Global Emissions Trading Market Is Estimated To Witness High Growth Owing To Stringent Environmental Regulations and Increasing Adoption of Carbon Neutrality Initiatives

The emissions trading market is estimated to be valued at US$334.80 billion in 2023 and is expected to exhibit a CAGR of 24% over the forecast period, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

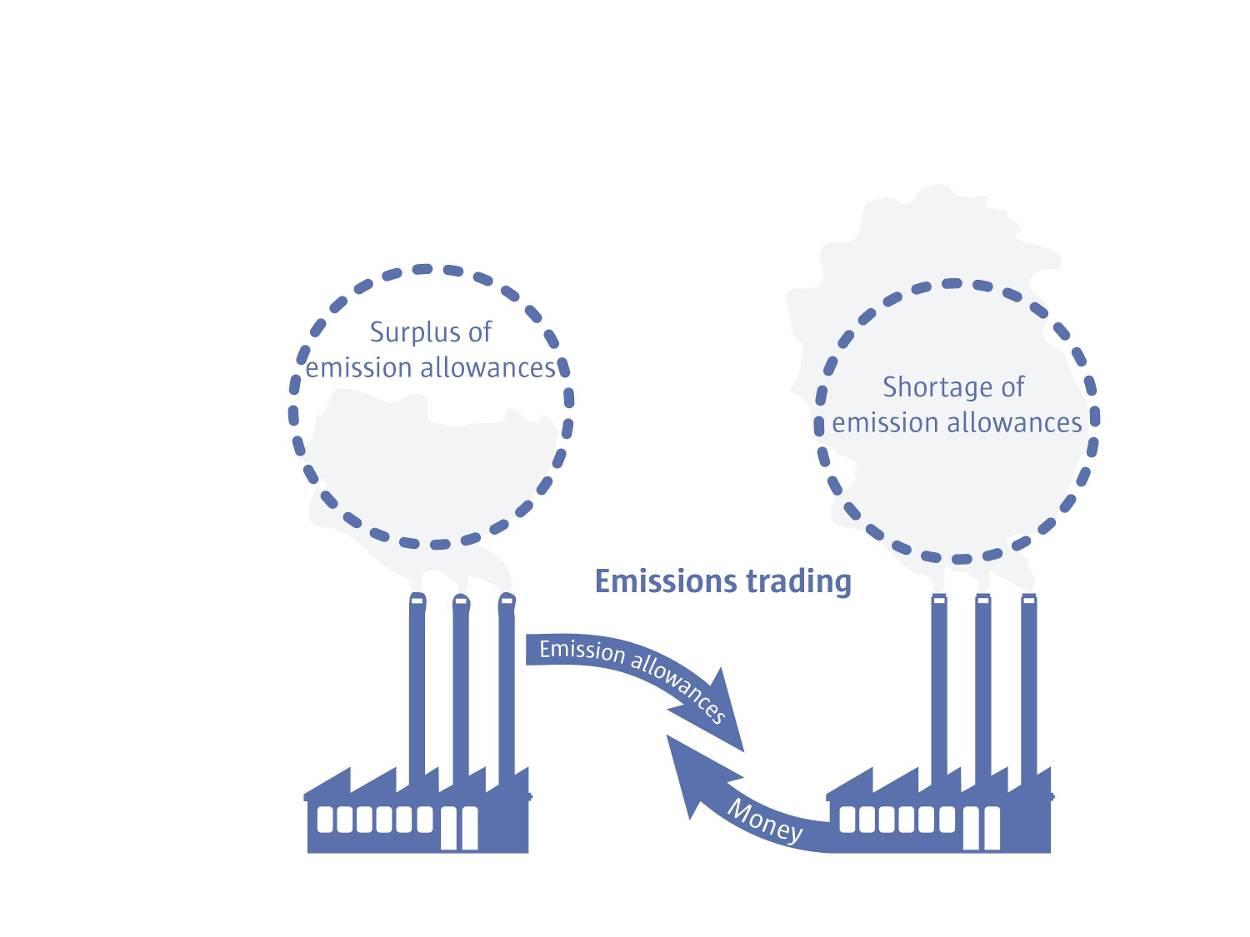

The emissions trading market involves the buying and selling of emissions permits or allowances, allowing companies to emit a certain amount of greenhouse gases. These permits can be traded among companies, providing financial incentives for reducing emissions. The market is driven by stringent environmental regulations imposed by governments worldwide to combat climate change and reduce carbon emissions. Companies are increasingly adopting carbon neutrality initiatives to minimize their environmental impact. This has led to a rise in demand for emission permits, driving the growth of the emissions trading market.

Market Dynamics:

The emissions trading market is driven by two key factors. Firstly, the implementation of strict environmental regulations by governments across the globe to reduce greenhouse gas emissions is creating a robust demand for emission permits. These regulations mandate companies to limit their carbon footprint and incentivize emission reduction through emissions trading. Secondly, the increasing adoption of carbon neutrality initiatives by businesses is fueling the demand for emission permits. Companies are voluntarily committing to reducing their carbon emissions to achieve sustainability goals and enhance their corporate image. This trend has significantly contributed to the growth of the emissions trading market.

SWOT Analysis:

Strength: The emissions trading market is expected to grow at a CAGR of 24% during the forecast period of 2023-2030, making it a highly lucrative market for investors. The market size for 2023 is projected to reach US$ 334.80 billion, indicating significant growth potential.

Weakness: One weakness of the emissions trading market is the lack of global consensus and uniform regulations regarding emissions. This inconsistency can hinder market growth and lead to uncertainty for investors. Another weakness is the potential for market manipulation and fraud within the trading system, which could undermine its credibility.

Opportunity: One opportunity in the emissions trading market is the increasing focus on sustainability and environmental consciousness globally. This has resulted in stricter emissions regulations and the need for companies to reduce their carbon footprint, creating a demand for emissions trading. Additionally, the emergence of technology solutions and platforms for emissions trading provides an opportunity for market growth and efficiency.

Threats: One threat to the emissions trading market is the potential for geopolitical tensions and trade disputes to impact the smooth functioning of the market. Changes in government policies and regulations can also pose a threat, as they can affect the demand for emissions trading and create uncertainty.

Key Takeaways:

The global emissions trading market is expected to witness high growth, exhibiting a CAGR of 24% over the forecast period of 2023-2030. This growth can be attributed to increasing environmental consciousness and regulatory focus on emissions reduction.

In terms of regional analysis, the fastest growing and dominating region in the emissions trading market is expected to be Europe. This is primarily due to the implementation of the European Union Emissions Trading System (EU ETS) and stringent emissions reduction targets set by European countries.

Key players operating in the emissions trading market include BP Plc, Royal Dutch Shell Plc, Total SE, Chevron Corporation, ExxonMobil Corporation, Engie SA, RWE AG, ON SE, Vattenfall AB, Gazprom, Mitsubishi UFJ Financial Group (MUFG), JPMorgan Chase & Co., Goldman Sachs Group, Inc., Citigroup Inc., and Barclays PLC. These key players play a significant role in shaping the market dynamics and driving innovation in emissions trading.

Read More:

https://ictideologist.blogspot.com/2023/09/emissions-trading-market-is-estimated.html

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology