The Future of Compression Therapy Market

Globally, an increasing number of people are actively participating in sports and physical activities (as a result of the growing awareness about health and fitness). This trend has, in turn, increased the incidence of sports injuries and injuries related to other physical fitness activities. In the US alone, ~8.6 million sports injuries are registered annually (source: US Department of Health and Human Services, data as of 2021).

Patient non-compliance with compression products and non-adherence to treatment protocols are the common issues related to compression therapy. Noncompliance is especially high in long-term treatments, where the primary goal is to prevent the occurrence of a specific condition (such as the occurrence or reoccurrence of ulcers).

Since compression therapy is generally used as a preventive therapy in a majority of cases, the compliance rate of patients with the therapy decreases over time. Moreover, conditions such as pain, swelling, and skin irritation are associated with the regular use of compression garments.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=146548022

Varicose vein treatment is captured the highest market share of the compression therapy market, by technique, in 2021

Based on applications, the compression therapy market is segmented into varicose vein treatment, deep vein thrombosis treatment, lymphedema treatment, leg ulcer treatment, and other applications. The varicose vein treatment segment accounted for the largest share of the compression therapy market in 2021.

The large share of this segment can primarily be attributed to high preference among healthcare providers for compression therapy as the first line of treatment for varicose veins and the procedural advantages offered by compression therapy products in the effective treatment of varicose veins.

Home care setting segment is estimated to grow at the highest CAGR during the forecast period

Based on distribution channel, the compression therapy market is segmented into hospitals & clinics, pharmacies & retailers, e-commerce platforms, and home care settings. In 2022, the hospitals & clinics segment is expected to account for the largest share of compression therapy market. The home care settings is fast emerging as a distribution channel for various compression therapy products owing to the rising demand for products for preventive care and increasing number of people are opting for compression devices for home use.

North America is capture the largest market for compression therapy market in 2021

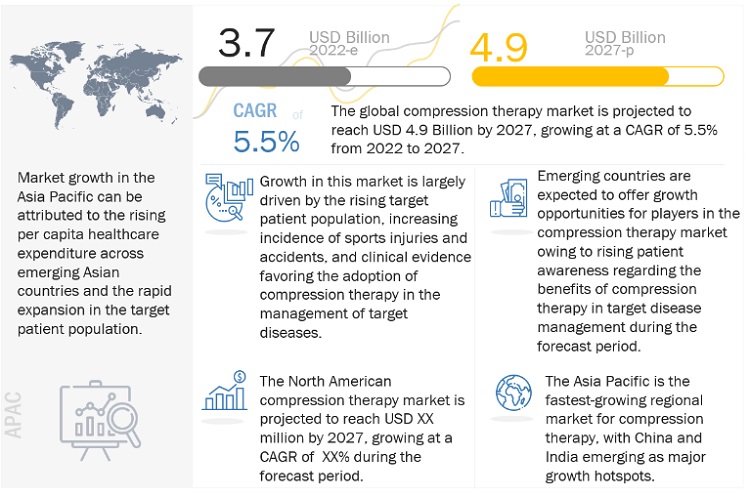

The global compression therapy market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. North America is expected to account for the largest share of the market in 2021.

Rapid growth in the geriatric population, rising number of orthopedic and spinal surgeries, and the presence of various compression therapy product manufacturers in the region. However, the Asia Pacific market is estimated to grow at the highest CAGR during the forecast period, primarily due to the rapid expansion of the target patient population in several Asia Pacific countries.

Compression Therapy Market Dynamics:

Drivers:

- Large target patient population

- Growing incidence of sports injuries and accidents

- Increasing number of orthopedic procedures

- Greater product affordability and market availability

- Clinical evidence favoring adoption of compression therapy for management of target conditions

Restraints:

- Lack of universally accepted standards for compression products

- Low patient compliance with compression garments

Opportunities:

- Growth potential offered by emerging markets

- Growing patient awareness regarding benefits of compression therapy

- Increased sales of off-the-shelf and online products

- Direct-to-consumer orthodontics

Challenges:

- Significant adoption of alternative therapies for specific target indications

- Increasing pricing pressure on market players

Key Market Players:

The major players operating in the global compression therapy market are DJO Global, Inc. (US), BSN medical (US), medi GmbH & Co. KG (Germany), Tactile Medical (US), SIGVARIS (Switzerland), Paul Hartmann AG (Germany), Sanyleg S.r.l. (Italy), 3M Company (US), ConvaTec Inc. (US), ArjoHuntleigh (Getinge Group, Sweden), and Julius Zorn GmbH (Germany).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology