An international Asia-Pacific Treasury Software market research report delivers widespread analysis of the market structure along with the estimations of the various segments and sub-segments of the market. This industry report also contains detailed profiles of market’s major manufacturers and importers who are dominating the market. Furthermore, the statistical and numerical data such as facts and figures are represented very precisely in the market report by using charts, tables, or graphs. The transformation in market landscape is mainly observed due to the moves of key players or brands which include developments, product launches, joint ventures, mergers, and acquisitions that in turn change the view of the face of the industry.

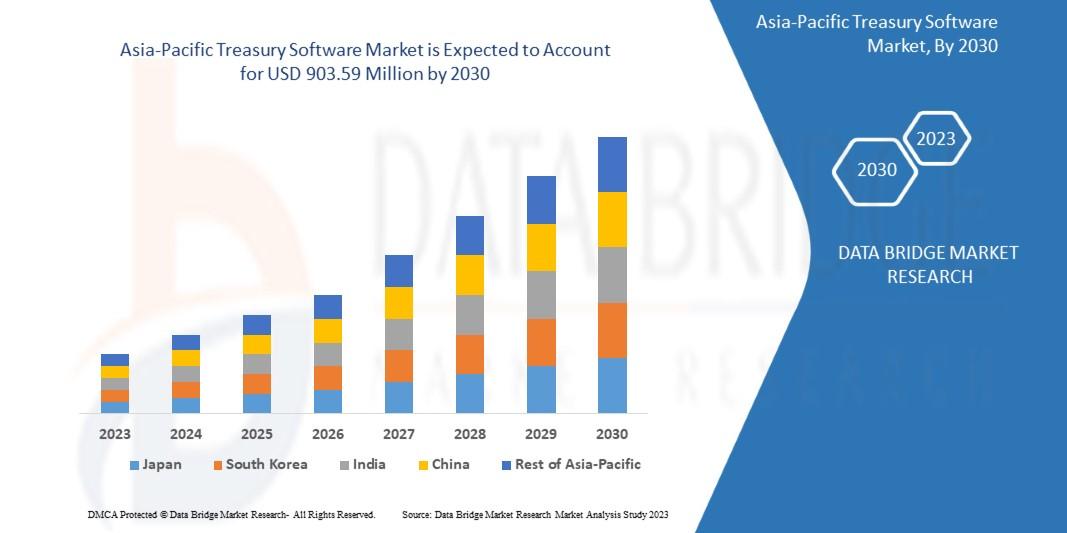

Asia-Pacific treasury software market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with the CAGR of 3.6% in the forecast period of 2023 to 2030 and expected to reach USD 903.59 million by 2030. Increase in the requirement of quick-decision making process in biotechnology is e expected to drive the growth of the market significantly.

Browse Full Report Along With Facts and Figures @ https://www.databridgemarketresearch.com/reports/-treasury-software-market

Market Overview:

Treasury software is an application that automates a company's financial activities like cash flow, assets, and investments. It provides a treasury management system that tracks the ability of a business to convert assets into cash to meet a financial obligation. Financial managers and accounts use Treasury management software to monitor liquidity and the ability to convert assets into cash to meet financial obligations. The software automates and streamlines treasury management functions, reducing financial and reputational risks, saving costs, and improving operational efficiency and effectiveness. The greater visibility, analytics, and forecasting that the treasury management system provides improves decision-making and helps to create organizational financial strategies.

Asia-Pacific Treasury Software Market Scope

The Asia-Pacific treasury software market is segmented on the basis of operating system, application, deployment model, organization size, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

· MAC

· WINDOWS

· IOS

· ANDROID

· LINUX

On the basis of operating system, the Asia-Pacific treasury software market is segmented into windows, linux, MAC, android, and iOS.

ASIA-PACIFIC TREASURY SOFTWARE MARKET, BY APPLICATION

· LIQUIDITY AND CASH MANAGEMENT

· FINANCIAL RISK MANAGEMENT

· DEBT MANAGEMENT

· INVESTMENT MANAGEMENT

· TAX PLANNING

· COMPLIANCE MANAGEMENT

· OTHERS

On the basis of application, the Asia-Pacific treasury software market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning, and others

Some of the major players operating in the Asia-Pacific treasury software market are Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others.

Browse Trending Reports:

https://www.databridgemarketresearch.com/reports/-multivendor-atm-software-market

https://www.databridgemarketresearch.com/reports/-grant-management-software-market

https://www.databridgemarketresearch.com/reports/-digital-business-support-system-market

https://www.databridgemarketresearch.com/reports/-cloud-field-service-management-market

About Data Bridge Market Research:

An absolute way to predict what the future holds is to understand the current trend! Data Bridge Market Research presented itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are committed to uncovering the best market opportunities and nurturing effective information for your business to thrive in the marketplace. Data Bridge strives to provide appropriate solutions to complex business challenges and initiates an effortless decision-making process. Data Bridge is a set of pure wisdom and experience that was formulated and framed in 2015 in Pune.

Data Bridge Market Research has more than 500 analysts working in different industries. We have served more than 40% of the Fortune 500 companies ly and have a network of more than 5,000 clients worldwide. Data Bridge is an expert in creating satisfied customers who trust our services and trust our hard work with certainty. We are pleased with our glorious 99.9% customer satisfaction rating.

Contact Us: -

Data Bridge Market Research

US: +1 888 387 2818

United Kingdom: +44 208 089 1725

Hong Kong: +852 8192 7475