Natural Gas Price Forecast, Trend, Index, Chart, News, Monitor and Historical Prices Analysis

Natural Gas Price in China

- China: 3485 USD/1000 MMBtu

The substantial drop in natural gas prices in China can be attributed to ample supply, decreased demand, and record production. By December of Q4 2023, the price of natural gas in China had reached 3485 USD/1000 MMBtu.

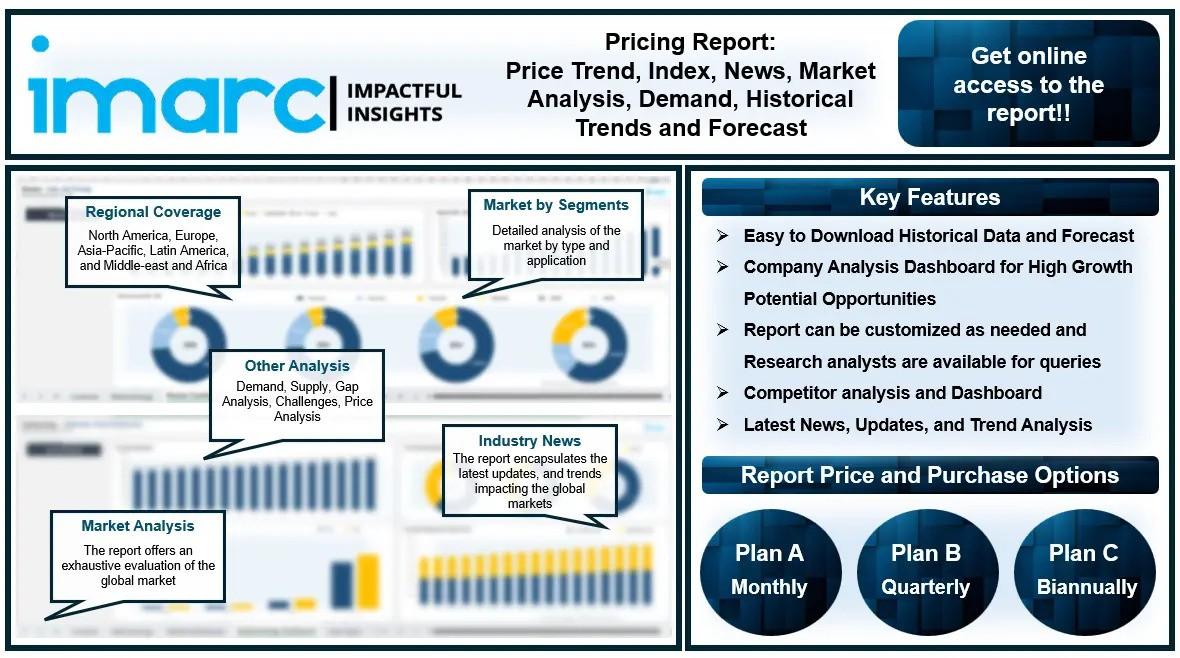

The latest report by IMARC Group, titled "Natural Gas Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of natural gas prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Natural Gas Prices December 2023:

- China: 3485 USD/1000 MMBtu

Report Offering

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting natural gas price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/natural-gas-pricing-report/requestsample

Natural Gas Price Trend- Q4 2023

Numerous factors affect the natural gas market, which in turn shapes its dynamics of supply, demand, and pricing. Since natural gas is an essential energy source for many industries, including power generation, industrial processes, and domestic heating, the worldwide energy demand is one important driver. The demand for natural gas is directly impacted by changes in industrial output, population trends, and economic expansion. Another important factor is geopolitical. Supply shortages and price volatility can result from disruptions in supply brought on by trade agreements, geopolitical crises, or hostilities. Furthermore, the availability and quantity of natural gas deposits, especially in areas like the US, Russia, and the Middle East, affect market dynamics.

Natural Gas Market Analysis

The global natural gas market size reached US$ 1,029.9 Billion in 2023. By 2032, IMARC Group expects the market to reach US$ 2,311.8 Billion, at a projected CAGR of 9.40% during 2023-2032. The North American natural gas industry demonstrated a number of noteworthy characteristics in the fourth quarter of 2023. The Mexican sector's strong demand first created a spike in market activity that encouraged market expansion. The market's natural gas supply, which ranged from modest to ample, was affected by a drawdown in domestic gas reserves to fulfill demand, which raised domestic gas prices. Furthermore, it was predicted that winter would be colder than usual, which would drive up natural gas prices. As a major participant in the North American natural gas market, the United States saw a bullish trend in the market that was marked by increased demand in the power sector and decreased heating needs.

A number of factors had a major impact on natural gas prices in the APAC area in the fourth quarter of 2023. Because of the pleasant weather in Europe and the USA, there was less demand globally, which drove down costs. The cost of shipments rose as a result of supply shortages brought on by geopolitical tensions and the intensification of the Israel-Hamas war. Price increases in the market were caused by the growing demand for power in the industry and the slow but steady depletion of gas supplies during the winter. Natural gas prices dropped significantly in China as a result of record supply, low demand, and high inventories.

The European natural gas market had gloomy conditions in Q42023 due to lingering energy crises and a faltering global economy. Germany's natural gas prices kept falling even with Australia's supply problems and frigid temperatures in some regions of the continent. The intensification of the Israel-Hamas conflict, possible gas infrastructure sabotage, supply constraints brought on by geopolitical conflicts, and rising demand in the electricity industry were some of the major factors affecting the market. However, Europe's high levels of domestic storage decreased the continent's average natural gas demand, which affected the dynamics of the worldwide market. Predictions for a colder-than-average winter and a reduction in domestic gas storage to fulfill demand point to a minor increase in natural gas prices in Germany in the upcoming months.

Browse Full Report: https://www.imarcgroup.com/natural-gas-pricing-report

Key Points Covered in the Natural Gas Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Natural Gas Prices

- Natural Gas Price Forecast

- Natural Gas Demand & Supply

- Natural Gas Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Natural Gas Price Analysis

- Natural Gas Industry Drivers, Restraints, and Opportunities

- Natural Gas News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology