US Cannabis Testing Services Market Is Driven By Increasing Legalization Of Medical And Recreational Cannabis

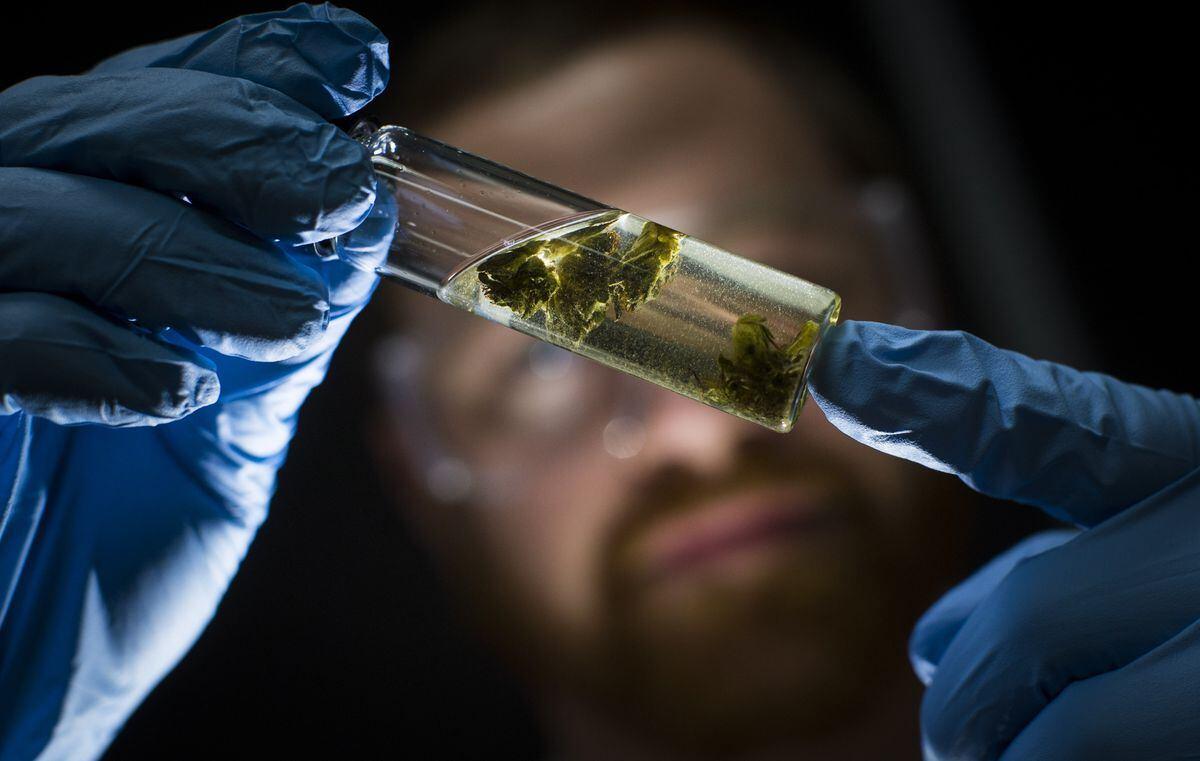

The US cannabis testing services market involves various methods and procedures to determine the chemical composition, Cannabinoids profile, concentration of bacteria, pesticides, residual solvents and potency of cannabis plants and cannabis-derived products. Testing cannabis is crucial for quality control and safety assurance of cannabis products. Services such as potency testing, heavy metal testing, pesticide screening, microbiological testing and residual solvent analysis play a vital role in ensuring cannabis quality and potency across various cannabis product types like flowers, concentrates, edibles and tinctures.

The Global Cannabis Testing Services Market is estimated to be valued at US$ 2.16 Bn in 2024 and is expected to exhibit a CAGR of 18% over the forecast period from 2024 to 2031.

Key Takeaways

Key players operating in the US Cannabis Testing Servicesmarket Size are Twist Bioscience Corporation, GenScript Biotech Corporation, Eurofins Scientific SE, and Thermo Fisher Scientific Inc. These players are investing heavily in developing innovative cannabis testing methods and solutions. For instance, Twist Bioscience Corporation launched synthetic cannabis reference standards in 2021 to help cannabis testing labs validate their methods and improve testing accuracy.

The demand for cannabis testing services is growing rapidly owing to the increasing legalization of medical and recreational cannabis across several US states. As of 2022, around 38 states have legalized medical cannabis while 19 states have legalized adult-use cannabis in the US. This wide spread legalization is fueling demand for tested and high quality cannabis products.

Moreover, US cannabis companies are expanding globally in medical and recreational cannabis markets in countries like Canada, Germany and Mexico. This global expansion is further driving the need for stringent cannabis quality control and testing according to international regulations, thereby propelling the cannabis testing services market growth.

Market drivers

One of the major drivers for the US cannabis testing services market is the implementation of strict testing regulations by regulatory authorities like the Cannabis Control Commission to ensure product safety and quality. Various states have made it mandatory for licensed cannabis companies to test their products for potency, heavy metals, pesticides, microbial impurities and residual solvents. Non-compliance with these regulations can lead to huge monetary penalties and loss of licenses. This is compelling cannabis companies to rely heavily on testing services.

The ongoing geopolitical conflicts and uncertainties are significantly impacting the growth of the US Cannabis Testing Services market. The rising trade tensions between US and China due to tariff issues have disrupted the supply chain movements for cannabis testing equipment and consumables. Moreover, the political instability and conflicts in key cannabis exporting countries like Colombia, Peru, and Jamaica are negatively affecting the imports of cannabis biomass in US for testing. This has created intermittent supply shortages for cannabis testing laboratories in US, thereby slowing down their business growth and expansion plans.

However, despite the prevailing geopolitical challenges, the cannabis testing service providers need to focus on diversifying their supply sources and establishing alternate supply routes globally. They must look at emerging export hotspots in South America, Africa, and Southeast Asia to guarantee uninterrupted supplies. Furthermore, adopting localized manufacturing and assembly of testing equipment through strategic partnerships can help insulate themselves from international supply chain disruptions. Technology innovations and digitalization of testing operations through tools like AI, blockchain and cloud will play a pivotal role in helping the market withstand geopolitical turbulences in the coming years.

In terms of value, California has been the largest market for cannabis testing services in US owing to its leading position as the largest legal cannabis market. The state accounts for about 30% of the total market value currently driven by stringent testing regulations. However, the markets in Florida and New York are expected to emerge as the fastest growing due to recent legislative changes legalizing cannabis in these states. With expanding consumer bases, these markets are poised to attract significant investments towards developing testing infrastructure and capacities over the next few years.

Most of the cannabis cultivators, producers and retailers in US are concentrated around the West Coast regions of California, Oregon and Washington where cannabis has been legal for many years now. These states collectively account for over 60% of the total market value currently due to their well established cannabis supply chains requiring extensive testing. However, rapid developments are underway in markets situated in the Northeast and South which are witnessing a boom in cannabis cultivation, manufacturing and dispensing activities. States like New York, New Jersey, Florida, Illinois and Massachusetts are projected to be the new hotspots driving the future growth in testing services demand over the forecast period.

Get more insights on This Topic- Cannabis Testing Services Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology