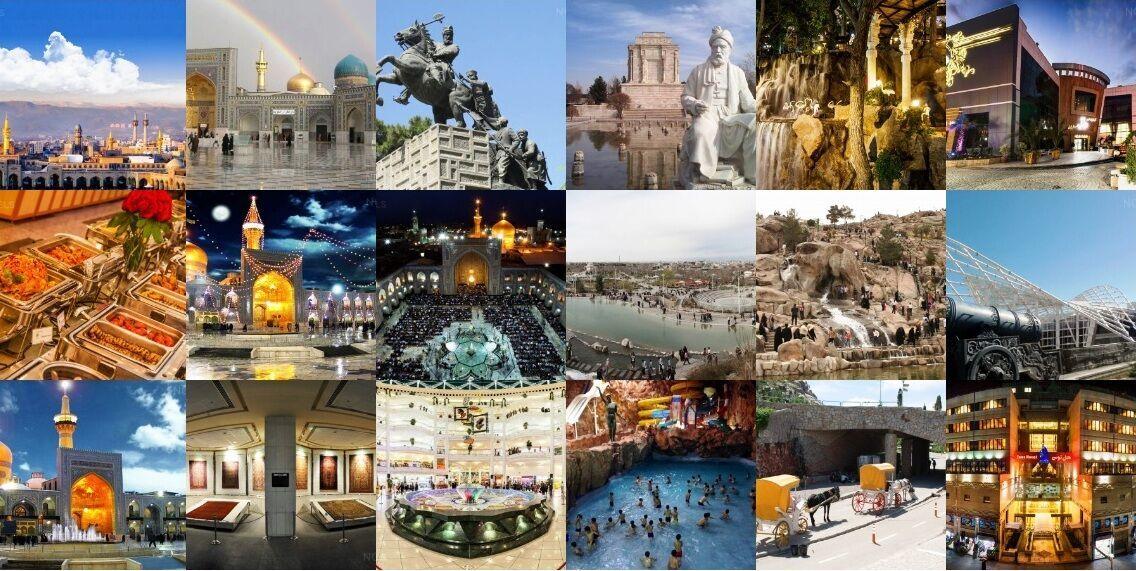

Exploring the Future of Religious Tourism: Market Trends & Growth Outlook (2025–2032)

The Religious Tourism industry is witnessing robust expansion driven by increasing spiritual travel and cultural exploration globally. This sector's intricate dynamics combine heritage preservation with modern travel preferences, positioning it at the intersection of traditional values and evolving market trends. The religious tourism market is set to capitalize on growing consumer interest in heritage-driven journeys and experiential travel formats.

Market Size and Overview

The global Religious Tourism market size is estimated to be valued at USD 1,380.52 Bn in 2025 and is expected to reach USD 2,175.09 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 6.7%from 2025 to 2032.

This Religious Tourism Market Growth is fueled by rising disposable incomes, increasing accessibility of pilgrimage sites, and integration of technology in travel services, enhancing consumer experiences. Overall, the market forecast reveals ample market oportunities amid evolving market dynamics and growing business growth in emerging regions.

Market Segments

The Religious Tourism market encompasses key segments based on type of pilgrimage, region, and travel service. The primary pilgrimage types include Christian, Hindu, Buddhist, Muslim, and other more niche religious tours. Among these, Christian pilgrimage remains the largest segment, with the fastest growth observed in Hindu pilgrimage due to expanding outbound religious travel from South Asia. Regionally, Asia-Pacific is dominant, propelled by countries such as India and Thailand, whereas the Middle Eastern zone is the fastest-growing due to increased infrastructure investments supported by local governments. Service-wise, package tours and digital travel planning platforms have led growth, enabling seamless booking and enhanced traveler customization.

Market Drivers

A pivotal market driver in 2024 and 2025 is the surge in eco-conscious and culturally immersive travel, prompting religious tourism operators to integrate sustainability initiatives. For instance, several pilgrimage sites in India and Saudi Arabia have applied waste reduction and green certification policies, increasing appeal among the environmentally sensitive traveler demographic. According to 2025 market report data, over 38% of religious tourists considered sustainability credentials when choosing their pilgrimage tours, significantly influencing market revenue and growth.

Segment Analysis

Focusing on the travel service segment, package tours dominate in market revenue due to their convenience and comprehensive offerings, with revenues surpassing USD 22 billion in 2025. However, independent travel planning via digital platforms is the fastest-growing sub-segment, reporting a 14% year-over-year growth rate in 2024. This shift is largely due to millennial and Gen Z consumers seeking personalized and flexible itineraries. Case studies from leading religious sites in Jerusalem and Varanasi highlight increased user engagement through mobile apps designed for self-guided pilgrimage experiences, creating distinct competitive advantages.

Consumer Behaviour Insights

Consumer behavior in religious tourism during 2024–2025 exhibited notable shifts. First, there was an amplified preference for personalized spiritual experiences, with 43% of travelers opting for customized tours rather than traditional group pilgrimages according to survey data. Second, digital consumption habits intensified, as more than half of travelers used online platforms to research and book their trips, prioritizing platforms offering augmented reality previews of pilgrimage sites. Third, a growing percentage of pilgrims exhibited pricing sensitivity but were willing to pay a premium for safety and hygiene assurances post-pandemic, directly affecting market scope and market growth strategies employed by operators.

Key Players

Prominent market players driving the religious tourism landscape include Shire Plc., CSL Limited, Octapharma AG, and LFB S.A., among others. In 2024-2025, these companies have strategically expanded their service portfolios through new product launches, including spiritual wellness packages and enhanced pilgrimage insurance. For example, Shire Plc. launched its innovative pilgrimage support app in 2025, boosting consumer engagement and market revenue. CSL Limited notably expanded its regional footprint into Southeast Asia during 2024, leveraging untapped market potential. These market companies continue to adapt to market challenges with innovative solutions aligned to evolving market insights.

Key Winning Strategies Adopted by Key Players

A unique growth strategy that sets Shire Plc. apart is its integration of AI-powered travel personalization introduced in 2025, which resulted in a 22% increase in user retention by tailoring spiritual tourism experiences based on user data. Similarly, Octapharma AG leveraged blockchain-based ticketing for pilgrimage events to enhance transparency and reduce fraud, implemented in late 2024 with measurable improvements in traveler trust and operational efficiency. Another impactful strategy by LFB S.A. involved partnering with local religious authorities to co-create authentic cultural events, widening community engagement and doubling visitor participation during key festivals in 2025. These strategies reveal a trend toward tech-enabled authenticity and consumer-centric innovation within the religious tourism market.

FAQs

1. Who are the dominant players in the Religious Tourism market?

Major market players include Shire Plc., CSL Limited, Octapharma AG, and LFB S.A., which lead through innovative services and regional expansions.

2. What will be the size of the Religious Tourism market in the coming years?

The market is projected to grow from USD 1,380.52 Bn in 2025 to USD 2,175.09 Bn by 2032, at a (CAGR) of 6.7%.

3. Which pilgrimage segment holds the largest growth opportunity?

While Christian pilgrimage commands the largest revenue, Hindu pilgrimage is the fastest-growing segment, driven by increased outbound travel from South Asia.

4. How will market development trends evolve over the next five years?

Trends point toward greater adoption of digital tools, personalized travel services, and sustainability-driven offerings shaping the market forecast.

5. What is the nature of the competitive landscape and challenges in the Religious Tourism market?

Competitive dynamics emphasize technology integration and regional diversification, with challenges including maintaining cultural authenticity and managing increasing visitor volumes sustainably.

6. What go-to-market strategies are commonly adopted in the Religious Tourism market?

Key strategies include AI-driven personalization, blockchain-based ticketing, regional partnership developments, and launching wellness-oriented pilgrimage packages to meet evolving consumer demands.

Get More Insights On- Religious Tourism Market

Get this report in Japanese language: 宗教観光市場

Get this report in Korean language: 종교 관광 시장

About Author:

Vaagisha brings over three years of expertise as a content editor in the market research domain. Originally a creative writer, she discovered her passion for editing, combining her flair for writing with a meticulous eye for detail. Her ability to craft and refine compelling content makes her an invaluable asset in delivering polished and engaging write-ups.

(LinkedIn: https://www.linkedin.com/in/vaagisha-singh-8080b91)

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology