Roller Compaction Market Poised To Grow Owing To Increasing Demand From Pharma Industry

Roller compaction machines are widely used in the pharmaceutical industry for direct compaction of active pharmaceutical ingredients (APIs) and excipients into granules or slugs. Roller compaction is commonly employed as a granulation process where the materials are compacted between two counter rotating rolls under pressure to form ribbons. The ribbons break into irregularly shaped granules upon handling. This process provides better control over granule properties compared to high shear granulation and results in enhanced flow and compaction characteristics. The pharmaceutical industry is rapidly growing owing to increasing prevalence of chronic diseases worldwide and rising demand for generics. Moreover, continuous process optimization to enhance process efficiency and throughput are further propelling demand for roller compaction machines in the pharma sector.

The global roller compaction market is estimated to be valued at US$ 5620.2 Mn in 2023 and is expected to exhibit a CAGR of 6.5% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The global roller compaction market is estimated to witness high growth owing to increasing demand from the pharmaceutical industry. Pharmaceutical companies are increasingly adopting roller compaction technology for APIs and excipient direct compaction during granulation processes due to advantages such as improved product attributes, tight particle size distribution and better flowability and compressibility of granules. Further, continuous efforts towards process optimization to enhance production efficiency are also driving sales of roller compaction machines. In addition, advantages of roller compaction over alternative granulation methods like wet granulation are further expected to support market growth over the forecast period. However, high costs associated with roller compaction machines and availability of alternative granulation techniques may limit market growth to some extent during the forecast period.

SWOT Analysis

Strength: Compaction machines are now equipped with advanced technologies like GPS, telematics, and connectivity which enhance their safety and efficiency. Development of hybrid and electric construction equipment provides lower fuel and maintenance costs to end-users. Growing infrastructure spending and urbanization drives the demand for compaction machines for road and infrastructure projects.

Weakness: High initial investment costs associated with purchasing new compaction machines limits their adoption, especially in developing regions. Older generation compaction machines operate at high noise levels which create safety and environmental concerns. Fluctuations in raw material prices increase production costs for OEMs.

Opportunity: Growth of smart city projects and expansion of road networks in developing countries creates new customers. Adoption of rental and leasing models for equipment boost equipment utilization and lower ownership costs. Development of compact machines suitable for urban construction sites expands addressable market size.

Threats: Economic slowdowns negatively impact infrastructure spending thereby contracting compaction equipment demand. Natural calamities like floods, earthquakes disrupt ongoing construction projects. Rising competititon from local players with cheaper alternatives impacts market shares of prominent brands.

Key Takeaways

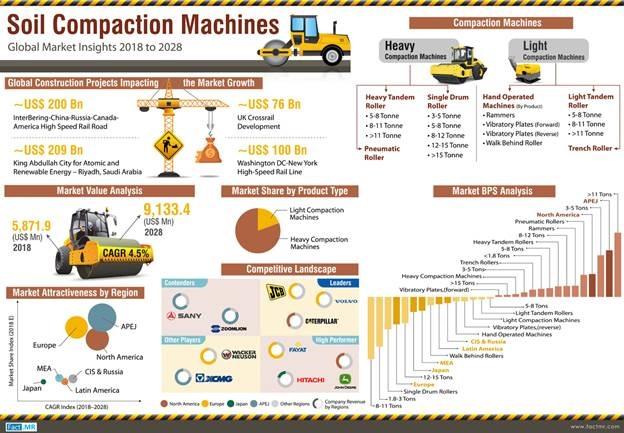

The global compaction machines market scope is expected to witness high growth driven by heavy infrastructure developments across regions. The global roller compaction market is estimated to be valued at US$ 5620.2 Mn in 2023 and is expected to exhibit a CAGR of 6.5% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

.

The Asia Pacific region currently dominates the market with over 35% share led by China, India, and Southeast Asian countries. These nations are engaged in modernizing road, railway and constructing new airports, metros to meet rising mobility needs of their large populations. Within Asia, China accounts for nearly 30% of global compaction equipment sales owing to its massive investments in high speed rail, road and residential projects under infrastructure push.

Regional analysis also comprises Europe holds the second largest market share and continues to be a major hub for construction equipment manufacturers like Wirtgen, Volvo, Atlas Copco etc. Stricter emission norms are prompting OEMs to develop electric models through JVs with automotive tech firms. North America remains an important mature market whereas countries like Brazil, Saudi Arabia, UAE are emerging hotspots in South America and Middle East driven by megaprojects.

Key players operating in the compaction machines market are Wacker Neuson SE, Sany Heavy Industry Co. Ltd, Volvo Construction Equipment, Wirtgen Group, Caterpillar Inc., Atlas Copco, Terex Corporation, Zoomlion Heavy Industries Science & Technology Co Ltd, Fayat Group, BOMAG GmbH, and XCMG Co. Ltd. Major brands are investing in R&D to sustain technological leadership through IoT enabled telematics, hybrid powertrains and autonomy for safer urban worksites. Strategic acquisitions help companies expand product portfolio and geographic footprint. Industry consolidation is underway to capture larger market shares globally

Get more insights on this topic: http://marketresearchinsighting.weebly.com/blog/compaction-machines-are-estimated-to-witness-high-growth-owing-to-growing-focus-on-infrastructure-development

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology