Asia-Pacific Identity Verification Market Trends, Share, Opportunities and Forecast By 2028

The finest Asia-Pacific Identity Verification market report describes CAGR value fluctuation during the forecast period of 2021-2028 for the market. It is the most suitable, rational, and admirable market research report provided with a devotion and comprehension of business needs. The market report also comprises drivers and restraints for the market that are obtained with the help of SWOT analysis and also show all the recent developments, product launches, joint ventures, mergers, and acquisitions by the several key players and brands with their systemic company profiles that are driving the market. Asia-Pacific Identity Verification is the most capable market research report which has been prepared in the way anticipated.

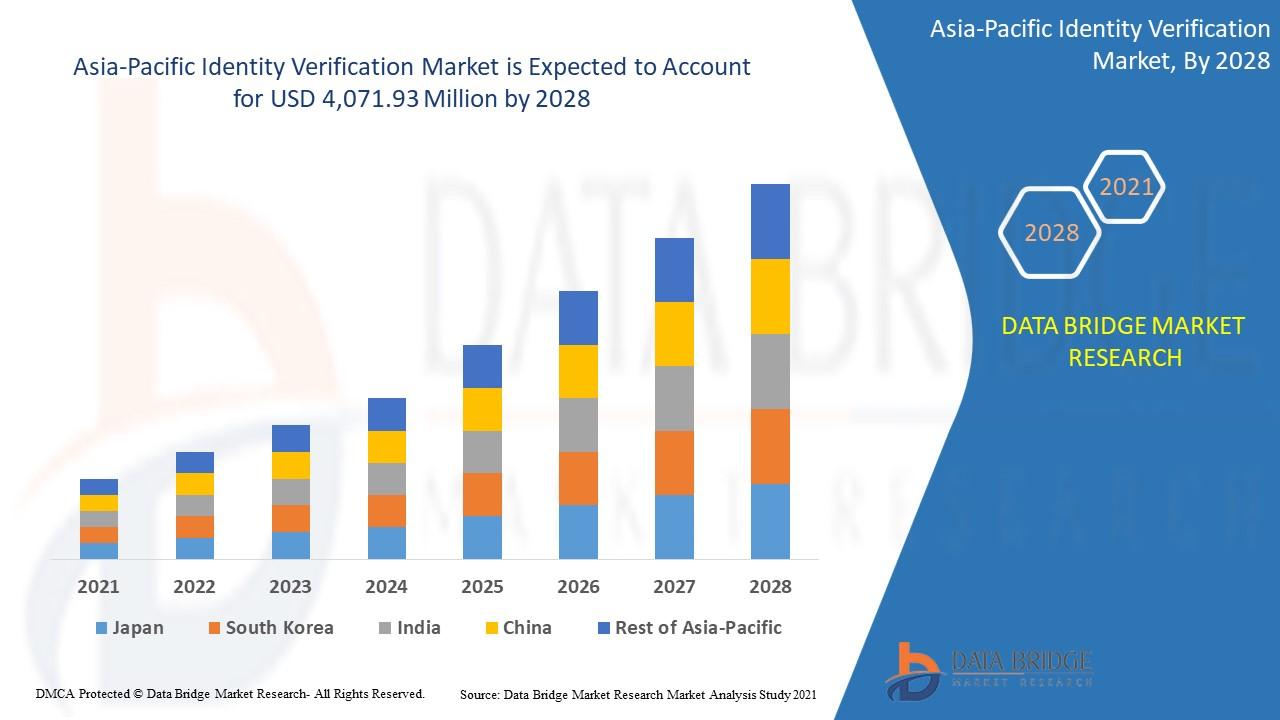

The identity verification market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 14.1% in the forecast period of 2021 to 2028 and is expected to reach USD 4,071.93 million by 2028. Growing demand for research and development activities is acting as major factor for the growth of the identity verification market.

Browse Full Report Along With Facts and Figures @ https://www.databridgemarketresearch.com/reports/asia-pacific-identity-verification-market

Market Overview:

Identity verification refers to the services and solutions which are used to verify the authenticity of physical identity of a person or their documents such as a driver’s license, passport or a nationally issued identity document and others. Identity verification is an important process which ensures a person’s identity matches the one that is supposed to be.

Identity Verification Market Scope and Market Size

The identity verification market is segmented on the basis of component, type, deployment mode, organization size and vertical. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

-

On the basis of component, the identity verification market is segmented into solution and services. In 2021, solution segment held larger share in the identity verification market owing to factors such as shift toward digital transformation by various industries, increasing need to fight against data breach and fraud, surging government support toward data protection laws and regulations, requisite to fulfil KYC and AML compliance and easy on boarding of customers as well as employees.

-

On the basis of type, the identity verification market has been segmented into non-biometrics and biometrics. In 2021, biometrics segment held larger share in the identity verification market due to factors such as increasing smartphone penetration in merging countries and growing use of fingerprint identification, increased security of protected data, improved authentication security to combat new threats, surging dependency on digital technologies, enhanced customer satisfaction and rising trend for contactless biometric solutions.

-

On the basis of deployment mode, the identity verification market has been segmented into on-premise and cloud. In 2021, on-premise segment held larger share in the identity verification market as government and defense sector along various financial institutions prefer to use on-premise identity solutions, due to security policy restrictions, data sharing and availability of budget to invest in infrastructure.

-

On the basis of organization size, the identity verification market has been segmented into large enterprises and SME’s. In 2021, large enterprises segment held larger share in the identity verification market due to factors such as protection against increased cases of money laundering, data breach, identity theft, secured processing of high risk transactions, mandatory compliant to different regulations and protected digital payments.

The major players covered in the Asia-Pacific identity verification market report are Experian Information Solutions, Inc. (a subsidiary of Experian plc), LexisNexis Risk Solutions Group, Thales Group, AccuraTechnolabs, GB Group plc ('GBG'), Precise Biometrics AB, IDEMIA, Equifax, Inc., Jumio, TransUnion LLC, Onfido, ForgeRock, Okta, Stripe and Ping Identity among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Browse Trending Reports:

About Data Bridge Market Research:

An absolute way to predict what the future holds is to understand the current trend! Data Bridge Market Research presented itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are committed to uncovering the best market opportunities and nurturing effective information for your business to thrive in the marketplace. Data Bridge strives to provide appropriate solutions to complex business challenges and initiates an effortless decision-making process. Data Bridge is a set of pure wisdom and experience that was formulated and framed in 2015 in Pune.

Data Bridge Market Research has more than 500 analysts working in different industries. We have served more than 40% of the Fortune 500 companies ly and have a network of more than 5,000 clients worldwide. Data Bridge is an expert in creating satisfied customers who trust our services and trust our hard work with certainty. We are pleased with our glorious 99.9% customer satisfaction rating.

Contact Us: -

Data Bridge Market Research

US: +1 888 387 2818

United Kingdom: +44 208 089 1725

Hong Kong: +852 8192 7475

- Asia-Pacific_Identity_Verification_Market

- Asia-Pacific_Identity_Verification_Market_size

- Asia-Pacific_Identity_Verification_Market_trends

- Asia-Pacific_Identity_Verification_Market_share

- Asia-Pacific_Identity_Verification_Market_scope

- Asia-Pacific_Identity_Verification_Market_growth

- Asia-Pacific_Identity_Verification_Market_demand

Search

Categories

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology

Read More

Ultrasound Probe Holders Market expected to reach USD 277.62 million by 2028

The Ultrasound Probe Holders Market sector is undergoing rapid transformation, with...

Tattoo Numbing Cream Market will grow at highest pace owing to growing tatto culture

The tattoo numbing cream market provides temporary numbing effects to reduce pain during tattoo...

Emerging Trends and Opportunities in theScrub Suits Market: Forecast to 2029

This Scrub Suits market report has been prepared by considering several fragments of the present...