Europe Digital Lending Platform Market Trends, Demand, Opportunities and Forecast By 2029

An excellent Europe Digital Lending Platform market document bestows clients with the best results and for the same it has been produced by using integrated approaches and latest technology. This market analysis report encompasses the growth factors of the worldwide market based on end-users. Also, the industry changing factors for the market segments are explored in this industry report. The report forecasts the innovative applications of the product market on the basis of several estimations. With the world class Europe Digital Lending Platform market report, it becomes easier to establish and optimize each stage in the lifecycle of industrial process that includes engagement, acquisition, retention, and monetization.

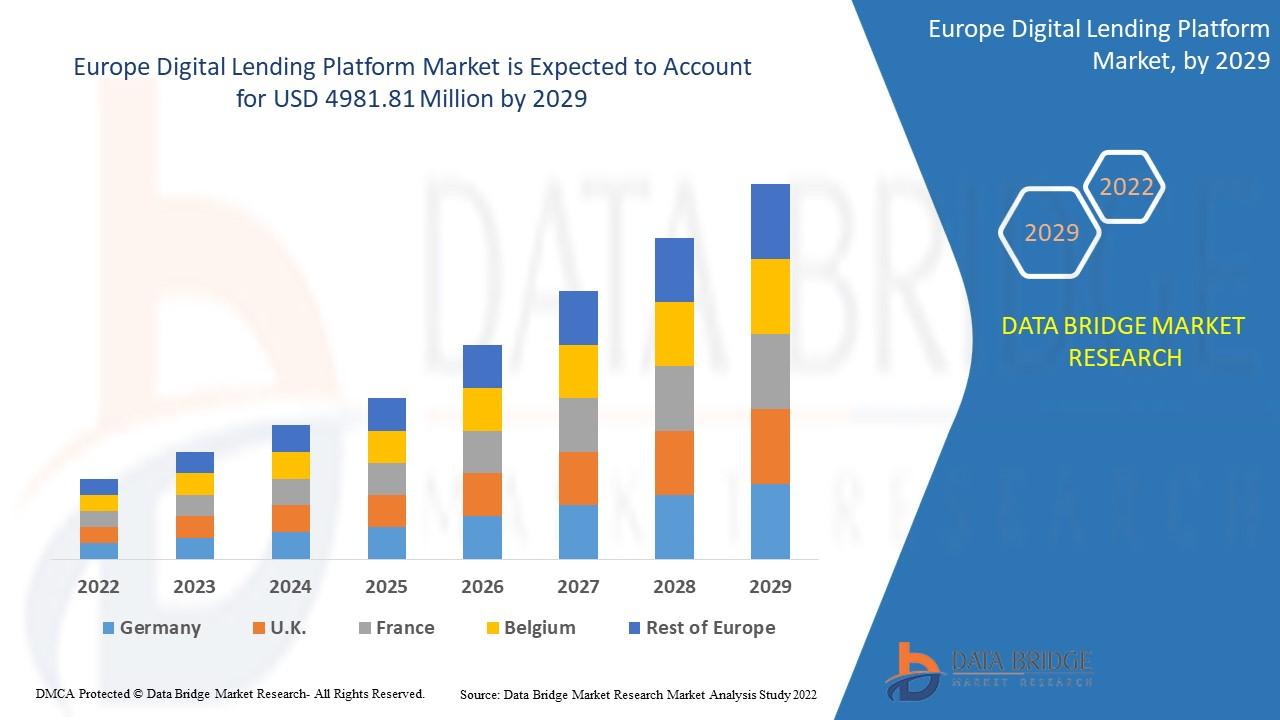

Europe digital lending platform market was valued at USD 1238.83 million in 2021 and is expected to reach USD 4981.81 million by 2029, registering a CAGR of 19.00% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Browse Full Report Along With Facts and Figures @ https://www.databridgemarketresearch.com/reports/europe-digital-lending-platform-market

Market Overview:

The digital lending platform makes it possible for lenders and borrowers to lend money in a digital or electronic format, improving user experience, making it easier to use, and reducing costs because client verification takes less time. The procedure begins with user registration and continues with the collecting of online paperwork, client identification and verification, loan approval, distribution of loans, and loan recovery.

COVID-19 Impact on Digital Lending Platform Market

The digital lending platform market was moderately impacted by the outbreak of COVID-19. Numerous nations have stringent lockdowns, closures, and mobility restrictions as a result of the COVID-19 outbreak to stop the virus from spreading. The COVID-19 crisis has resulted in growth across the board for FinTech, including payment investments, lending, and general banking. Although lending platforms have fewer users overall, they have seen a 25% rise in users despite having fewer people overall. This is primarily because many enterprises required speedy loan approvals to maintain their operations during the difficult times. People have begun to choose contactless transactions to stop the virus from spreading. Also, the credit unions and banks are especially improving their digital banking services to better serve their consumers. Furthermore, during the COVID-19 pandemic, banks have been using digital channels more frequently to disburse loans under the Paycheck Protection Program. Small businesses can get funding for up to 8 weeks under the Paycheck Protection Program in the US. Numerated, a digital lending platform supplier, reports that 82% of American businesses elect to apply for PPP loans online at COVID-19 instead of through conventional methods.

Some of the major players operating in the digital lending platform market are

· General Electric (U.S.)

· IBM (U.S.)

· PTC (U.S.)

· Microsoft (U.S.)

· Siemens (Germany)

· ANSYS, Inc (U.S.)

· SAP SE (Germany)

· Oracle (U.S.)

· Robert Bosch GmbH (Germany)

Browse Trending Reports:

https://www.databridgemarketresearch.com/reports/global-risk-management-software-market

https://www.databridgemarketresearch.com/reports/global-cloud-supply-chain-management-market

https://www.databridgemarketresearch.com/reports/global-fintech-block-chain-market

https://www.databridgemarketresearch.com/reports/global-iot-healthcare-market

https://www.databridgemarketresearch.com/reports/global-financial-statement-fraud-market

About Data Bridge Market Research:

An absolute way to predict what the future holds is to understand the current trend! Data Bridge Market Research presented itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are committed to uncovering the best market opportunities and nurturing effective information for your business to thrive in the marketplace. Data Bridge strives to provide appropriate solutions to complex business challenges and initiates an effortless decision-making process. Data Bridge is a set of pure wisdom and experience that was formulated and framed in 2015 in Pune.

Data Bridge Market Research has more than 500 analysts working in different industries. We have served more than 40% of the Fortune 500 companies globally and have a network of more than 5,000 clients worldwide. Data Bridge is an expert in creating satisfied customers who trust our services and trust our hard work with certainty. We are pleased with our glorious 99.9% customer satisfaction rating.

Contact Us: -

Data Bridge Market Research

US: +1 888 387 2818

United Kingdom: +44 208 089 1725

Hong Kong: +852 8192 7475

- Europe_Digital_Lending_Platform_Market

- Europe_Digital_Lending_Platform_Market_size

- Europe_Digital_Lending_Platform_Market_trends

- Europe_Digital_Lending_Platform_Market_share

- Europe_Digital_Lending_Platform_Market_scope

- Europe_Digital_Lending_Platform_Market_growth

- Europe_Digital_Lending_Platform_Market_demand

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology