Reconciliation Software Market Key Players, Growth and Size 2032

`

Reconciliation Software Market Scope and Overview:

Reconciliation software plays a crucial role in financial management, providing organizations with the tools to streamline and automate the reconciliation process across various accounts, transactions, and financial data sets. This software helps businesses ensure accuracy, compliance, and efficiency in their financial operations. The global Reconciliation Software Market has witnessed significant growth as organizations increasingly prioritize financial transparency, regulatory compliance, and operational efficiency.

Get a Sample Report @ https://www.snsinsider.com/sample-request/2807

Key Players Covered in this Research Report:

ReconArt Inc., Oracle Corporation, BlackLine Inc., Broadridge Financial Solutions, Inc., SolveXia, Tata Consultancy Services Limited, Xero Limited, SmartStream Technologies Ltd., Gresham Technologies plc, DUCO, StatementMatching.com Limited, SAP SE, Fiserv Inc

Segmentation Analysis:

The reconciliation software market can be segmented based on deployment type, end-user industry, and functionality. Deployment types include on-premises and cloud-based solutions, catering to the diverse needs of organizations ranging from small businesses to large enterprises. End-user industries span across banking and finance, healthcare, retail, manufacturing, and others. Functionality encompasses bank reconciliation, account reconciliation, invoice reconciliation, and intercompany reconciliation, among others.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the reconciliation software market. While the initial phase saw disruptions in business operations and a slowdown in software investments due to economic uncertainties, the need for remote work solutions and digital transformation initiatives accelerated adoption of cloud-based reconciliation software. Organizations sought agile and scalable solutions to manage financial processes remotely, driving demand for reconciliation software with advanced automation, AI-driven analytics, and real-time visibility.

Regional Outlook:

Geographically, North America holds a significant share in the reconciliation software market, driven by the presence of large enterprises, stringent regulatory requirements, and early adoption of technology. Europe follows suit, with countries like the UK, Germany, and France embracing reconciliation software to enhance financial controls and compliance. Emerging economies in Asia-Pacific, such as China and India, present lucrative opportunities for market growth, fueled by rapid digitization, increasing investments in financial technology, and regulatory reforms.

Competitive Analysis:

The reconciliation software market is highly competitive, with a mix of established players and innovative startups vying for market share. Key players such as SAP, BlackLine, and Fiserv dominate the market with their comprehensive solutions and global presence. However, niche players and emerging startups are disrupting the market with specialized offerings, user-friendly interfaces, and agile deployment options. Strategic partnerships, mergers, and acquisitions are prevalent in the market as companies seek to expand their product portfolios and geographic reach.

Report Conclusion:

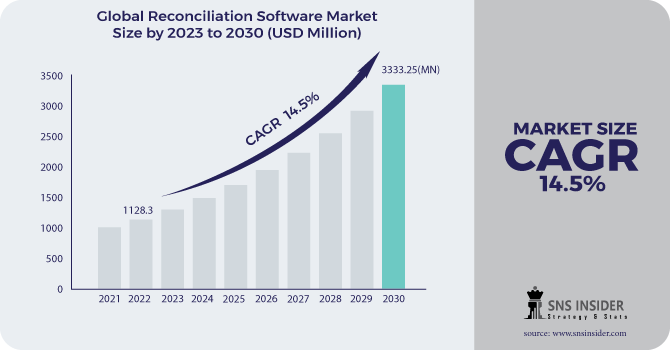

In conclusion, the reconciliation software market continues to witness robust growth driven by the increasing focus on financial transparency, regulatory compliance, and operational efficiency across industries. The COVID-19 pandemic has accelerated digital transformation initiatives, spurring demand for cloud-based reconciliation solutions with advanced automation and analytics capabilities. As organizations strive to navigate complex financial landscapes and mitigate risks, reconciliation software emerges as a critical tool for achieving accuracy, efficiency, and agility in financial management. The market is poised for further expansion, propelled by technological advancements, evolving regulatory requirements, and the relentless pursuit of financial integrity.

Buy the Research Report Now @ https://www.snsinsider.com/checkout/2807

Continued…

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology