniture Market is Forecasted to Reach Nearly, Size, Share, Trends, Development Strategies and Competitive Scenario https://www.databridgemarketresearch.com/reports/global-bathroom-furniture-market

· black strap molasses Market is Projected to Reach at , Key Drivers, Types, Segment, Size, Share, Growth, Challenges and Opportunity Analysis https://www.databridgemarketresearch.com/reports/global-black-strap-molasses-market

· Club Store Packaging Market Set to Reach Valuation of, Size, Share, Demand, Future Growth, Key Players and Revenue Forecast https://www.databridgemarketresearch.com/reports/global-club-store-packaging-market

· Cross-linking Coating Agents Market to See Promising Growth of, Size, Share, Growth, Trends, Gross Revenue and Key Players Outlook https://www.databridgemarketresearch.com/reports/global-cross-linking-coating-agents-market

· Diabetic Mastopathy Treatment Market Is Expected to Grow at a Highest, Size, Share, Growth Statistics, Emerging Trends and Value Forecast https://www.databridgemarketresearch.com/reports/global-diabetic-mastopathy-treatment-market

· Electronic Weighing Machines Market to Garner, Share, Size, Growth, Key Players, and Trends forecast https://www.databridgemarketresearch.com/reports/global-electronic-weighing-machines-market

· Flexible Foam Packaging Market Is Expected to Grasp the Value by Size, Share, Key Growth Drivers, Trends and Competitive Outlook https://www.databridgemarketresearch.com/reports/global-flexible-foam-packaging-market

· Gunshot Detection System Market to Receive Overwhelming Growth by , Size, Share, Trends, Growth and Revenue Outlook https://www.databridgemarketresearch.com/reports/global-gunshot-detection-system-market

· Hydantoin anticonvulsants Market Destine to Reach Size, Share, Industry Growth Rate, Technological Advancements, Demand & Revenue Outlook https://www.databridgemarketresearch.com/reports/global-hydantoin-anticonvulsants-market

· Metalized Film Flexible Packaging Market to Garner Size, Share, Growth, Demand, Challenges, Opportunities and Competitive outlook https://www.databridgemarketresearch.com/reports/global-metalized-film-flexible-packaging-market

· Non-dairy whipping agents Market Is Likely to Upsurge, Size, Share, Trend, Demand, Challenges and Competitors Outlook https://www.databridgemarketresearch.com/reports/global-non-dairy-whipping-agents-market

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavours to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Data Bridge Market Research has over 500 analysts working in different industries. We have catered more than 40% of the fortune 500 companies globally and have a network of more than 5000+ clientele around the globe. Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. We are content with our glorious 99.9 % client satisfying rate.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

- Digital_Lending_Platform_Market_Growth

- Digital_Lending_Platform_Market_Size

- Digital_Lending_Platform_Market_Share

- Digital_Lending_Platform_Market_Trends

- Digital_Lending_Platform_Market_Demands

- Digital_Lending_Platform_Market_Opportunities

- Digital_Lending_Platform_Market_Overview

- Digital_Lending_Platform_Market_Types

- Digital_Lending_Platform_Market_Application

- Digital_Lending_Platform_Market_Segmentations

- Digital_Lending_Platform_Market_Data_Bridge_Market_Research

- Digital_Lending_Platform_Market_Analysis.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology