Rental Cars Procurement Intelligence: Challenges and Opportunities

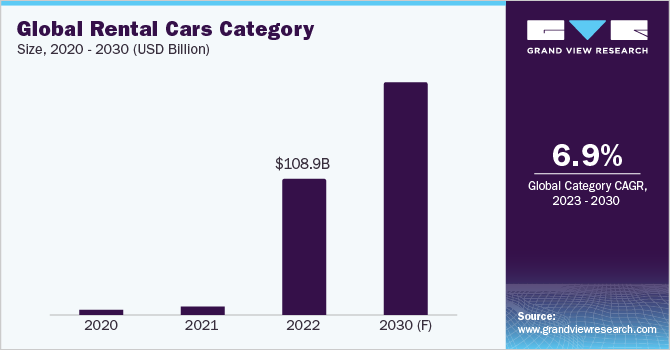

The rental cars category is expected to grow at a CAGR of 6.95% from 2023 to 2030. North America accounts for the largest share of the category. The rising urban population with an increasing tendency towards adventure and travel is boosting growth. Companies are focusing on adopting various strategies such as investments, partnerships, and mergers & acquisitions. For instance, in April 2022, SIXT, a leading global mobility provider, announced the opening of two new branches in Charlotte and Baltimore, expanding its presence on the East Coast. The new branches offer customers a wider range of rental choices and provide SIXT with a stronger foothold in this region.

Mobility-as-a-Service (MaaS) is a kind of service that offers users the ability to plan, reserve, and pay for a variety of mobility services through a single digital channel. A transition from privately owned modes of transportation to mobility as a service is outlined in the concept. This is made possible by bundling transportation services from both public and private transportation providers through a single payment portal that initiates and manages the journey.

To enhance their technologies to meet growing customer needs, companies are either looking to develop their own platform or trying to partner with those companies that have such offerings. For instance,

• In March 2023, Woodford Group and Enterprise Holdings signed a collaboration agreement. Enterprise Holdings declared launching its service in South Africa as part of the cooperation. The company provides point-to-point services, long-term subscriptions, and short-term car rentals with chauffeurs.

• In February 2023, Udrive, a pay-per-minute car rental platform, launched a new offering that helps users to explore tourist attractions in the highlights of Dubai. Under this offering, the company is offering an exclusive fleet to and from Hatta.

• In January 2023, Hertz signed a public-private partnership with the regulatory body of Denver, Colorado, to accelerate the transition of EVs in the rental industry. The company will switch towards providing rental electric cars contributing towards sustainability.

• In October 2022, ERGO partnered with SIXT and agreed to perform a pilot project using a pay-as-you-drive pricing model. Under this partnership, ERGO would offer an exclusive insurance solution that caters to the needs of SIXT’s rental cars in Germany.

The growth of this category is expected to be driven by rising urbanization around the globe. The increasing traffic congestion and tougher automobile ownership laws is a key factor driving this trend. The rising demand for on-demand transportation services is attributed to the low rate of car ownership among millennials, the increasing cost of car ownership, and the demand for flexible and cost-effective transportation options.

Order your copy of the Rental Cars Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Rental Cars Sourcing Intelligence Highlights

• The global rental cars category is characterized as a fragmented market, with a large number of small and large players operating in different regions. This fragmentation has led to intense competition between players, as they strive to gain a wider customer base and improve customer experiences.

• The suppliers of this service have increased over time, reducing the supplier’s bargaining power to some extent.

• Asset depreciation, fuel, accident insurance, and maintenance form the most significant cost component in providing rental cars. The overall cost also depends on factors such as local tax, registration, and administrative overheads.

• Most of the service providers offer complete services from rental cars, pickup & drop-off, insurance, chauffeurs, and others.

List of Key Suppliers

• Sixt SE

• Localiza

• Avis Budget Group

• Europcar

• Enterprise Holdings Inc.

• The Hertz Corporation

• Toyota Rent-a-Car

• Alamo Rent-a-Car LLC

• Carzonrent India Pvt Ltd

• ANI Technologies Pvt. Ltd

Browse through Grand View Research’s collection of procurement intelligence studies:

• Legal Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Insurance Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Rental Cars Procurement Intelligence Report Scope

• Rental Cars Category Growth Rate: CAGR of 6.95% from 2023 to 2030

• Pricing Growth Outlook: 3 - 7% (annual)

• Pricing Models: Cost plus pricing, tier-based pricing

• Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

• Supplier Selection Criteria: Vehicle type, booking options, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology