Injection Molding Machines 2025–2032: Hydraulic Backbone, 500-Ton+ Muscle

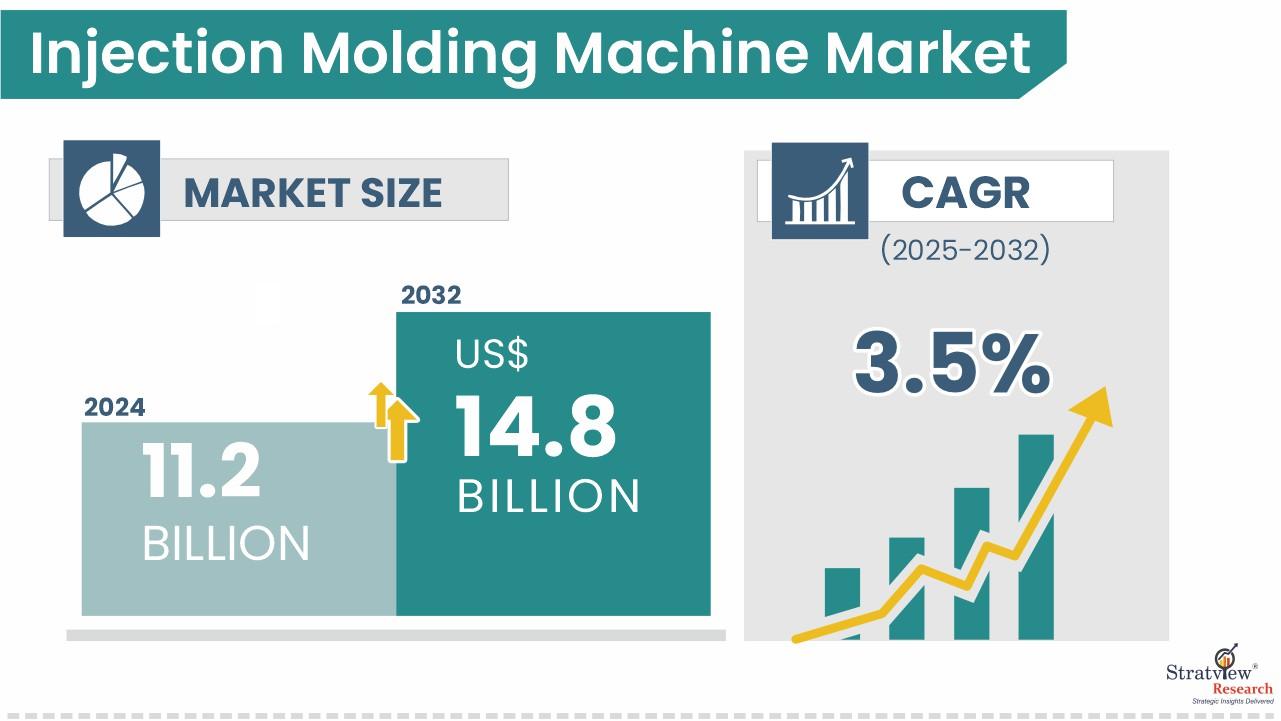

Injection molding machines (IMMs) are the workhorses behind high-volume parts across plastics, rubber, metals, and ceramics—pairing an injection unit with a clamping unit to form precise components at speed. Stratview Research estimates the global injection molding machine market at USD 11.2 billion in 2024 and projects it to reach USD 14.8 billion by 2032, a 3.5% CAGR (2025–2032).

Request a sample report to preview our in-depth analysis:

https://www.stratviewresearch.com/Request-Sample/1146/injection-molding-machine-market.html#form

Drivers

Demand for plastic components across end-markets. Rising consumption of packaged foods and beverages, pharmaceuticals, vehicles, and electronics is lifting plastic part volumes, reinforcing new buys and retrofit cycles for IMMs. Stratview cites packaging, building & construction, and automotive as core demand pillars for plastics processing.

Automotive & consumer goods intensity. Among end-uses, automotive and consumer goods together account for 30%+ share (2024), reflecting persistent demand for lightweight, durable parts and aesthetics-critical housings.

Scale requirements in large parts. As part sizes grow (e.g., bumpers, large containers, appliance housings), buyers favor higher clamping forces—driving outsized demand for ≥500-ton machines.

Regional investment—APAC momentum. Expanding manufacturing bases, urbanization, and foreign investment across Asia are widening the installed IMM base; Asia-Pacific holds 30%+ share and is the fastest-growing region.

Trends

1) Product focus—plastics dominate. By product type, plastic IMMs hold 65%+ share (2024) and remain the anchor, supported by the breadth of plastic applications across autos, consumer goods, and packaging.

2) Machine architecture—hydraulic leads, hybrids/electrics rise. Hydraulic machines exceed 40% share, benefiting from durability and service familiarity; buyers layer in all-electric and hybrid units for energy efficiency, faster cycles, and precision where ROI is clear.

3) Clamping force—shift to heavy tonnage. The above-500-ton segment is the largest today and is set to stay dominant, aligned with the need to mold larger or multi-cavity parts without compromising quality.

4) Geographic mix—APAC speeds ahead; NA/EU steady. APAC’s growth outpaces other regions on multi-industry demand and supply-chain depth, while North America and Europe remain robust on technology upgrades and diversified end-use exposure.

Conclusion

Through 2032, the IMM market advances steadily on the back of plastics consumption, automotive/consumer-goods intensity, and APAC manufacturing scale. Expect plastic IMMs and hydraulic architectures to remain the backbone, ≥500-ton machines to anchor large-part capacity, and a measured uptick in hybrids/electrics where energy and precision economics win—all consistent with Stratview’s USD 14.8B trajectory at 3.5% CAGR.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology