Market Is Estimated To Witness High Growth Owing To Increasing Carbon Emission Regulations And Rising Demand For Renewable Energy.

The Carbon Verification Market is estimated to be valued at US$ 12.73 Billion in 2023 and is expected to exhibit a CAGR Of 26% Over the forecast period 2023 To 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

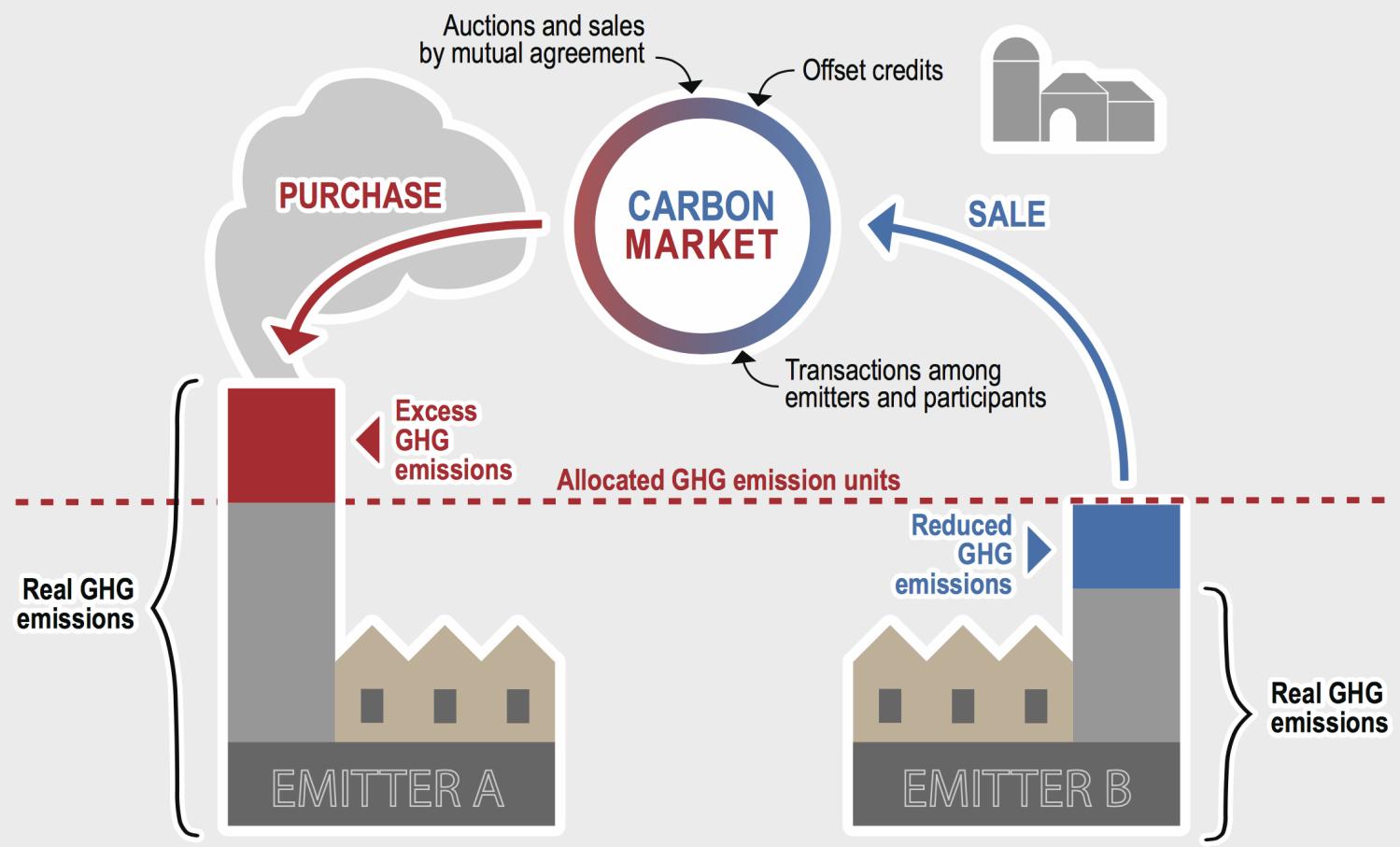

Carbon verification refers to the independent third-party validation and auditing of carbon reduction initiatives and carbon footprint reporting. Carbon verification ensures the accuracy and reliability of self-reported emissions data and greenhouse gas reduction claims. It involves verification at organization level, project level as well as product level to validate emissions reductions and removals for compliance as well as voluntary purposes.

Market Dynamics:

The carbon verification market is expected to witness significant growth over the forecast period, owing to increasing implementation of carbon emission regulations worldwide and rising demand for renewable energy. Stringent government policies and carbon pricing mechanisms to curb greenhouse gas emissions are prompting companies to measure, report and reduce their carbon footprint, thereby driving the need for carbon verification services. Furthermore, increasing consumer awareness about carbon footprint is also augmenting the market growth. The growth of voluntary carbon markets and emergence of new offsetting initiatives are further fueling the demand for independent third-party verification of carbon credits.

SWOT Analysis

Strength: Carbon verification provides third party assurance of carbon reduction claims made by companies. It helps build trust and ensures transparency. Verification methods are well established with ISO standards. The process identifies reduction opportunities and supports sustainability targets.

Weakness: Carbon verification is a time consuming and resource intensive process. It requires collecting and auditing extensive documentation. Smaller companies may find the costs prohibitive. Methodologies can vary between verification bodies leading to inconsistent results.

Opportunity: Growing global emphasis on reducing carbon emissions and achieving net zero targets is driving increased demand for carbon verification. More companies are pledging commitments and requiring verification to demonstrate progress to investors and customers. Emerging carbon markets also require robust verification protocols.

Threats: Alternatives like self reporting without third party verification could reduce market share. Potential changes to climate policies and regulations may impact verification needs and methods. Competitive pressures exist from new verification entrants and competing sustainability services.

Key Takeaways

The global Carbon Verification Market is expected to witness high growth, exhibiting CAGR of 26% over the forecast period, due to increasing climate change concerns and net zero commitments from companies. Verification supports emissions reduction goals and transitions to low carbon economies.

The US represents the largest share of the carbon verification market currently due to strong policy drivers and corporate sustainability initiatives. The Asia Pacific region is anticipated to be the fastest growing market with growing emissions trading schemes and carbon pricing across countries like China, India and South Korea. Growing verification demand is observed from industries like oil and gas, mining, aviation, construction and transportation sectors.

Key players operating in the carbon verification market are DNV GL, SGS SA, Bureau Veritas, TÜV NORD GROUP, Intertek Group plc. DNV GL is a leading global verification provider with expertise across multiple industries and programs. SGS SA offers sustainable business solutions including certification, verification, testing and quality assurance.

Read More : https://marketinsightsminds.blogspot.com/2023/11/global-carbon-verification-market-is.html

The Carbon Verification Market is estimated to be valued at US$ 12.73 Billion in 2023 and is expected to exhibit a CAGR Of 26% Over the forecast period 2023 To 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

Carbon verification refers to the independent third-party validation and auditing of carbon reduction initiatives and carbon footprint reporting. Carbon verification ensures the accuracy and reliability of self-reported emissions data and greenhouse gas reduction claims. It involves verification at organization level, project level as well as product level to validate emissions reductions and removals for compliance as well as voluntary purposes.

Market Dynamics:

The carbon verification market is expected to witness significant growth over the forecast period, owing to increasing implementation of carbon emission regulations worldwide and rising demand for renewable energy. Stringent government policies and carbon pricing mechanisms to curb greenhouse gas emissions are prompting companies to measure, report and reduce their carbon footprint, thereby driving the need for carbon verification services. Furthermore, increasing consumer awareness about carbon footprint is also augmenting the market growth. The growth of voluntary carbon markets and emergence of new offsetting initiatives are further fueling the demand for independent third-party verification of carbon credits.

SWOT Analysis

Strength: Carbon verification provides third party assurance of carbon reduction claims made by companies. It helps build trust and ensures transparency. Verification methods are well established with ISO standards. The process identifies reduction opportunities and supports sustainability targets.

Weakness: Carbon verification is a time consuming and resource intensive process. It requires collecting and auditing extensive documentation. Smaller companies may find the costs prohibitive. Methodologies can vary between verification bodies leading to inconsistent results.

Opportunity: Growing global emphasis on reducing carbon emissions and achieving net zero targets is driving increased demand for carbon verification. More companies are pledging commitments and requiring verification to demonstrate progress to investors and customers. Emerging carbon markets also require robust verification protocols.

Threats: Alternatives like self reporting without third party verification could reduce market share. Potential changes to climate policies and regulations may impact verification needs and methods. Competitive pressures exist from new verification entrants and competing sustainability services.

Key Takeaways

The global Carbon Verification Market is expected to witness high growth, exhibiting CAGR of 26% over the forecast period, due to increasing climate change concerns and net zero commitments from companies. Verification supports emissions reduction goals and transitions to low carbon economies.

The US represents the largest share of the carbon verification market currently due to strong policy drivers and corporate sustainability initiatives. The Asia Pacific region is anticipated to be the fastest growing market with growing emissions trading schemes and carbon pricing across countries like China, India and South Korea. Growing verification demand is observed from industries like oil and gas, mining, aviation, construction and transportation sectors.

Key players operating in the carbon verification market are DNV GL, SGS SA, Bureau Veritas, TÜV NORD GROUP, Intertek Group plc. DNV GL is a leading global verification provider with expertise across multiple industries and programs. SGS SA offers sustainable business solutions including certification, verification, testing and quality assurance.

Read More : https://marketinsightsminds.blogspot.com/2023/11/global-carbon-verification-market-is.html

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology