Autonomous Robot Market Comprehensive Research Study, Competitive Landscape and Forecast to 2030

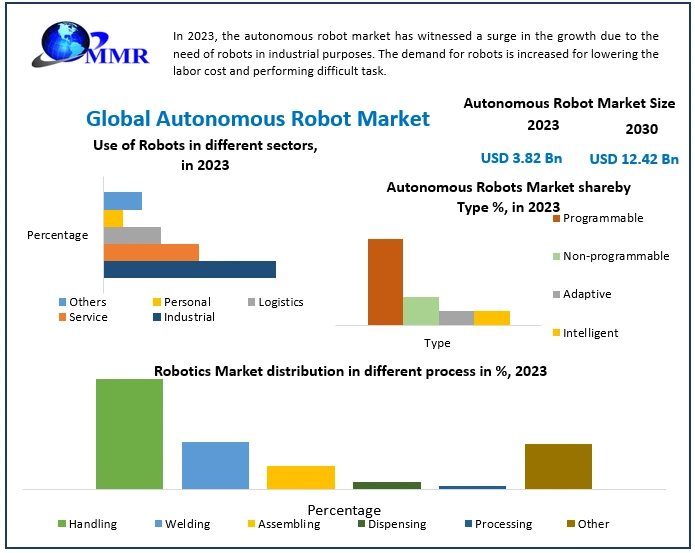

Autonomous Robot Market size was valued at USD 3.82 Bn in 2023 and the market is expected to reach USD 12.42 Bn to grow by 2030 at a CAGR of 18.34 % from 2024-2030

Market Size

- 2023 Market Size: USD 6.5 billion

- 2024 Estimate: USD 7.5 billion

- 2034 Projection: USD 15.4 billion; 2035 Projection: USD 34.6 billion

- CAGR (2025–2034/35): Approximately 14.9–15%

Overview

Autonomous robots—spanning unmanned ground vehicles (UGVs), aerial drones, marine vehicles, and inventory-handling machines—equip industries with self-guided capabilities, relying on AI, sensors, and robotics software. These systems perform inspection, material handling, logistics, agriculture, and defense tasks with minimal human guidance, enhancing operational safety, uptime, and scalability.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/65211/

1. Market Estimation & Definition

Metrics and segments considered include:

- Robot Types:

- Unmanned Ground Vehicles (AMRs, self-driving forklifts)

- Unmanned Aerial Vehicles (UAVs/drones)

- Unmanned Marine Vehicles

- Modes of Operation:

- Fully Autonomous vs. Semi-Autonomous

- End-User Sectors:

- Manufacturing & Industrial, Logistics & Warehouse, Healthcare & Medical, Oil & Gas, Agriculture & Mining, Military & Defense, Other services (security, hospitality)

- Offerings Across Value Chain:

- Hardware, Software, Integration & Support Services

- Regions Covered:

- North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa

2. Market Growth Drivers & Opportunity

- E-commerce and Logistics Surge: A booming warehouse automation wave favors AMRs for picking, sorting, and intralogistics.

- Healthcare & Medical Applications: Autonomous robots support surgery, sanitation, and patient care, especially post-pandemic.

- AI & Industry 4.0 Integration: Enhancements in computer vision, planning algorithms, and deep learning are enabling robots to navigate dynamic, unstructured environments.

- Safety & Labor Shift: Robots address workforce shortages and hazardous environments in mining, manufacturing, and defense.

- Regional Industrial Investment: Asia‑Pacific automation investments and North American logistics infrastructure provide fertile ground.

3. Segmentation Analysis

- By Type:

- UAVs (drones): Lead by value (~47% share) as of 2023.

- AMRs (ground robots): Fastest-growing segment in logistics and warehousing.

- Goods‑to‑Person Robots & Autonomous Inventory Robots are gaining traction in e-commerce flows.

- By Offering:

- Hardware dominates early revenue.

- Software & Services (analytics, predictive maintenance) are growing rapidly, especially post-2025.

- By Operation Mode:

- Fully autonomous usage is rising.

- Semi-autonomous systems still used in mixed-mode environments.

- By End-Use Industry:

- Logistics & Warehouse is the largest end-use segment (~30–35%), followed by Manufacturing (especially automotive, electronics, pharmaceuticals).

- Healthcare, agriculture, and defense represent fast expansion opportunities.

4. Major Manufacturers

Leading global companies include:

- ABB

- KUKA AG

- GreyOrange Inc.

- Locus Robotics

- Harvest Automation

- Clearpath Robotics

- Boston Dynamics

- Amazon Robotics

- Teledyne FLIR

- Northrop Grumman

- IAM Robotics

These firms deliver comprehensive hardware/software stacks, industry-specific solutions, and global distribution.

Get More Info: https://www.maximizemarketresearch.com/request-sample/65211/

5. Regional Analysis

- North America: Market leader in 2024 with ~40% share; logistics-heavy and high automation investments. Continued leadership is expected.

- Asia‑Pacific: Fastest-growing region (CAGR >15%) due to e-commerce growth, industrial robotics expansion, and infrastructure upgrades. Leaders include China, Japan, India, and South Korea.

- Europe: Strong automation focus in Germany, the UK, and France, especially in manufacturing and warehouse sectors.

- Latin America & MEA: Emerging growth markets with adoption in logistics, mining, and agriculture sectors. AMRs are gaining regional traction with CAGRs of ~23–25%.

6. Country-level Analysis (USA, Germany)

- United States: The largest national market in 2024, anchored in warehouse and defense robotics. Major companies and ecosystem dominance support approximately 25% of the global share.

- Germany: A European robotics hub; strong demand for autonomous robots in manufacturing and pharmaceuticals. Growth is fueled by Industry 4.0 initiatives, with expected CAGR of 14–15%.

- China (optional): Asia‑Pacific powerhouse; domestic leaders and government-backed investments support rapid robotics scaling.

7. COVID‑19 Impact Analysis

Pandemic disruptions in 2020–21 delayed production and deployment. However, they accelerated the focus on automation and contactless operations in healthcare, warehousing, and defense. By 2022, autonomous robot investments rebounded sharply as companies upgraded logistics and sanitation capabilities.

8. Competitive Analysis

Market Structure: Moderately consolidated—global OEMs operate alongside innovators and regional players. The AMR niche shows increasing fragmentation.

Competitive Trends:

- Hardware–software integration for end-to-end systems

- Evolution of AGVs into flexible, intelligent AMRs

- AI adoption to enable autonomous navigation in unstructured environments

- Expansion of service robots (delivery, healthcare, hospitality)

Challenges:

- High capital investment and long ROI timelines, especially for SMEs

- Regulatory compliance and safety certification for public-facing deployments

- Skilled workforce shortage for deployment and maintenance

Opportunities:

- Robotics-as-a-service (RaaS) subscription models

- Customized solutions for healthcare, hospitality, and security

- Retrofitting traditional factories with automation

- Scaling in emerging markets via low-cost robotic platforms

9. Key Questions Answered

|

Question |

Answer |

|

Market size in 2023? |

USD 6.5 billion |

|

2024 estimate? |

USD 7.5 billion |

|

2034/35 forecast? |

USD 15.4–34.6 billion |

|

CAGR? |

~14.9–15% |

|

Largest type segment? |

UAVs/drones (by revenue) |

|

Fastest‑growing type? |

AMRs (ground robots in logistics) |

|

Leading region today? |

North America |

|

Fastest‑growing region? |

Asia‑Pacific |

|

Major players? |

ABB, KUKA, GreyOrange, Amazon Robotics, etc. |

|

Key challenge? |

High upfront cost, regulatory clearance |

Conclusion

The autonomous robot industry is entering a transformative phase as logistics, healthcare, agriculture, and manufacturing demand more resilient and scalable automation. From an estimated USD 7.5 billion in 2024, this market is poised to exceed USD 15–34 billion by 2034–35, depending on adoption scenarios. Companies offering AI-powered systems, integrated hardware-software solutions, and flexible service models will dominate. With strategic investments underway in North America, Asia‑Pacific, and Europe, autonomous robotics is poised to become a cornerstone of next-generation industrial and service infrastructure.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology