The industrial landscape is constantly evolving, demanding ever-increasing efficiency and safety standards. In this environment, Risk-Based Inspection (RBI) has emerged as a vital tool for optimizing asset management strategies. This blog delves into the RBI market, exploring its key drivers, applications, and future outlook.

What is Risk-Based Inspection (RBI)?

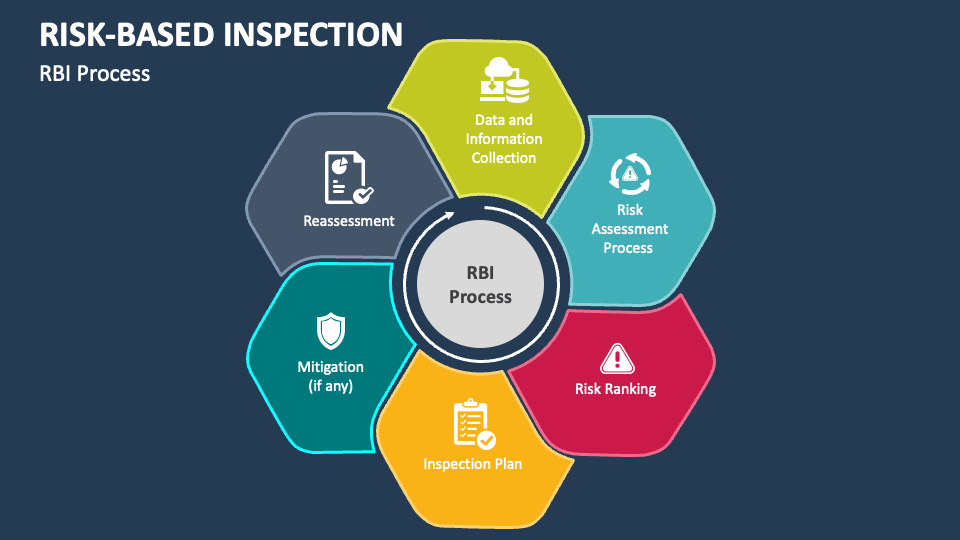

RBI is a data-driven approach to inspection planning that prioritizes equipment based on its potential for failure. It considers both the likelihood of failure (probability of failure) and the severity of the consequences (consequence of failure). By focusing on high-risk assets, RBI helps organizations optimize inspection resources, minimize downtime, and ensure operational safety.

Market Drivers for RBI

The Risk-Based Inspection (RBI) market is driven by several key factors, including:

- Growing focus on safety and environmental regulations: Stringent regulations across industries mandate proactive measures to prevent accidents and environmental damage. RBI helps organizations comply with these regulations.

- Aging industrial infrastructure: As industrial assets age, the risk of failure increases. RBI helps identify critical equipment that needs immediate attention.

- Rising maintenance costs: Traditional, time-based inspection methods can be expensive and inefficient. RBI optimizes inspection schedules, leading to cost savings.

- Advancements in data analytics and sensor technology: The growing adoption of data analytics and sensor technology allows for real-time monitoring of equipment health, further enhancing RBI effectiveness.

Applications of RBI

RBI finds application across various industries, including:

- Oil & Gas

- Petrochemical

- Chemical Processing

- Power Generation

- Pulp & Paper

Download Sample Copy: https://shorturl.at/nopV6

The Future of the RBI Market

The RBI market is expected to witness significant growth in the coming years. The increasing adoption of Industry 4.0 principles, with its emphasis on data-driven decision making and predictive maintenance, will further fuel market expansion. Additionally, the integration of RBI with advanced technologies like artificial intelligence (AI) and machine learning (ML) is expected to offer deeper insights into asset health and optimize inspection plans even further.

Conclusion

RBI plays a crucial role in ensuring the integrity and safety of industrial assets. As industries strive for operational excellence, the RBI market is poised for significant growth. By leveraging the power of data analytics and emerging technologies, RBI will continue to be a cornerstone of effective asset management strategies.