United States ATM Market Size Worth USD 12.6 Billion by 2033 | CAGR: 4.6%: IMARC Group

IMARC Group has recently released a new research study titled “United States ATM Market Report by Solution (Deployment Solutions, Managed Services), Screen Size (15" and Below, Above 15"), Application (Withdrawals, Transfers, Deposits), ATM Type (Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States ATM Market Overview

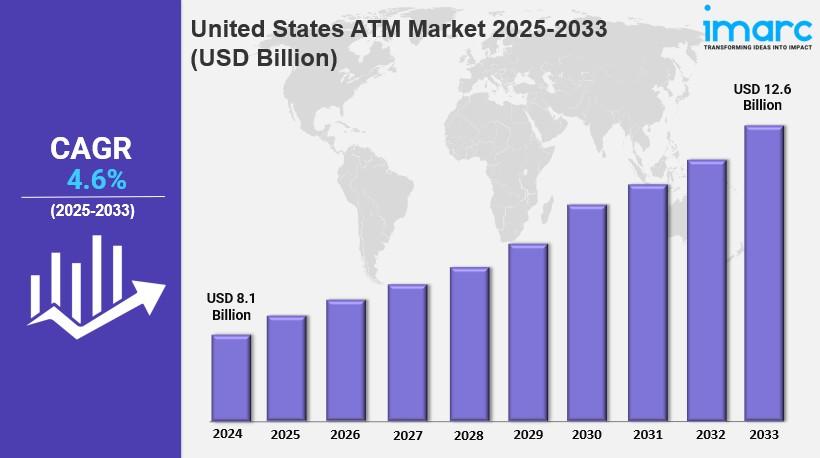

The United States ATM market size reached USD 8.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 8.1 Billion

Market Forecast in 2033: USD 12.6 Billion

Market Growth Rate (2025-2033): 4.6%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-atm-market/requestsample

Key Market Highlights:

✔️ Steady growth supported by demand for convenient cash access

✔️ Rising adoption of smart and contactless ATM technologies

✔️ Increasing deployment in retail and remote locations

✔️ Enhanced security features driving consumer trust

✔️ Growing integration with digital banking ecosystems

United States ATM Market Trends and Drivers:

The United States ATM market is currently experiencing several key trends that reflect the evolving landscape of consumer banking and technology integration. One of the most prominent trends is the adoption of advanced technologies, which is transforming traditional ATMs into multifunctional kiosks that offer a range of services beyond cash withdrawal. By 2025, it is expected that these technological advancements will enhance user experience and operational efficiency, with features such as biometric authentication and contactless transactions becoming standard. Additionally, the demand for cash access remains strong, as many consumers prefer cash transactions for various reasons, including budgeting and convenience, particularly in underserved areas. This ongoing need for cash is prompting financial institutions to expand their ATM networks and service offerings.

Adoption of Advanced Technologies

The United States ATM market is undergoing a significant transformation driven by the adoption of advanced technologies aimed at enhancing user experience and operational efficiency. Traditional ATMs are evolving into multifunctional kiosks that offer a variety of services beyond cash withdrawal, such as bill payments, mobile top-ups, and account management. The integration of biometric authentication methods, such as fingerprint and facial recognition, is becoming more prevalent, providing enhanced security and convenience for users. Additionally, the rise of contactless transactions is prompting ATM manufacturers to upgrade their machines to support NFC (Near Field Communication) technology, allowing customers to withdraw cash using their smartphones or contactless cards.

Increasing Demand for Cash Access

Despite the growing trend towards digital payments, there remains a robust demand for cash access in the United States, driving the ATM market's stability. Cash continues to be a preferred payment method for many consumers, particularly in specific demographics such as the elderly and those in lower-income brackets who may not have access to banking services or prefer cash transactions for budgeting purposes. Additionally, small businesses often rely on cash payments, further contributing to the ongoing need for ATMs. The convenience of ATMs allows users to access cash at any time, which is particularly important in rural areas where bank branches may be sparse. As a result, financial institutions are investing in expanding their ATM networks to ensure widespread access to cash, especially in underserved communities.

Regulatory Changes and Compliance Issues

The United States ATM market is also influenced by regulatory changes and compliance issues that affect how ATMs operate and are managed. Financial institutions and ATM operators must adhere to various regulations, including those related to anti-money laundering (AML), customer data protection, and accessibility standards under the Americans with Disabilities Act (ADA). Recent regulatory updates have mandated stricter compliance measures, requiring ATM operators to implement enhanced security features and maintain detailed transaction records. Additionally, the rise of cyber threats has led to increased scrutiny of ATM security protocols, pushing operators to invest in advanced security technologies, such as EMV (Europay, MasterCard, and Visa) chip technology and encryption solutions. These compliance requirements, while necessary for protecting consumers and maintaining the integrity of the financial system, can also lead to increased operational costs for ATM operators.

United States ATM Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Solution:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

Breakup by Screen Size:

- 15" and Below

- Above 15"

Breakup by Application:

- Withdrawals

- Transfers

- Deposits

Breakup by ATM Type

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

Breakup by Region:

- Northeast

- Midwest

- South

- West

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=19123&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology