Cell & Gene Therapy Manufacturing Services Market worth $11.5 billion by 2027 at a CAGR of 17.5%

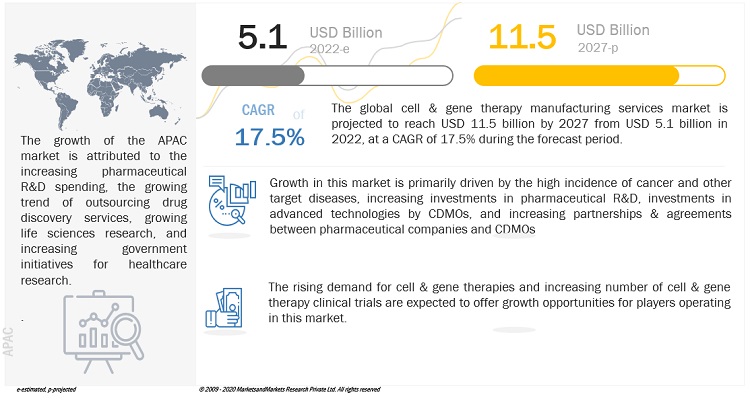

According to market research report, "Cell & Gene Therapy Manufacturing Services Market by Type (Allogeneic, Autologous, Viral Vector, Non-viral vector), Indication (Oncology, Orthopedic, Ophthalmology), Application (Clinical, Commercial), End User (Pharma, Biotech) - Global Forecast to 2027", size is projected to reach USD 11.5 billion by 2027 from USD 5.1 billion in 2022, at a CAGR of 17.5% during the forecast period. Growth in this market is driven by cancer prevalence which is a major burden on healthcare systems across geographies coupled with heavy investments of pharmaceutical companies in research and development to deliver high-quality and innovative products.

Despite the limited number of approvals, cell and gene therapy companies are attracting an increasing amount of private and public investment. Private equity and capital investment in life sciences have increased rapidly over the last decade.

Similarly, the growth of investment in cell and gene therapy companies is also significant. For instance, there is a steep rise in investment from USD 362 million in 2020 to nearly USD 68 billion in 2021. This is expected to increase the demand for outsourcing, thereby increasing the growth of cell and gene therapy manufacturing services.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

The clinical manufacturing segment accounted for the largest share of the application segment in 2021.

The clinical manufacturing application segment accounted for the largest share of the cell & gene therapy manufacturing services market in 2021. Cellular & gene therapy-related research and development worldwide continue to grow rapidly, with several products advancing in clinical development. Thus, increase in the number of clinical trials for the development of cell & gene therapies is fueling the growth of this segment.

Pharmaceutical & biotechnology companies accounted for the largest end user segment in 2021.

Pharmaceutical & biotechnology companies form the largest end-user segment of the cell & gene therapy manufacturing services market. The large share of this segment can be attributed to the increasing expenditure on R&D by pharmaceutical & biotechnology companies, increasing collaborations between pharmaceutical and biotechnology companies for the launch of new products, and the growing number of cell & gene therapies in the R&D pipeline.

The Asia Pacific region is the fastest-growing region of the cell & gene therapy manufacturing services market in 2021.

In 2021, the Asia Pacific region of the cell & gene therapy manufacturing services market grew at the fastest CAGR region during the forecast period. The factors such as growing research in the life sciences sector along with increasing outsourcing trend for drug discovery services is expected to fuel the market growth in this region.

Some of the prominent players in the Cell & gene therapy manufacturing services market are Lonza (Switzerland), Catalent (US), Thermo Fisher Scientific (US), Charles River Laboratories (US WuXi AppTec (China), Merck KGaA (Germany), Takara Bio Inc. (Japan), Nikon Corporation (Japan), FUJIFILM Holdings Corporation (Japan), Oxford Biomedica plc (UK), and Cell and Gene Therapy Catapult (UK).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology