Generating Income with Confidence: Harnessing the Power of Writing Call Options

In the previous article, we explored the concept of buying a call option to profit from an expected rise in the price of an underlying asset. Now, let's delve into the strategy of writing a call option to generate income, also known as selling a covered call.

What is Writing a Call Option?

Writing a call option involves selling a call contract to another investor. As the writer (or seller) of the call option, you are granting the buyer the right to purchase a specific asset from you at a predetermined price (strike price) on or before the option's expiration date. In return for selling this right, you receive a premium from the buyer.

Example Scenario: Writing a Covered Call on UP

Imagine you already own 100 shares of UP, and you want to generate income from your holdings. Currently, UP is trading at $20 per share. You decide to write a covered call option with a strike price of $22 and an expiration date in December 2021.

By writing this covered call, you are effectively creating an obligation to sell your UP shares at $22 per share if the buyer exercises the option before it expires. In return, you receive a premium of, let's say, $75 for this covered call option.

Income Generation with Covered Calls

When you write a covered call, you receive the premium from the buyer upfront. In this case, you would receive $75 for writing the covered call on your 100 shares of UP. This income can be viewed as a form of yield on your investment.

Calculating the Equivalent Yield

The premium you receive from the covered call can be expressed as a percentage of the total value of your UP shares. For instance, if the 100 shares are valued at $4,000 (100 shares × $20 per share), the $75 premium equates to a 1.875% yield on your investment.

Managing the Covered Call Position

Once you have written the covered call, several scenarios can unfold:

• Expiration Worthless: If UP's price does not rise above the strike price of $22 by the option's expiration date, the option will expire worthless, and you keep the premium as income. You can then write another covered call to generate more income.

• Option Exercised: If UP's price rises above $22, the buyer may choose to exercise the option and buy your shares at the strike price. In this case, you sell your shares at $22 each and keep the premium received from writing the covered call.

Pros and Cons of Writing Covered Calls

Writing covered calls can be an attractive strategy for income-oriented investors. It offers the opportunity to generate additional cash flow from existing holdings and potentially enhance overall portfolio returns. However, it comes with certain trade-offs:

• Opportunity Cost: When you write a covered call, you cap your potential upside gain if the price of the underlying asset rises significantly.

• Risk of Losing the Asset: If the price of the underlying asset surges well above the strike price, you may have to sell your asset at a lower price than its market value.

Conclusion

Writing a covered call is a strategy that allows investors to generate income from their existing holdings. By selling a call option on an asset they already own, investors receive a premium, which acts as a form of yield on their investment. While writing covered calls can provide income and serve as a hedge against price declines, it's essential to understand the potential risks and rewards of this strategy.

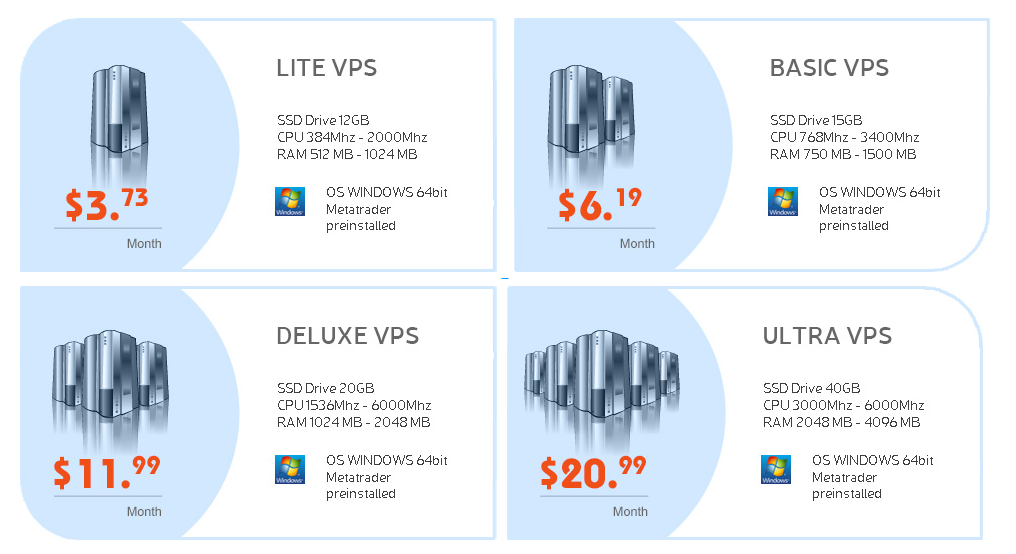

Looking for the most reliable and affordable forex VPS? Check out cheap-forex-vps.com to find the perfect virtual server to optimize your forex trading strategies.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology