Ethernet Card Market Is Estimated To Witness High Growth Owing To Increased Adoption Of Ethernet Across Industries

The Ethernet Card Market is estimated to be valued at US$ 6.25 Bn in 2023 and is expected to exhibit a CAGR of 9.0% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

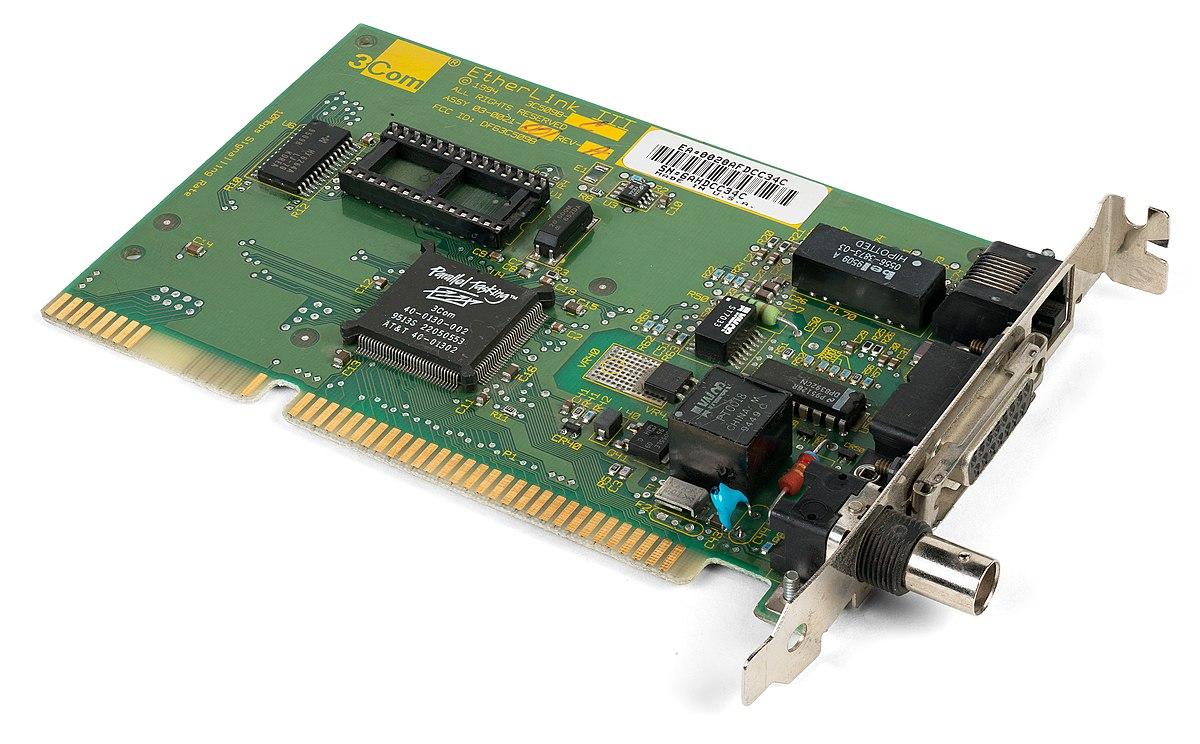

Ethernet cards are networking hardware devices that enable ethernet connectivity within computer systems. They enhance data transfer speeds and allow computers to connect with various devices using ethernet cables. With increasing digitalization across industries, there has been a rise in the adoption of ethernet for local area network connectivity. Ethernet cards play a vital role in establishing high-speed communication networks within organizations.

Market key trends:

One of the key trends fueling the growth of the ethernet card market is increased adoption of ethernet across various industries. Industries such as healthcare, manufacturing, BFSI, and IT & telecom have widely adopted ethernet technology for their networking needs due to benefits such as high speeds, reliability, and cost-effectiveness. Furthermore, growing deployment of IoT devices has also augmented the demand for advanced ethernet connectivity solutions. Iot devices require seamless interconnectivity within infrastructure which is effectively provided by ethernet networks. Rising investments by organizations in digital transformation initiatives are further driving the need for robust networking infrastructure which is a major factor propelling the ethernet card market growth over the forecast period.

Porter’s Analysis

Threat of new entrants: The Ethernet card market has moderate barriers to entry due to involvement of large capital investment and high costs of R&D. However, the threat is moderate due to opportunity for new players in specialized and niche market segments.

Bargaining power of buyers: The bargaining power of buyers is moderate as there are a number of established vendors supplying Ethernet cards. However, larger buyers such as data centers and telecom companies have some bargaining power.

Bargaining power of suppliers: The bargaining power of suppliers is low to moderate. This is because the components used in Ethernet cards such as chips, controllers and cables are available from multiple global and domestic suppliers.

Threat of new substitutes: The threat of substitutes is low as Ethernet technology has emerged as a widely used networking standard and there exists no direct substitute.

Competitive rivalry: High due to presence of numerous global and regional players competing on performance, features and pricing.

SWOT Analysis

Strength: Ethernet cards offer high speed data transfers with low latency and power consumption. Innovation in Ethernet technology has resulted in adoption in new applications.

Weakness: High initial investment and operational costs associated with Ethernet infrastructure limits adoption for smaller organizations. Dependence on networking hardware makes it susceptible to obsolescence.

Opportunity: Growing cloud computing, IoT and big data analytics market is driving demand for high performance networking solutions. Adoption of newer Ethernet standards such as 400G and 800G cards presents an opportunity.

Threats: Commoditization of Ethernet cards may lead to pricing pressures on vendors. Technology shifts such as adoption of advanced wireless technologies can reduce demand.

Key Takeaways:

The Global Ethernet Card Market Size is expected to witness high growth, exhibiting a CAGR of 9.0% over the forecast period, due to increasing demand for high-speed network connectivity solutions driven by wide proliferation of IoT devices and rising cloud computing adoption.

Regional analysis: North America dominates the global Ethernet card market, owing to strong presence of global Ethernet card manufacturers and early adoption of advanced networking technologies. Asia Pacific is projected to witness the highest growth during the forecast period due to rapid digitalization of industries, growing infrastructure investments, and expanding 5G deployments in the region.

Key players operating in the Ethernet card market are Intel Corporation, Broadcom Inc., Mellanox Technologies (now part of NVIDIA), Cisco Systems Inc., Juniper Networks Inc., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Huawei Technologies Co. Ltd., Arista Networks Inc., Extreme Networks Inc., Juniper Networks Inc., Marvell Technology Group Ltd., Fujitsu Limited, NEC Corporation, Microchip Technology Inc.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology