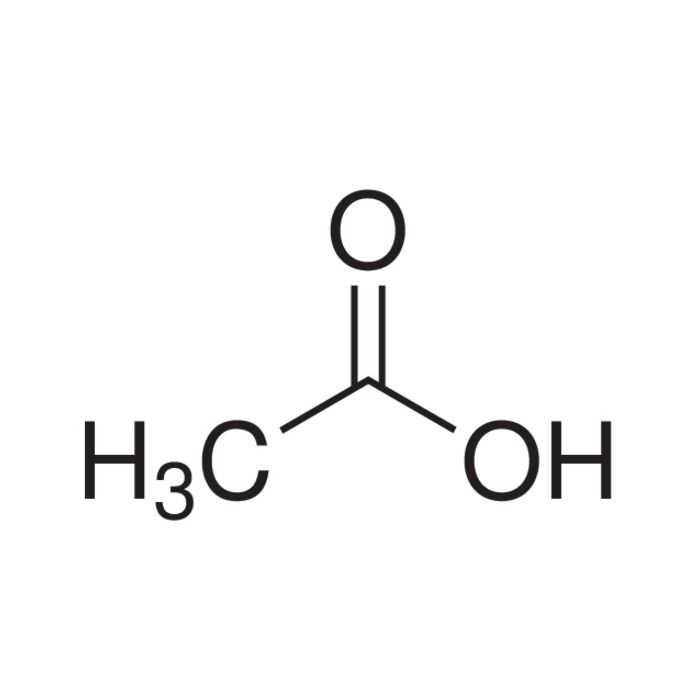

Acetic Acid Market To Witness High Growth Owing To Increasing Demand From Vinyl Acetate Monomer Application

The global Acetic Acid Market is estimated to be valued at US$ 14.63 Bn in 2023 and is expected to exhibit a CAGR of 9.7% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

The acetic acid market comprises products such as vinyl acetate monomer, purified terephthalic acid, acetate esters, and others. Acetic acid finds major applications in vinyl acetate monomer which is used to produce polyvinyl alcohol and ethylene-vinyl alcohol copolymers. These products are widely used in paints, adhesives, textiles industries.

Market Dynamics:

The growing demand for vinyl acetate monomer is a major factor driving the growth of the acetic acid market. Vinyl acetate monomer is widely used to produce polyvinyl alcohol and ethylene-vinyl alcohol copolymers which find applications in paints, adhesives and textile industries. For instance, according to Coherent Market Insights' analysis, vinyl acetate monomer accounted for over 50% share of the global acetic acid consumption in 2021.

Moreover, growing demand from purified terephthalic acid application is also augmenting market growth. Purified terephthalic acid is used in the manufacturing of polyester which is consumed by various industries such as textiles, films, beverages bottles. The increasing consumption of polyester across the world is favoring the demand for purified terephthalic acid which in turn is propelling the acetic acid market growth over the forecast period.

SWOT Analysis

Strength: Acetic acid has strong applications in vinegar production which has seen consistent demand growth. It is also used as a building block for several derivatives with applications in food additives and pharmaceuticals. Being relatively inexpensive and easily produced from natural feedstocks provides an economic advantage.

Weakness: Production of acetic acid results in air pollution and greenhouse gas emissions. Strict environmental regulations around the world increase compliance costs. Dependence on limited raw materials like fossil fuels adds supply chain risks.

Opportunity: Growing demand for pvc, pet bottle resin and other downstream products driven by packaging industry expansion in Asia Pacific and Middle East countries creates new market opportunities. Development of bio-based production methods can help address sustainability concerns.

Threats: Price volatility of key raw materials like crude oil impacts costs. Presence of substitute chemicals poses competition in certain applications. Trade wars and geopolitical issues disrupt global supply chains.

Key Takeaways

The global Acetic Acid Market Share is expected to witness high growth, exhibiting CAGR of 9.7% over the forecast period, due to increasing demand from vinyl acetate monomer production. The global VAM market is driven by rising polymer demand in end use industries like packaging, hygiene, construction etc.

Regional analysis: Asia Pacific dominates the global acetic acid market, accounting for over 50% share in 2023. China contributes to over a quarter of global demand led by robust VAM consumption. Southeast Asian countries are also growing rapidly on back of expanding chemical and manufacturing sectors in countries like Indonesia, Malaysia and Thailand. North America and Western Europe are mature markets but are expected to grow steadily during the forecast period.

Key players operating in the acetic acid market are Celanese Corporation, British Petroleum, Eastman Chemical Company, Jiangsu Sopo (Group) Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), Lyondell Basell Industries, Saudi Basic Industries Corporation (SABIC), Mitsubishi Chemical Company, PetroChina Co. Ltd., PetroChina Co. Ltd., BASF SE. The market remains consolidated with top five players dominating over 60% share. Companies are focusing on tapping opportunities in Asia Pacific and Middle East through capacity additions as well as developing bio-based production routes.

Get More Insights On This Topic: https://blogger-veritas.blogspot.com/2023/12/vinyl-acetate-monomer-vam-is-fastest.html

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology