Creatinine Measurement Market worth $700.8 million by 2027 at a CAGR of 8.4%

The Jaffe’s kinetic method segment is expected to hold the largest in the market in 2018

The creatinine measurement market, by test type, is segmented into the Jaffe’s kinetic method and enzymatic method. In 2018, the Jaffe’s kinetic method segment is expected to hold the largest share of the creatinine measurement market. The widespread availability and cost-effectiveness of kits and reagents used in Jaffe’s kinetic method is a key factor driving the growth of this market.

Based on the type of sample, the blood/serum segment is expected to register the highest CAGR during the forecast period

Based on type of sample the creatinine measurement market is segmented into blood/serum and urine samples. The blood/serum segment is expected to witness the highest CAGR over the forecast period. Most creatinine measurement kits and reagents are based on the analysis of creatinine in blood samples owing to its accuracy in inferring creatinine concentration and low risk of contamination. These benefits are responsible for the increasing adoption of the blood/serum sample for the measurement of creatinine levels.

North America to dominate the creatinine measurement market

In 2018, North America is expected to dominate the market followed by Europe. The large share of North America is attributed to factors such as the increasing incidence of renal disorders, rising prevalence of other chronic disorders like hypertension and diabetes (which can lead to renal dysfunction) in the region, and the implementation of favorable government initiatives to increase awareness about kidney diseases and their early diagnosis.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=206847385 .

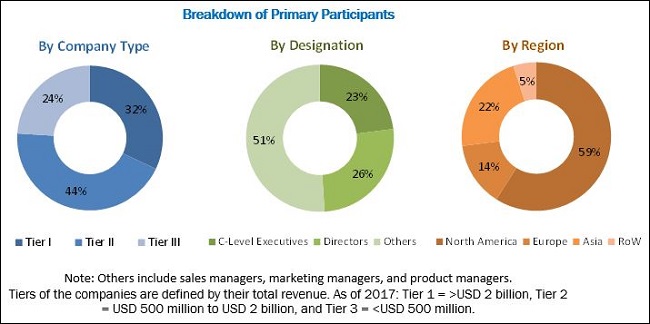

For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the creatinine measurement market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

Secondary sources such as directories; databases such as D&B Hoovers, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies were referred.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology