What Is the Current Size of the Global Online Insurance Market and What Are Its Key Growth Drivers and Trends?

Global Online Insurance Market is valued at approximately USD 150 billion in 2024, driven primarily by increasing internet penetration, rising consumer preference for digital insurance solutions, and advancements in AI-powered underwriting processes.

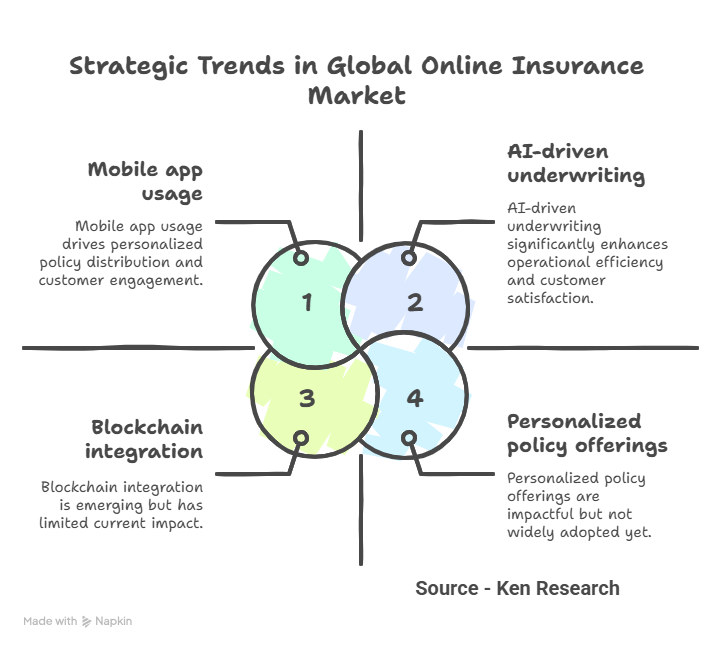

As the Global Online Insurance Market evolves, emerging trends such as embedded insurance, blockchain integration, and personalized policy offerings are reshaping the landscape, prompting strategic shifts among insurers. For comprehensive insights, visit Ken Research.

Growth Drivers in the Global Online Insurance Market

Key factors fueling expansion in the online insurance sector encompass technological adoption, consumer behavior shifts, and regulatory support, driving increased digital penetration and tailored product offerings:

- 45% annual growth in mobile insurance app downloads highlights rising consumer preference for digital convenience, creating significant opportunities for personalized policy distribution.

- 60% of millennials prefer purchasing insurance online, emphasizing a demographic shift that accelerates demand for streamlined, user-friendly digital platforms.

- AI integration in underwriting reduces claim processing time by up to 50%, enhancing operational efficiency and attracting tech-savvy customers seeking faster service.

- Regulatory reforms in 30+ countries encourage digital insurance sales, lowering entry barriers and fostering innovation in product customization and distribution channels.

- Projected CAGR of 12.8% through 2028 underscores robust market momentum driven by expanding internet penetration and growing awareness of insurance benefits globally.

Explore the Global Online Insurance Market growth drivers now to capitalize on emerging market opportunities before competitors do.

Key Trends in Global Online Insurance Market

Exploring innovation, growth, and strategic trends shaping the global online insurance landscape in 2024.

Accelerated Digital Adoption and Customer Engagement

With over 65% of insurance consumers worldwide preferring online channels, digital adoption is driving personalized customer engagement and seamless policy management, enhancing satisfaction and retention rates.

- 72% of insurers are investing in AI-driven chatbots to improve customer interaction efficiency.

- Mobile app usage for insurance services has increased by 40% year-over-year, enabling on-the-go access.

Integration of Artificial Intelligence and Data Analytics

AI and advanced analytics are transforming underwriting and claims processing, reducing operational costs by up to 30% and accelerating claim resolutions by 45%, fostering trust and operational excellence.

- 68% of online insurers leverage predictive analytics to personalize premiums and optimize risk management.

- Real-time fraud detection systems have decreased fraudulent claims by 25%, enhancing profitability.

Expansion of Usage-Based and On-Demand Insurance Models

Usage-based insurance (UBI) adoption has surged, accounting for 22% of new policies, reflecting consumer demand for flexible, cost-efficient coverage aligned with actual usage patterns.

- On-demand insurance is projected to grow at a CAGR of 18% through 2027, driven by millennial and Gen Z customer segments.

- Telematics data integration enables more accurate risk assessment, reducing premiums for low-risk users by 15-20%.

Regulatory Evolution and Cybersecurity Enhancements

Stricter regulations and cybersecurity investments, with spending on cyber defense up 38% in 2023, are critical to safeguarding consumer data and ensuring compliance in a rapidly digitizing market.

- Compliance with GDPR and CCPA mandates has increased insurer trust scores by 12% in key markets.

- Cyber insurance products are expanding, with market size expected to hit $20 billion by 2025.

To capitalize on these transformative forces, explore the comprehensive insights in the Global Online Insurance Market Trends report now.

Future Outlook for the Global Online Insurance Market

The global online insurance market is projected to reach a market size of $250 billion by 2030, growing at a CAGR of 12.5%, driven by digital adoption, enhanced customer experience, and regulatory support.

- Rising smartphone penetration and internet access expanding customer base worldwide

- AI and machine learning integration improving underwriting and claims processing

- Increased demand for personalized insurance products fueled by data analytics

- Regulatory reforms promoting transparency and digital transactions

To capitalize on these growth opportunities, explore in-depth insights and actionable strategies at Ken Research. Stay ahead in this rapidly evolving market by making informed decisions today.

Conclusion What’s Next for the Global Online Insurance Market

The global online insurance market is poised for robust growth driven by digital innovation, AI integration, and expanding consumer adoption. Opportunities abound for insurers leveraging big data and personalized solutions. Stakeholders including insurers, investors, and technology providers should monitor evolving regulations and consumer preferences closely to capitalize on upcoming market shifts.

People Also Ask

What is the market size of the Global Online Insurance Market

The market size exceeded USD 100 billion in 2023, with a compound annual growth rate (CAGR) above 10% projected through 2030, reflecting strong digital insurance adoption worldwide.

What are the key trends in the Global Online Insurance Market

Key trends include AI-driven underwriting, increased mobile platform usage, personalized insurance products, and integration of IoT for risk assessment and claims processing.

Who are the major players in the Global Online Insurance Market

Leading companies include Allianz, AXA, Progressive, Lemonade, and Ping An Insurance, all investing heavily in digital transformation and customer-centric online platforms.

Looking to gain exclusive insights into this fast-evolving industry? Download the Free Sample Report on the Global Online Insurance Market and make smarter strategic decisions today.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology