Air Starter Market Trends, Size, Top Leaders, Future Scope and Outlook 2032

Air Starter Market Forecast to Reach Approximately USD 695 Million by 2032, Driven by Industrial Safety and Reliability Demand

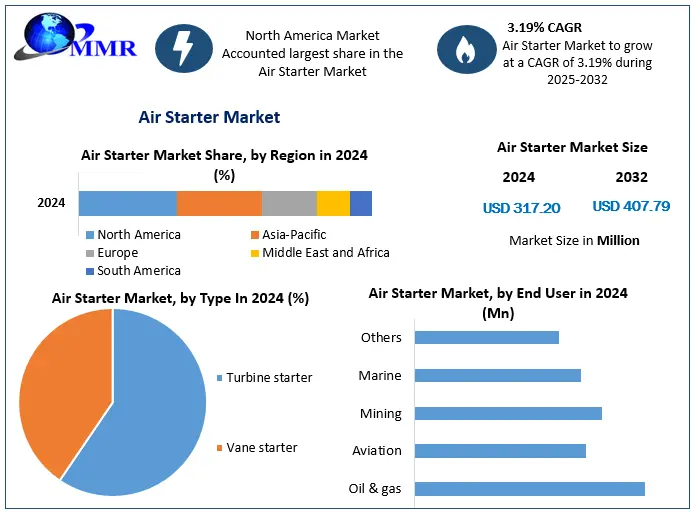

Market Size

- 2024 market value: USD 448–449 million

- 2025 projection: USD 468 million

- 2034 forecast: USD 695 million

- CAGR (2025–2034): approximately 4.5%

Industry estimates for earlier reference years include:

- USD 418–440 million in 2023 (CAGR ~2.4–6.2%)

- Forecast ranges vary to USD 528–559 million by 2029 (at ~2.35–4.5% CAGR)

Overview

An air starter is a mechanical engine ignition device that uses compressed air to initiate rotation in large diesel or turbine engines. Widely adopted across offshore oil & gas, marine, aviation, mining, and power generation sectors, air starters excel in hazardous or high-compression environments where electric starters are impractical or unsafe.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/24802/

Market Estimation & Definition

The global air starter market encapsulates:

- Types: Turbine air starters, vane air starters, and electric air starters

- End-User Verticals: Oil & gas, aviation & military, marine, mining, and industrial machinery

- Regional Coverage: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

In 2024, turbine air starters held the largest segment share (circa 60–67%) due to high torque and durability for heavy-duty engines. End-use dominance lies with oil & gas, followed by aviation and marine sectors.

Growth Drivers & Opportunity

- Oil & Gas and Offshore Exploration

Air starters are essential in remote and explosive environments (e.g., offshore rigs), offering spark-free ignition and high torque reliability. - Aviation & Marine Engines

The growth in commercial and military aviation, along with maritime engine needs, sustains demand for dependable air-starter systems. - Reliability and Safety in Harsh Conditions

Ability to operate without electrical sparking is critical for environments with flammable gases or dusty conditions—making air starters preferred in mining, refineries, and tunnels. - Technological Enhancements

Incremental improvements in torque density, material strength, and system maintenance efficiency boost adoption. - Infrastructure & Industrial Expansion in APAC

Rapid industrialization across China, India, and Southeast Asia is driving higher demand for robust engine-start solutions across energy and construction machinery.

Segmentation Analysis

- By Type

- Turbine Air Starters: Dominant in share (~60–67%)

- Vane Air Starters: Still significant in cost-sensitive or compact applications

- Electric Air Starters: Emerging market, especially in hybrid systems

- By End‑Use Application

- Oil & Gas: Leading vertical

- Aviation & Military: Critical for turbine engines

- Marine: Key in large engine operations

- Mining & Others: Reliable ignition in harsh or flammable environments

- By Region

- North America: Largest revenue share, driven by energy and aerospace refinements

- Asia-Pacific: Fastest-growing region, led by infrastructure and energy growth

- Europe, Latin America, MEA: Smaller but stable markets with industrial growth

Major Manufacturers

Leading global suppliers in air starter systems include:

- Ingersoll Rand

- Caterpillar

- Honeywell International

- Rheinmetall

- JetAll

- Maradyne

- Gali International

- SPICO

- Industrial Power Units (IPU)

- TDI

- Hilliard Corporation

- Textron Specialized Vehicles

These firms compete based on torque performance, material durability, safety certifications, and alignment with energy-sector specifications.

Regional Analysis

North America

Captures the largest share due to major oil & gas operations, defense sectors, and aerospace engine requirements.

Asia-Pacific

Exhibits highest growth rates, driven by rapid industrial development, expanding mining operations, and extensive usage in construction machinery.

Europe

Moderate growth rooted in marine engine markets and stringent equipment safety standards.

Latin America & MEA

Emerging markets with growing demand tied to energy and infrastructure investments.

COVID‑19 Impact Analysis

- 2020: Demand dipped due to project delays, lower fossil fuel prices, and paused industrial activity.

- 2021–2022: Recovery propelled by resumed energy exploration and aviation buildouts.

- 2023 onward: Focus sharpened on operational safety and remote-start capabilities, strengthening air starter market resilience.

Competitive Analysis

- Product Innovation: Turbocharged turbine starters with greater torque-to-weight ratios and long-term reliability outpace older options.

- Safety Distinction: Spark-free operation remains critical in hazardous operations.

- OEM vs Aftermarket Strategy: Service bundles, retrofit kits, and training services increase client retention.

- Regional Advantage: Asia-based suppliers leverage broader affordability and faster delivery cycles.

- Barriers to Entry: High tech complexity, safety certifications, and capital requirements limit new competition.

Key Questions Answered

- What was the air starter market worth in 2024, and what is it expected to reach by 2034?

– About USD 448–449 million in 2024, projected to grow to USD 695 million by 2034 at a CAGR of ~4.5%. - Which starter type is most popular?

– Turbine air starters dominate (60–67% share); vane types serve niche or cost-sensitive needs. - Which end-user industry drives growth?

– Oil & gas is the largest vertical; aviation and marine sectors follow closely. - Which region leads and which is growing fastest?

– North America leads in volume; Asia-Pacific grows fastest in CAGR. - Who are the key companies in the market?

– Ingersoll Rand, Caterpillar, Honeywell, JetAll, Gali, SPICO, IPU, TDI, and others.

Conclusion

The global air starter market is on a steady upward trajectory—rising from roughly USD 448 million in 2024 to nearly USD 695 million by 2034. Key growth is anchored in oil & gas, aviation, marine, and remote industrial applications that value reliability, safety, and durability. Turbine starters remain the backbone of market share, while vane and electric variants carve out specialized niches.

Vendors integrating torque-efficient design, global safety certification, and aftermarket support are best positioned to capitalize. As energy operations diversify and infrastructure advances, the demand for efficient, rugged air starter technologies will continue to expand.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology