Key Trends in Management Consulting Procurement Intelligence

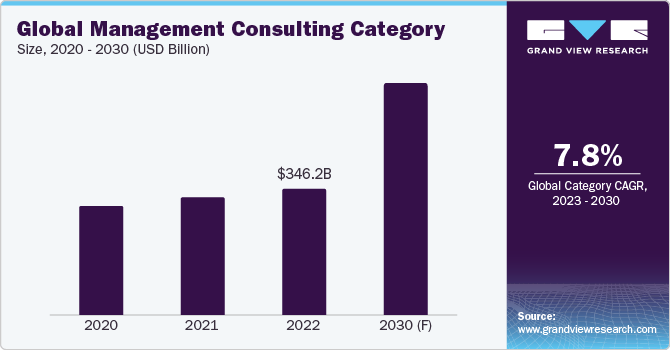

The management consulting category is expected to grow at a CAGR of 7.8% from 2023 to 2030. The increase in the adoption of consulting services to reduce operational costs and improve business efficiency is driving the category’s growth of the category. Additionally, the globalization of management consulting services, widespread access to high-speed internet, and the process automation of processes are further fueling the expansion of this category.

In the evolving digital landscape, consulting firms play a vital role in guiding organizations through transformative processes. They provide expertise in implementing digital technologies and data analytics, managing data, and facilitating change, ensuring enhanced efficiency and reduced costs. As a result, most consulting firms are integrating technology and data analytics more extensively into their services, aiding clients in staying ahead of market trends. Machine Learning (ML) models are typically integrated into APIs, which facilitates their easy integration into applications. By effectively and precisely cleaning raw data, mining fresh data, or synthesizing millions of records, consultants can provide customized services. Moreover, firms are embracing innovative methods to deliver their services, employing technologies like virtual and augmented reality for visualizing complex ideas, and utilizing cloud-based platforms for real-time collaboration with clients.

Companies in this category invest significantly in training employees to be tech-savvy, aiding clients in navigating technology transitions. Companies are also collaborating with tech companies to implement technologies such as ChatGPT into their process. For instance, in 2023 companies such as Boston Consulting Group, Accenture, and Bain & Company partnered with tech companies to make their processes technology-driven.

In a volatile economic environment, the demand for real-time consumer insights is crucial for making data-driven decisions. Due to shifts in consumer behaviors and expectations triggered by global events and emerging technologies, businesses must swiftly adapt their strategies. Consequently, management consultants need to concentrate on swiftly gathering and analyzing data from digital platforms like social media and eCommerce websites to gain a precise understanding of customer behavior.

Order your copy of the Management Consulting Procurement Intelligence Report, 2023 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Management Consulting Sourcing Intelligence Highlights

• In the consulting industry, skilled professionals are the primary suppliers. Their expertise is the core product offered by firms. The bargaining power of these professionals can be high, especially if they possess specialized or rare skills. Consulting firms must attract and retain top talent to maintain their competitive edge.

• The category is moderately consolidated as tier 1 and tier 2 companies account for almost 60% of the market share. Companies are continuously focusing on providing specialized services to offer more relevant and tailored services to their clients.

• Consultant salaries, office rent/utilities, consultant training, and recruitment, IT & technology costs, legal costs, and othersare some of the costs incurred in providing services.

• Starting a consulting business can be a fulfilling and lucrative venture, but it requires an investment of resources and time. Careful consideration of the various costs associated with opening the firm can help in making informed decisions about the budget.

List of Key Suppliers

• Boston Consulting Group

• Bain & Company

• McKinsey & Company

• KPMG

• PWC

• Alvarez & Marsal

• Oliver Wyman

• A.T. Kearney

• L.E.K. Consulting

• Accenture

Browse through Grand View Research’s collection of procurement intelligence studies:

• Enterprise Resource Planning (ERP) Software Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Management Consulting Procurement Intelligence Report Scope

• Management Consulting Category Growth Rate: CAGR of 7.8% from 2023 to 2030

• Pricing growth Growth Outlook: 5% - 15% (Annually)

• Pricing Models: Value-based pricing, service-based pricing, competition-based pricing

• Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

• Supplier Selection criteria: Services provided, end-to-end services, project timeline, global reach, regulatory compliance, operational capabilities, quality measures, certifications, data privacy regulations, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology