Crowdfunding Market Scope and Overview:

In recent years, Crowdfunding Market has emerged as a disruptive force in the world of finance, revolutionizing the way businesses, startups, and creative projects secure funding. This innovative model allows individuals and organizations to raise capital by pooling small contributions from a large number of people, typically via online platforms. The scope of crowdfunding extends across various sectors including technology, art, healthcare, real estate, and social causes.

Crowdfunding platforms serve as intermediaries, connecting project creators with potential investors or donors. These platforms offer diverse funding models such as reward-based, donation-based, equity-based, and debt-based crowdfunding, catering to the unique needs of different projects and investors.

Get a Sample Report @ https://www.snsinsider.com/sample-request/3395

Key Players Covered in this Research Report:

Kickstarter, GaoFundMe, PBC, Wefunder Inc., ConnectionPoint Systems Inc. (CPSI), SeedInvest Technology, LLC, Indiegogo, Inc., Seedrs Limited, StartSomeGood, Crowdcube Capital Ltd, Fundable, RM Technologies LLC., Fundly

Key Market Segmentation

By Type

Reward-based Crowdfunding

Equity-based Crowdfunding

Debt-based Crowdfunding

Donation-based Crowdfunding

Others

By Application

Food and Beverage

Technology

Media and Entertainment

Real Estate

Healthcare

Others

By Investment Size

Small and Medium Investment

Large Investment

By End-user

Startups

NGOs

Individuals

Segmentation Analysis:

The crowdfunding market can be segmented based on funding model, platform type, and sector. Funding models include reward-based crowdfunding, where backers receive non-monetary rewards or products in return for their contributions; donation-based crowdfunding, where contributions are made without any expectation of financial return; equity-based crowdfunding, where investors receive ownership stakes in the project or company; and debt-based crowdfunding, where backers receive fixed returns on their investments.

Platform types range from generalist platforms that host a wide variety of projects to niche platforms specializing in specific sectors or funding models. Additionally, crowdfunding activities span across sectors such as technology, arts and culture, healthcare, real estate, and social causes, each with its unique characteristics and funding requirements.

COVID-19 Impact Analysis:

The COVID-19 pandemic has had a profound impact on the crowdfunding market. While the economic uncertainty caused by the pandemic initially led to a slowdown in crowdfunding activities, certain sectors such as healthcare, technology, and social causes experienced a surge in funding as the need for innovative solutions and support for affected communities intensified.

Moreover, the shift towards remote work and digital communication during the pandemic accelerated the adoption of online crowdfunding platforms, facilitating access to a broader pool of potential investors and donors. However, challenges such as reduced consumer spending, heightened risk aversion, and increased competition for funding have also emerged in the wake of the pandemic, shaping the dynamics of the crowdfunding landscape.

Regional Outlook:

The crowdfunding market exhibits significant regional variations in terms of regulatory frameworks, market maturity, and cultural attitudes towards crowdfunding. North America and Europe remain key regions for crowdfunding, driven by favorable regulatory environments, robust startup ecosystems, and a culture of innovation and entrepreneurship.

Asia-Pacific is poised to witness substantial growth in the crowdfunding market, fueled by the rapid expansion of internet penetration, rising disposable incomes, and government initiatives to promote entrepreneurship and innovation. Latin America and the Middle East & Africa also present untapped opportunities for crowdfunding, albeit with unique challenges related to regulatory constraints, economic stability, and investor confidence.

Competitive Analysis:

The crowdfunding market is characterized by intense competition among platform operators vying for market share and differentiation. Established players such as Kickstarter, Indiegogo, and GoFundMe dominate the global crowdfunding landscape, leveraging their brand recognition, expansive user base, and network effects to attract both project creators and backers.

However, niche platforms catering to specific sectors or geographic regions are also gaining traction, offering tailored services and targeted marketing strategies to attract a loyal user base. Moreover, the emergence of blockchain-based crowdfunding platforms and decentralized finance (DeFi) solutions presents disruptive opportunities to streamline fundraising processes, enhance transparency, and expand access to capital.

Report Conclusion:

In conclusion, the crowdfunding market continues to evolve and expand, driven by technological advancements, shifting consumer preferences, and socio-economic trends. While the COVID-19 pandemic has posed challenges for the industry, it has also underscored the resilience and adaptability of crowdfunding as a financing mechanism.

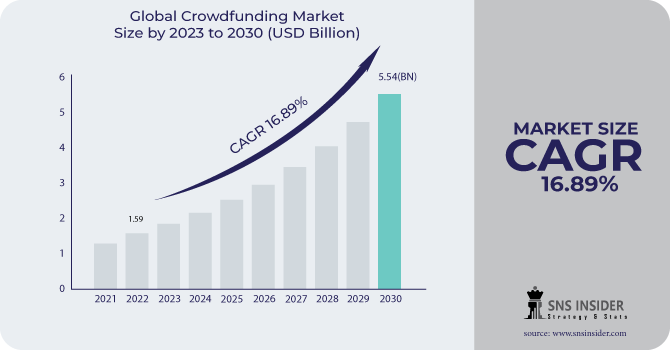

Looking ahead, the crowdfunding market is poised for sustained growth, fueled by increasing digitalization, democratization of finance, and the democratization of access to capital. As regulatory frameworks continue to evolve and investor confidence strengthens, crowdfunding is expected to play an increasingly prominent role in shaping the future of finance, empowering entrepreneurs, and fostering innovation on a global scale.

Buy the Research Report Now @ https://www.snsinsider.com/checkout/3395

Continued…

Contact Us:

Akash Anand – Head of Business Development & Digital Evidence Management

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)