Global Vaccines Market: Scale, Shifts, and the Next Decade of Immunization

Global Vaccines Market Overview

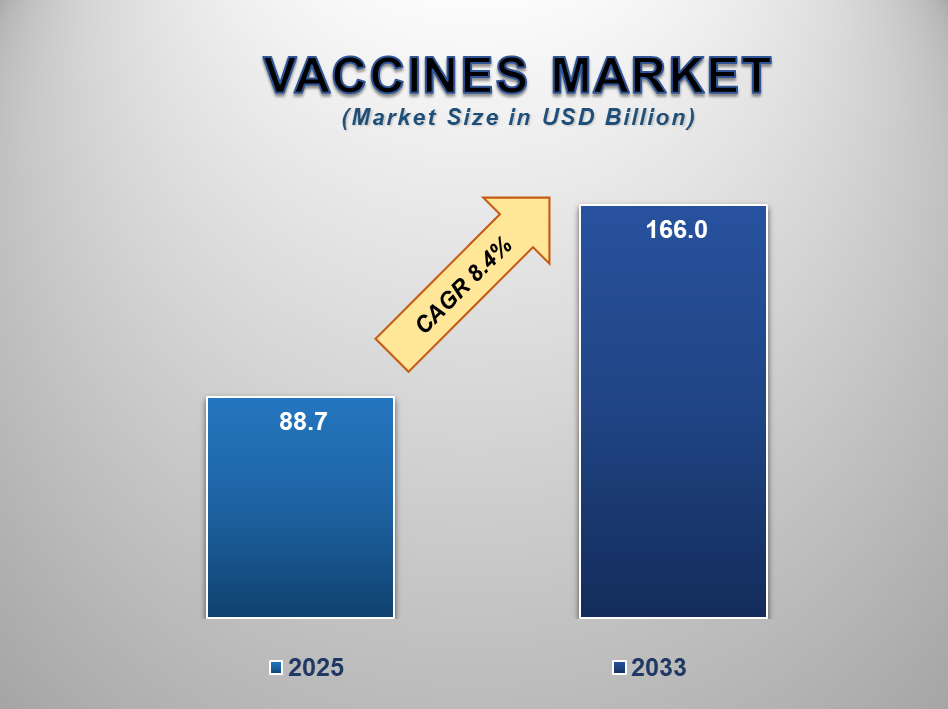

The global Vaccines market size is projected to grow from USD 88.7 Billion in 2025 to USD 166.0 Billion by 2033, expanding at a CAGR of 8.4% over the forecast period. Vaccines remain among the most effective public health tools for the prevention and control of infectious diseases. The global rise in immunization programs, supportive government policies, and increasing R&D investments from both public and private sectors are key drivers for market expansion.

Get Report Link : https://m2squareconsultancy.com/reports/global-vaccines-market

Market size and outlook

The WHO’s 2024 GVMR (covering the 2023 market) provides the most comprehensive cross-country view of supply, demand, and procurement. It estimates a US$ 77 billion value across 88 vaccine products sold in 207 countries, supplied by around 116 manufacturers, underlining how globally distributed and policy-sensitive this market remains.

Private analyst views differ on precise dollar trajectories—reflecting assumptions about COVID-19 volumes, RSV uptake, pricing in middle-income markets, and public financing. For example, Fortune Business Insights projects the market to nearly double to US$ 178.8 billion by 2032 (10.5% CAGR); Grand View Research estimates US$ 151.9 billion by 2033 (7.8% CAGR); and Global Market Insights sees US$ 145.8 billion by 2034 (7.1% CAGR). Precedence Research forecasts US$ 161.4 billion by 2034 (6.7% CAGR). The consensus signal: steady expansion, with growth strongest in innovative categories and in regions scaling routine and catch-up coverage.

Demand drivers: routine, catch-up, and new indications

Global routine immunization coverage is stabilizing, but millions of “zero-dose” and under-immunized children remain—a core demand driver for Gavi-supported and domestic public programs. WHO and UNICEF report that in 2024, 89% of infants received at least one DTP dose and 85% completed all three doses—a modest improvement over 2023, yet still leaving >14 million infants unvaccinated and pockets of measles risk. This equilibrium—high but plateauing coverage with persistent gaps—creates sustained demand for traditional pediatric vaccines and for outbreak response stockpiles.

On top of routine volumes, new or expanding indications are adding growth layers:

-

RSV prevention (maternal vaccines, older-adult shots, and long-acting monoclonal antibodies for infants) is scaling in high-income markets and select middle-income countries, with clinical and policy momentum shaping seasonal procurement.

-

HPV vaccination is broadening as countries adopt gender-neutral programs and catch-up cohorts; multi-year tenders and pooled procurement are strengthening visibility for manufacturers.

-

Adult immunization (influenza, pneumococcal, COVID-19 boosters, and travel vaccines) remains a meaningful contributor in higher-income markets, with pricing dynamics and annual campaigns supporting revenues.

Supply-side landscape and manufacturing capacity

The vaccines market relies on a concentrated but diverse set of players—Pfizer, Moderna, GSK, Sanofi, Merck, CSL Seqirus, AstraZeneca, and Novavax among the most visible in high-income settings—supplemented by a long tail of regional and emerging-market manufacturers supplying EPI vaccines and tender-based channels. Policy meetings and advisory votes (e.g., in the U.S.) can reshape seasonal demand mix, labeling, and uptake expectations for influenza, RSV, MMR, and COVID-19 products.

Notably, supply robustness varies by antigen. For instance, UNICEF’s BCG market note (October 2024) estimated demand at ~330 million doses with 24 active manufacturers and adequate global capacity, while other products can face intermittent constraints depending on regulatory, quality, or input bottlenecks. UNICEF’s ongoing market notes track such shifts across key pediatric and outbreak-response vaccines.

There is also a structural push toward regionalized manufacturing, especially in Africa, to improve resilience after COVID-19 supply inequities. Recent initiatives—such as Gavi’s US$ 1.2 billion effort to catalyze African manufacturing—aim to diversify supply bases through performance-linked incentives, though near-term volumes will still be dominated by established hubs.

Procurement and pricing: multi-channel dynamics

Procurement channels shape market behavior:

-

UNICEF/Gavi pooled procurement and PAHO’s Revolving Fund secure large pediatric volumes at tiered prices for low- and some middle-income countries.

-

National tenders (Europe, Asia, Middle East) determine market share for traditional products and newer adult vaccines.

-

Private channels (especially in upper-middle and high-income markets) support premium pricing for adult and travel immunizations, RSV innovations, high-dose/adjuvanted influenza, and combination vaccines.

The WHO GVMR 2024 underscores the importance of cross-country variation in pricing and the need for more transparent, predictable procurement to ensure sustainable markets—especially for outbreak-prone or low-volume products that can be unattractive without pooled demand guarantees.

Policy and financing headwinds (and tailwinds)

Immunization financing is in flux. Gavi’s next five-year strategy (2026–2030) targets ~US$ 9–12 billion to sustain routine vaccination, reach zero-dose children, and strengthen regional manufacturing. As of June 2025, donors had pledged over US$ 9 billion at a Brussels summit co-hosted by the EU and the Gates Foundation—encouraging, but still shy of the upper end of needs.

At the same time, major donor volatility is a risk. The U.S. government’s stated plan to halt Gavi funding, alongside reported UK reductions for 2026–2029, has raised concerns about downstream effects on access and supplier incentives—although other donors and philanthropies have reiterated support. In short, the macro-funding picture remains unsettled, with potential implications for volume commitments and market health in the Gavi channel.

Segmentation and regional outlook

By antigen/technology

-

Traditional pediatric vaccines (DTP-containing, MMR, polio, hepatitis) anchor volumes; pricing remains tightly managed via pooled mechanisms and national tenders.

-

HPV will continue to expand with broader national programs, improved supply, and gender-neutral policies, supporting double-digit value growth in some markets.

-

Influenza and adult respiratory (including high-dose/adjuvanted flu and RSV products) contribute seasonal, often premium-priced revenue in higher-income countries.

-

COVID-19 has normalized to smaller, risk-group-oriented campaigns; volumes are materially below pandemic peaks but remain non-trivial in annual revenue.

By region

-

North America and Europe: mature markets with substantial adult immunization and rapid uptake of novel products (e.g., RSV); reimbursement and HTA decisions drive product mix and speed of adoption.

-

Asia-Pacific: diverse dynamics—from high-growth private markets (India’s private adult segment, Southeast Asia travel vaccines) to expanded public programs in China and emerging ASEAN members; local manufacturing capabilities are rising.

-

Africa and lower-income regions: a significant share of pediatric volumes via Gavi/UNICEF channels; manufacturing localization efforts and cold-chain investments are strategic focus areas.

Competitive landscape

A handful of multinational leaders dominate high-value segments: Pfizer, Moderna, GSK, Sanofi, Merck, CSL Seqirus, and AstraZeneca, with Novavax active in COVID-19 boosters and combination candidates. Competition intensifies in seasonal respiratory markets (influenza, RSV), where differentiated formulations (e.g., high-dose, adjuvanted, cell-based) and real-world effectiveness data inform procurement decisions. Meanwhile, emerging-market manufacturers (including India- and China-based producers) play a pivotal role in high-volume pediatric tenders, often with WHO prequalification.

Risks to watch

-

Financing uncertainty: Shifts in donor and government budgets can ripple into procurement volumes, tender timing, and supplier capacity planning—especially in pediatric EPI markets.

Policy and advisory dynamics: Changes in national advisory committees or labeling can alter seasonal demand for respiratory vaccines.

Supply disruptions: Quality events or input shortages can tighten specific markets; continuous monitoring (e.g., UNICEF market notes) is essential for stakeholders.

Outbreak volatility: Measles, polio (cVDPV), and other outbreaks can shift near-term vaccine allocations and funding priorities, complicating planning but creating critical public-health needs.

Strategic takeaways for stakeholders

-

Manufacturers should calibrate portfolios toward resilient pediatric tenders and premium adult segments (RSV, enhanced influenza, adult pneumococcal/pertussis), while engaging with regional manufacturing initiatives to participate in policy-backed capacity growth.

-

Investors can expect steady market expansion, with returns tied to innovation speed (antigen design, platforms, combinations), lifecycle management, and payer evidence generation—especially real-world effectiveness in older adults. Benchmarked consensus across reputable firms points to high-single-digit CAGRs into the early-to-mid 2030s.

-

Public buyers and donors should prioritize predictable, multi-year procurement and transparent pricing frameworks to maintain supplier participation in less lucrative antigens, guarding against shortages and ensuring equity.

Outlook

The vaccines market is evolving from pandemic surge to durable, innovation-led growth. The base is solid—routine immunization and catch-up campaigns underpin volumes—while RSV, enhanced influenza, and broader HPV adoption add high-value layers. Yet, the sector’s health ultimately depends on stable financing and policy coherence. If Gavi’s replenishment closes its funding gap and national budgets hold, manufacturers will have clearer demand signals to invest in capacity and next-gen platforms; if not, access and sustainability risks could re-emerge, particularly for products serving the poorest countries. On balance, with global attention refocusing on immunization as a core health security investment, the medium-term trajectory remains positive—for public health outcomes and for a vaccines industry that continues to innovate.

- Related Reports Links :

https://m2squareconsultancy.com/reports/self-adhesive-labels-market

https://m2squareconsultancy.com/reports/smart-irrigation-market

https://m2squareconsultancy.com/reports/rare-disease-drugs-market

https://m2squareconsultancy.com/reports/sickle-cell-anemia-testing-and-screening-market

https://m2squareconsultancy.com/reports/urine-testing-cups-market

https://m2squareconsultancy.com/reports/global-vaccines-market

https://m2squareconsultancy.com/reports/surgical-instruments-market

https://m2squareconsultancy.com/reports/predictive-analytics-market

https://m2squareconsultancy.com/reports/smart-cities-market

https://m2squareconsultancy.com/reports/seed-treatment-market

Reasons to Purchase this Report

- Qualitative and quantitative analysis of the market based on segmentation involving both economic as well as non-economic factors

- Provision of market value data for each segment and sub-segment

- Indicates the region and segment that is expected to witness the fastest growth as well as to dominate the market

- Analysis by geography highlighting the consumption of the product/service in the region as well as indicating the factors that are affecting the market within each region

- Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major market players

- The current as well as the future market outlook of the industry with respect to recent developments which involve growth opportunities and drivers as well as challenges and restraints of both emerging as well as developed regions

- Market dynamics scenario, along with growth opportunities of the market in the years to come

About m2squareconsultancy :

We are a purpose-driven market research and consulting company passionate about turning data into direction. Founded in 2023, we bring together researchers, strategists, and data scientists who believe that intelligence isn’t just about numbers, it’s about insight that sparks progress.

We cater to a wide range of industries by delivering customized solutions, strategic insights, and innovative support that help organizations grow, adapt, and lead in their respective sectors. Here’s a brief overview of key industries we work with

Contact Us:

Email: sales@m2squareconsultancy.com

Phone (IN): +91 80978 74280

Phone (US): +1 929 447 0100

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology