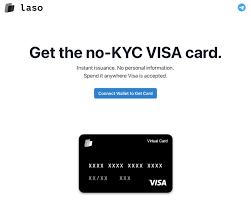

Unveiling the Future: Virtual Cards Without KYC Verification

Introduction

In our increasingly digital world, the way we conduct financial transactions has evolved at an astonishing pace. Virtual cards have emerged as a convenient and secure alternative to traditional payment methods. However, for some, the requirement of Know Your Customer (KYC) verification can be a roadblock. This brings us to the exciting world of virtual cards without KYC. These cards offer a pathway to secure, private, and hassle-free online payments without the need for extensive personal identification. In this article, we'll explore the benefits of virtual card without kyc and how they are revolutionizing the landscape of online transactions.

Understanding Virtual Cards Without KYC

Virtual cards without KYC, also known as anonymous virtual cards, are digital payment cards that can be obtained and used without the need for extensive personal identification. They provide an extra layer of privacy by allowing users to conduct online transactions without disclosing sensitive personal information.

Privacy Redefined

The primary allure of virtual cards without KYC lies in the promise of enhanced privacy. Many individuals are rightfully concerned about sharing extensive personal details for the sake of making online payments. With anonymous virtual cards, users can enjoy a level of privacy not typically afforded by traditional payment methods.

Security Remains Paramount

Contrary to the misconception that anonymity equates to reduced security, virtual cards without KYC still boast robust security measures. They are equipped with advanced encryption technology and adhere to industry-standard security protocols to safeguard transactions. By eliminating the need for extensive personal information, these cards can actually reduce the risk of identity theft or fraudulent activity.

Guarding Against Data Breaches

In an age marked by increasing concerns over data breaches and cyberattacks, the appeal of virtual cards without KYC becomes even more pronounced. Since they are not linked to personal identities, even if a virtual card's details were to be compromised in a data breach, the user's sensitive personal information remains protected.

Global Accessibility and Inclusion

Virtual cards without KYC can be particularly advantageous for individuals who seek to make international transactions without the constraints of geographical borders. Traditional banks often impose restrictions or fees on international transactions, but with virtual cards, users can engage in borderless commerce without these limitations. This inclusivity empowers individuals who may not have access to traditional banking systems or lack the necessary documentation for KYC verification to participate in the digital economy.

Streamlined Verification Processes

Traditional KYC procedures can be time-consuming and often involve the submission of various forms of identification. Virtual cards without KYC eliminate this process, allowing users to acquire and use their cards almost instantly. This efficiency is particularly beneficial for those who need to make online transactions promptly.

Preserving Financial Privacy Rights

In an era where privacy rights are of increasing concern, virtual cards without KYC offer a solution that aligns with the desire to maintain control over one's personal information. It allows users to engage in online commerce with confidence, knowing that their financial activities remain confidential.

Conclusion

The emergence of virtual cards without KYC verification represents a monumental step forward in the world of online payments. Their ability to provide enhanced privacy, security, and accessibility without the need for extensive personal information sets them apart as a valuable tool for modern consumers. As the importance of online privacy continues to grow, the demand for anonymous virtual cards is likely to rise. Embracing this technology ensures that you have a secure, private, and hassle-free means of conducting transactions in the digital age. So why wait? Experience the future of online payments today and take control of your financial privacy like never before.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology