Market Is Estimated To Witness High Growth Owing To Strong Demand And Rising Awareness Towards Carbon Neutrality

The Carbon Offset Market is estimated to be valued at US$ 414.80 Billion in 2023 and is expected to exhibit a CAGR Of 31.7% over the forecast period 2023 To 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

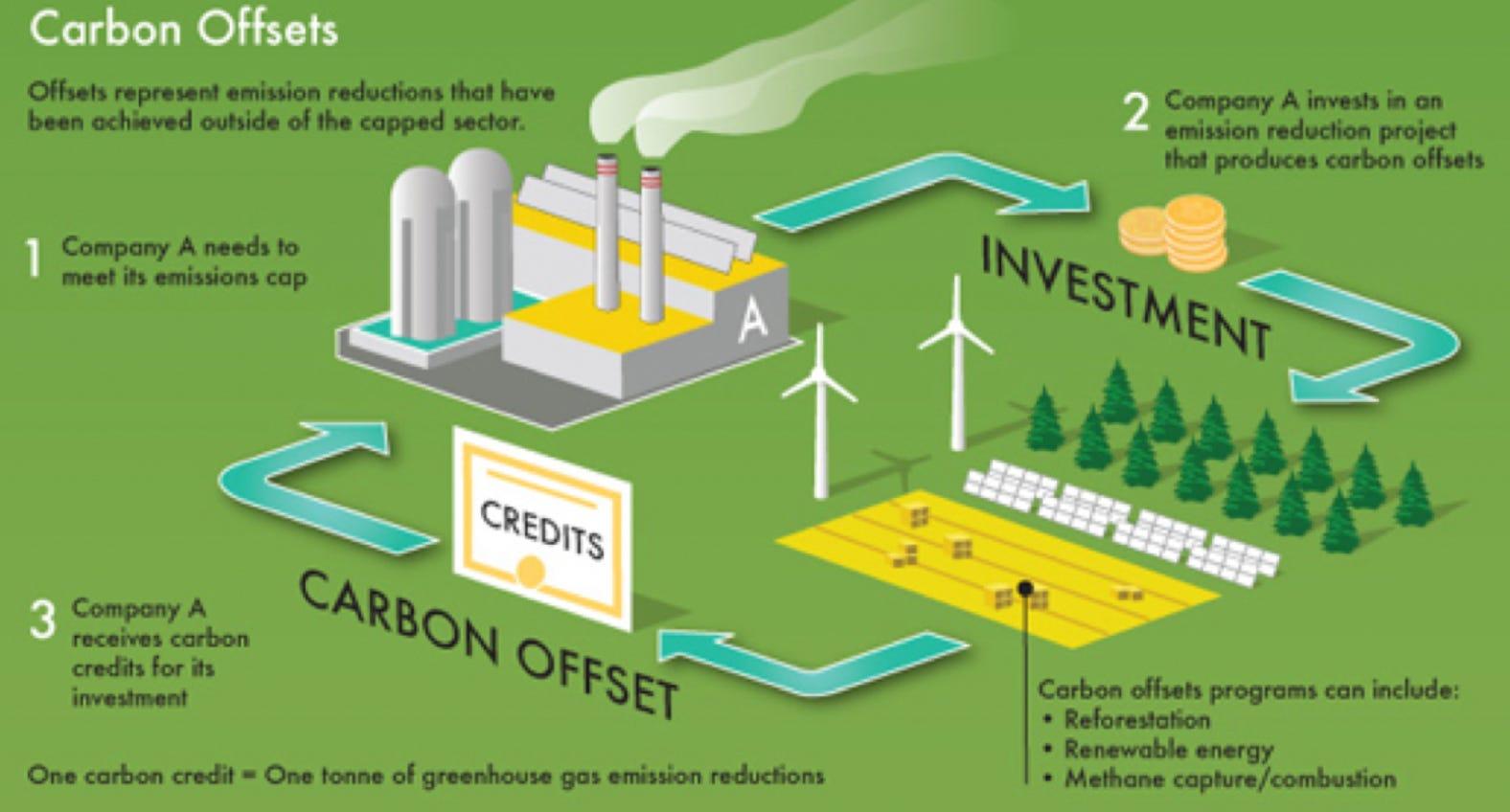

Carbon offset refers to reduction in emissions of carbon dioxide or greenhouse gases made to compensate for emissions made elsewhere. They are measured in metric tons of carbon dioxide-equivalent (CO2e) and one offset represents the reduction of one metric ton of carbon emissions. Carbon offsets are used by governments and companies to comply with emission reduction obligations. They are also used voluntarily by individuals and organizations to reduce their carbon footprint.

Market Dynamics:

The carbon offset market is driven by strong demand from companies aiming to achieve carbon neutrality in their operations. With rising awareness about environmental issues, many large corporations have announced carbon neutral targets and are investing in offsets to reduce emissions. The market is also witnessing high growth owing to implementation of stringent regulations in different countries to curb greenhouse gas emissions. Various climate summits and conferences have highlighted the need for urgent actions to limit global warming and transition to low carbon economy, which is further fueling demand for offsets.

SWOT Analysis

Strength: Explain in three sentences - Carbon offset market provides opportunities for reducing carbon footprint. It allows businesses and individuals to invest in emission reduction projects. There is high demand for carbon credits due to stringent government regulations and emission reduction targets.

Weakness: Explain in three sentences - Lack of standardized rules and regulations for carbon offset projects. Concerns related to additionality and impermanence of carbon credits. Project development and monitoring activities require high initial investments.

Opportunity: Explain in three sentences - Growing global focus on environmentally friendly practices and sustainability. Increasing popularity of voluntary carbon offset programs among corporates for branding and CSR activities. Development of new offset methodologies and project types.

Threats: Explain in two sentences - Changes in government policies related to emissions and carbon pricing. Emergence of alternate low carbon technologies reducing need for offsets.

Key Takeaways

The global Carbon Offset Market is expected to witness high growth, exhibiting CAGR of 31.7% over the forecast period, due to increasing climate change concerns and stringent government regulations on emissions. Carbon offset projects in sectors like forestry, agriculture and renewable energy are gaining traction.

Regional analysis –

North America dominates the global carbon offset market and is expected to continue its dominance, growing at a CAGR of around 32.2% during the forecast period. This is attributed to presence of key market players and stringent government policies in the US and Canada. Asia Pacific exhibits the fastest growth due to supportive government initiatives and carbon pricing mechanisms in countries like China and India.

Key players –

Key players operating in the carbon offset market are 3Degrees Inc., NativeEnergy, ClimatePartner, Carbon Credit Capital, Terrapass, Renewable Choice Energy, Gold Standard, Offsetters, South Pole Group, Veridium, Cool Effect, ClimateCare, MyClimate, Forest Carbon, Verified Carbon Standard. These players are focusing on new project development, carbon credit registry and voluntary offset programs.

Read More : https://marketinsightsminds.blogspot.com/2023/11/carbon-offset-market-to-witness-strong.html

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology