The Offshore Pipeline Market Is Driven By Growing Gas & Oil Exploration And Production Activities

Key Takeaways

Key players operating in the offshore pipeline market are Becton, Dickinson and Company, Pfizer Inc., Novo Nordisk A/S, Gerresheimer AG, B. Braun Medical Inc., Grifols S.A, Baxter International, Inc., Fresenius Kabi AG, Mylan N.V., Bayer AG, F. Hoffmann-La Roche AG, Farmoquimica S.A., Novartis International AG, Eli Lily and Company, União Química Farmacêutica, Nacional S.A., Cristália, Aspen Pharmacare Holdings Limited, Blau Farmaceutica S.A., Halex Istar Indústria, Farmacêutica SA, Eurofarma, Ache Laboratorios Farmaceuticos SA, Laboratorio Teuto Brasileiro S/A, EMS Pharma, and Hipolabor Farmaceutica Ltda.

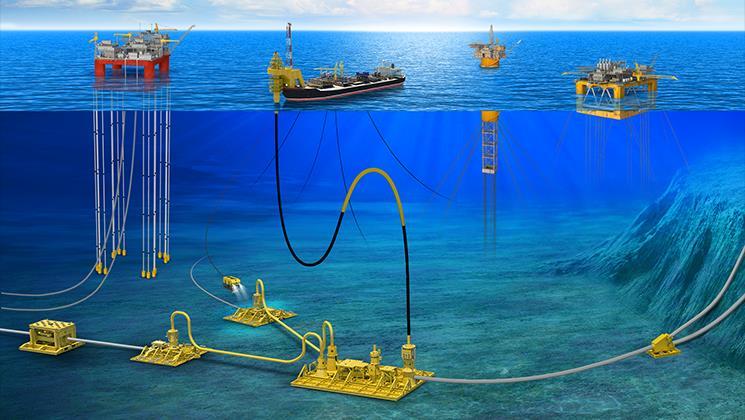

The demand for offshore pipelines is growing due to increasing exploration and production of oil and gas reserves in deeper waters and remote offshore locations. Major companies are investing heavily in offshore pipeline infrastructure development projects to capitalize on new oil and gas field discoveries.

With increasing deepwater and ultra-deepwater exploration worldwide, companies are focusing on strengthening regional offshore pipeline networks and systems to boost hydrocarbon transport capacities. This is facilitating the global expansion of offshore pipeline infrastructure to remote locations.

Market drivers

One of the key drivers for the Offshore Pipeline Market Size is the growing gas and oil exploration and production activities. With rising energy demand globally, oil and gas companies are aggressively exploring new reserves including tapping into deepwater and ultra-deepwater reserves which are remotely located far offshore. This is boosting needs for reliable offshore pipeline networks for transportation of oil and gas over long distances. Offshore pipelines offer a cost-effective solution for bulk transportation of oil and gas to onshore facilities.

Impact of geopolitical situation on offshore pipeline market growth

The ongoing geopolitical conflicts and sanctions have impacted energy trade between certain regions and countries. This has put pressure on the flow of oil and gas through existing pipeline network. Countries are now focusing on developing new domestic as well as transnational pipeline projects to ensure energy security and independence. However, obtaining necessary regulatory approvals and resolving territorial disputes for cross border pipelines has become challenging. Rising tensions have also restricted financing and technology sharing for pipeline projects near conflict zones. This risks delaying capacity additions through critical pipelines, putting upward pressure on energy prices. Pipeline companies will need to closely monitor the geopolitical climate and be ready with contingency plans to mitigate risks of supply disruptions through alternative routes. Investing in pipeline infrastructure development within secure domestic regions would help insulate the market from external political pressures to an extent.

Get more insights on Offshore Pipeline Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology