Pressure Vessels 2024–2031: Energy Projects, Hydrogen, and the Shift to Type IV

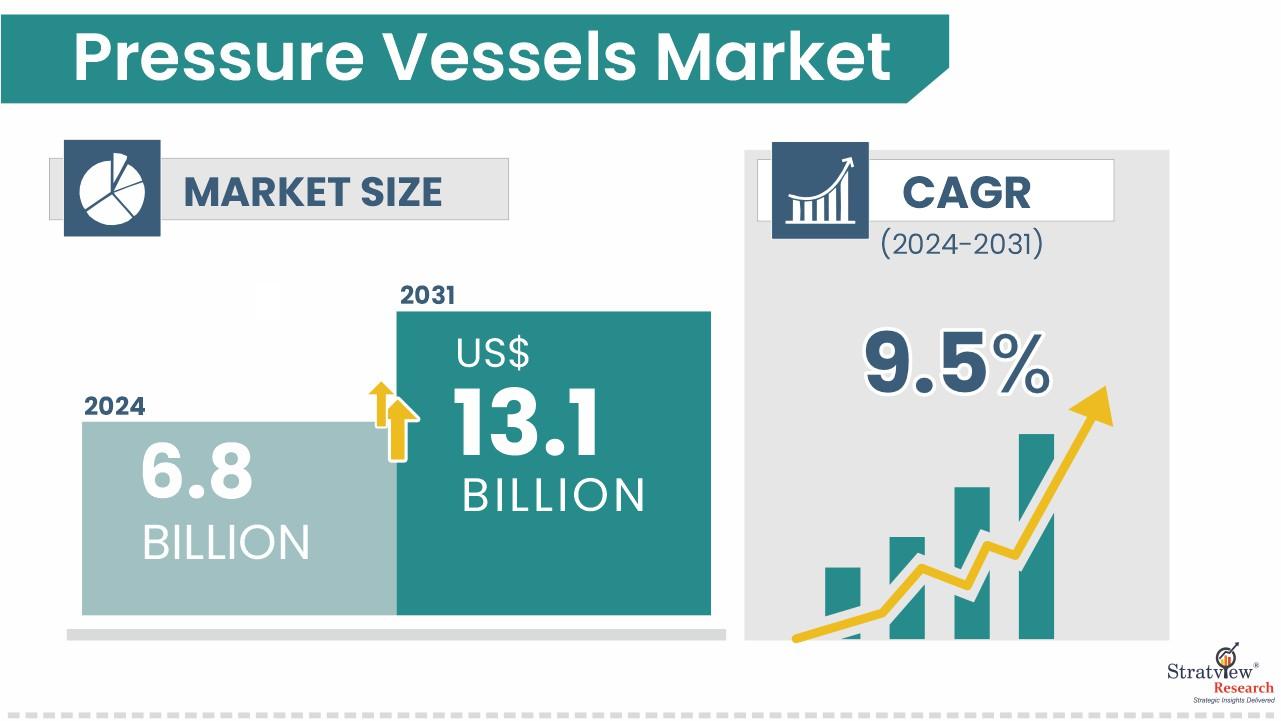

Pressure vessels—sealed containers engineered to hold gases or liquids at pressures significantly different from ambient—are indispensable across oil & gas, chemicals, power generation, mobility, and emerging hydrogen value chains. Stratview Research sizes the pressure vessels market at USD 6.8 billion in 2024, projecting USD 13.1 billion by 2031 at a 9.5% CAGR (2024–2031).

Download the Free Sample Report:

https://www.stratviewresearch.com/Request-Sample/438/Pressure-Vessel-Market.html#form

Drivers

- Energy build-out. New power capacity (including nuclear and renewables), refinery upgrades, and gas-processing projects sustain baseline demand for high-pressure storage and process vessels.

- Hydrogen & low-carbon fuels. Investments in hydrogen mobility and infrastructure are accelerating, pulling demand for advanced, lightweight vessels—especially Type IV for mobility. (Stratview calls out the hydrogen pressure vessels market reaching USD 10.3 billion by 2030 at 52.8% CAGR.)

- Materials innovation & safety. Adoption of composites and corrosion-resistant alloys improves strength-to-weight and lifecycle cost while meeting stricter codes and safety regimes that compel higher-quality vessel procurement.

Trends

- Applications: Transportation is the largest demand generator today (e.g., CNG/LNG/H₂ onboard storage), while gas carrier & storage is set to grow fastest with LNG terminals, hydrogen hubs, and industrial gas logistics.

- Vessel type: Type I remains the largest by installed base and cost-effectiveness; Type IV (polymer liner + carbon fiber overwrap) is the fastest-growing, propelled by H₂ mobility and weight-critical use cases.

- Regional shape: Asia-Pacific stays dominant on industrialization and integrated supply chains; Europe is flagged to grow fastest on clean-energy policy and hydrogen programs.

- Competitive landscape: A deep bench—Hexagon Composites, Luxfer, Worthington Industries, CIMC Enric, Beijing Tianhai, ILJIN Composites, Everest Kanto, Cylinders Holding, Sinoma, TriMas—competes across steel and composite categories.

Conclusion

Through 2031, core energy and process industries keep the market resilient, while hydrogen and LNG infrastructure add a powerful growth vector. Expect Type I to anchor volume and Type IV to pace growth; transportation remains the near-term workhorse, with gas carrier & storage scaling quickly. Suppliers that blend code-compliant steel offerings with composite portfolios—and that partner into hydrogen mobility and storage programs—should outperform a market tracking to USD 13.1 billion.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology