Exploring the Growth of the Veterinary Ultrasound Market

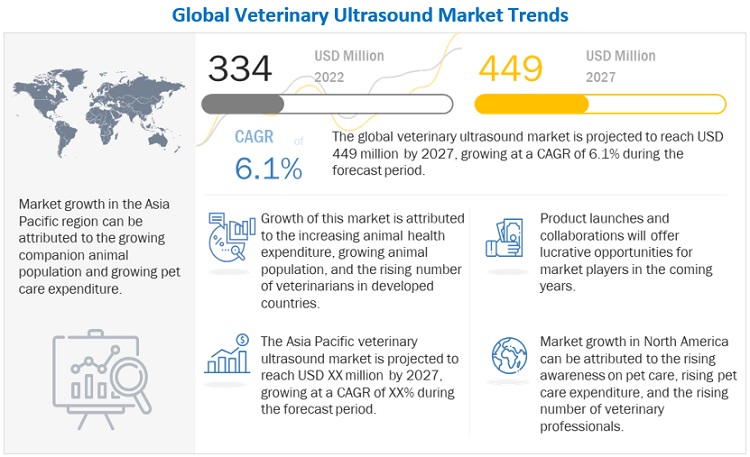

According to market research report, "Veterinary Ultrasound Market by Type (2D, 3D/4D, Doppler), Product (Portable Scanners), Technology (Contrast, Digital), Animal Type (Small, Large), Application (Gynecology, Cardiology, Orthopedics), End User (Clinics, Hospitals) - Global Forecast to 2027", is projected to reach USD 449 million by 2027 from USD 334 million in 2022, at a CAGR of 6.1% during the forecast period.

With the increasing penetration of pet insurance and the increasing pet care expenditure, access to high-cost diagnostic and treatment procedures for various veterinary health conditions is expected to increase in the coming years. This is considered an indicator of the growth of the veterinary ultrasound market.

A surge in the overall companion animal population and adoption rate has been witnessed on a global scale. According to several studies, keeping a companion animal is associated with positive health benefits, such as reduced cardiac arrhythmias, normalization of blood pressure, decreased anxiety, greater psychological stability, and improved well-being.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=10482074

Emerging markets such as Brazil, China, India, and Mexico are also witnessing growth in animal ownership. The increasing pet population is expected to drive the demand for pet care products and services, which, in turn, will support the growth of dependent industries such as veterinary ultrasound.

Veterinary ultrasound are high-priced products, the cost of traditional cart-based ultrasound systems is approximately USD 20,000–25,000, while that of portable ultrasound systems is around USD 10,000–15,000.

Similar to ultrasound systems, the cost of veterinary ultrasound procedures is also high. For instance, abdominal ultrasound costs around USD 250–500. Specialists such as cardiologists, oncologists, and radiologists offer more expensive services ranging up to USD 500 per area of an animal body.

The high cost of these procedures a major market restraint, as it prompts pet owners to avoid an ultrasound until it becomes necessary.

The small animals segment accounted for the largest share of the veterinary ultrasound market

Based on animal type, the veterinary ultrasound market is segmented into small animals, large animals, and other animals. In 2021, the small animals segment accounted for the largest share of the veterinary ultrasound market. The increasing small companion animal population, growing pet care expenditure, and growing demand for pet insurance are some of the major factors driving the small companion animals segment.

The veterinary clinics segment accounted for the largest share of the veterinary ultrasound market

Based on end user, the veterinary ultrasound market is segmented into veterinary clinics, veterinary hospitals and academic institutes, as well as other end users. The veterinary clinics segment accounted for the largest share of the veterinary ultrasound market in 2021. The growing number of patient visits, along with the increasing number of private clinical practices and increasing revenues of veterinary clinics, are the key factors driving the demand for veterinary ultrasound in clinics.

The Asia Pacific market is estimated to witness the highest CAGR during the forecast period

The Asia Pacific market is estimated to witness the highest CAGR during the forecast period owing to the growing livestock population, increasing pet adoption, rising awareness about animal health, progressive urbanization, and growing per capita animal health expenditure in several Asia Pacific countries.

Key players in the veterinary ultrasound market

The prominent players in the veterinary ultrasound market are GE Healthcare (US), Esaote SpA (Italy), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Siemens Healthineers (Germany), FUJIFILM Holdings Corporation (Japan), Heska Corporation (US), Samsung Electronics Co., Ltd. (South Korea), Diagnostic Imaging Systems, Inc. (US), and IMV Imaging (UK).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology