How the Biofuel Industry is Embracing ESG Principles

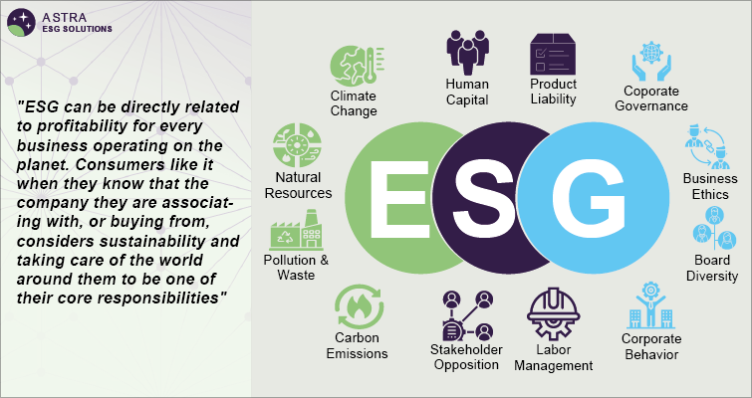

Stakeholders are counting on environmental, social and governance (ESG) goals to decarbonize the supply chain of the biofuel industry. The global push to replace fossil fuels with biofuels has sparked innovations and prompted industry players to invest in renewable feedstock. Sustainable solutions will warrant infrastructure developments, demand signals and sound corporate governance. Energy companies will likely consider ESG risks and opportunities for a low-carbon economy.

The need for clean energy has spurred the penetration of renewable sources. According to an IEA report, in the net zero scenario, biofuel produced from residues, wastes and dedicated crops that do not compete with food crops account for 50% of the biofuels consumed in 2030. Moreover, biofuels can prevent 4.4% of global road transport oil use.

Businesses are responding to the need for low-carbon fuels to help decarbonize the automotive, transport, marine and aviation sectors. For instance, Raízen produced approximately 3 billion liters of ethanol from sugar cane, while around 26 million liters of second-gen cellulosic ethanol from inedible agricultural waste in 2022. Besides, during the same period, Shell inked a non-binding MoU with Lufthansa to supply sustainable aviation fuel (SAF) to help reduce carbon emissions from air travel.

All that glitter is not gold. Green campaigners claim that biofuels could disrupt land use patterns that may lead to increased GHG emissions, air and water pollution and pressure on water resources, thereby augmenting food prices. According to Transport & Environment, palm biodiesel is three times worse for the climate than fossil fuel. Besides, the watchdog claimed that every day around 19 million bottles of rapeseed and sunflower oil, and 14 million bottles of soy and palm oil are burned across Europe. Amidst the flak received from governing bodies, forward-looking companies and innovators are expected to bolster their ESG profile to enhance their brand values.

Valero Energy Emphasizes Reducing Scope 1 and 2 Emissions

Sustainable fuels have become paramount in contributing to the energy transition and a decarbonized economy. Forward-looking companies, such as Valero, have bolstered their emission targets and are gearing up to propel a low-carbon economy. The company has injected over USD 4.65 billion into low-carbon fuels business. In 2021, it allocated over 70% of the growth capital to low-carbon projects. Furthermore, the U.S.-based company is on course to minimize and displace 100% of refinery Scope 1 and 2 GHG emissions by 2035.

The petroleum refinery is expected to augment the total annual capacity of the new renewable diesel plant to 1.2 billion gallons and 50 million gallons of renewable naphtha. Similar to Shell, Valero has spurred emphasis on sustainable aviation fuel: it is assessing the engineering capability to include SAF in the new renewable diesel facility in Port Arthur. Renewable fuel and SAF could be game changer to undergird the ESG profile and create long-term value for stockholders.

Diversity and Equity Garner Headlines in Bunge Limited

Mental well-being and diversity, to name a few, have become the bedrock for organizations to propel their ESG rankings. With shifting trends, training, diversity, equity and inclusion have amassed huge attention across business verticals. In 2021, Bunge offered its employees over 87,000 hours of training, while over 60 participants were in targeted female development programs. The company infers that around 44% of all new hires across the organization were women.

Bunge Employee Resource Group has furthered its focus on community building and awareness initiatives, including Proud & Allied, Women @Bunge, Veterans, Bunge Global Black Network and Asian Professionals. Besides, the U.S-headquartered company also established a “Together We Grow” consortium—a coalition (public-private) between food companies, agriculture, the USDA, nonprofits and universities—to address diversity and inclusion within the food and agriculture sectors in the U.S. Brands will potentially put their energy into building an organization that complements diversity and fair representation at every level.

Is your business one of participants to the Biofuel Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

Commitment to Ethics & Compliance Paves Way for Petrobras

A governance model that fosters transparency, ethics, compliance and integrity has become instrumental in fostering ESG practices. Petrobras has formed an Ethics Commission to oversee compliance with the Code of Conduct of the Federal Senior Management (CCAF). It also supervises the Compliance Program through the Statutory Audit Committee with the support of the Senior Management.

Compliance risk management has gained ground to monitor, define, control and report actions as a riposte to the risks and prioritize money laundering, fraud & corruption, harassment, antitrust, conflict of interest, trade sanctions and embargoes. The organization asserts it has an independent board for the compliance program. Robust history of good governance and manufacturing biofuel ethically will enable companies to bring ESG solutions to farmers and customers.

The competitive nature of the industry indicates sustainable sourcing of products and the role of biofuels across business verticals will steer the growth trajectory. Governments exhibited resilience amidst havoc wracked by the COVID-19 pandemic. In June 2022, the USDA announced pouring USD 700 million to restore sustainable fuel markets grappling with the outbreak. Besides, the Wall Street Journal was reported to have mentioned that Archer Daniels Midland (ADM) would receive USD 50 million in U.S. aid to tone down losses during the pandemic. These ESG trends validate Grand View Research’s projected CAGR of the global biofuel market at 6.9% between 2019 and 2024.

Related Reports:

- Biomass Power Industry ESG: https://astra.grandviewresearch.com/biomass-power-industry-esg-outlook

- Hydrogen Generation Industry ESG: https://astra.grandviewresearch.com/hydrogen-generation-industry-esg-outlook

- Solar Energy Generation Industry ESG: https://astra.grandviewresearch.com/solar-energy-generation-industry-esg-outlook

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology