Metal Silicon Demand, Trend, Index, Chart, News, Monitor and Historical Prices Analysis

Metal Silicon Price in USA

- United States: 3570 USD/MT

In December 2023, the price of metal silicon in the USA peaked at 3570 USD/MT. This report encompasses the most recent developments, updates, and trends affecting the global metal silicon market, delivering stakeholders with timely and pertinent insights.

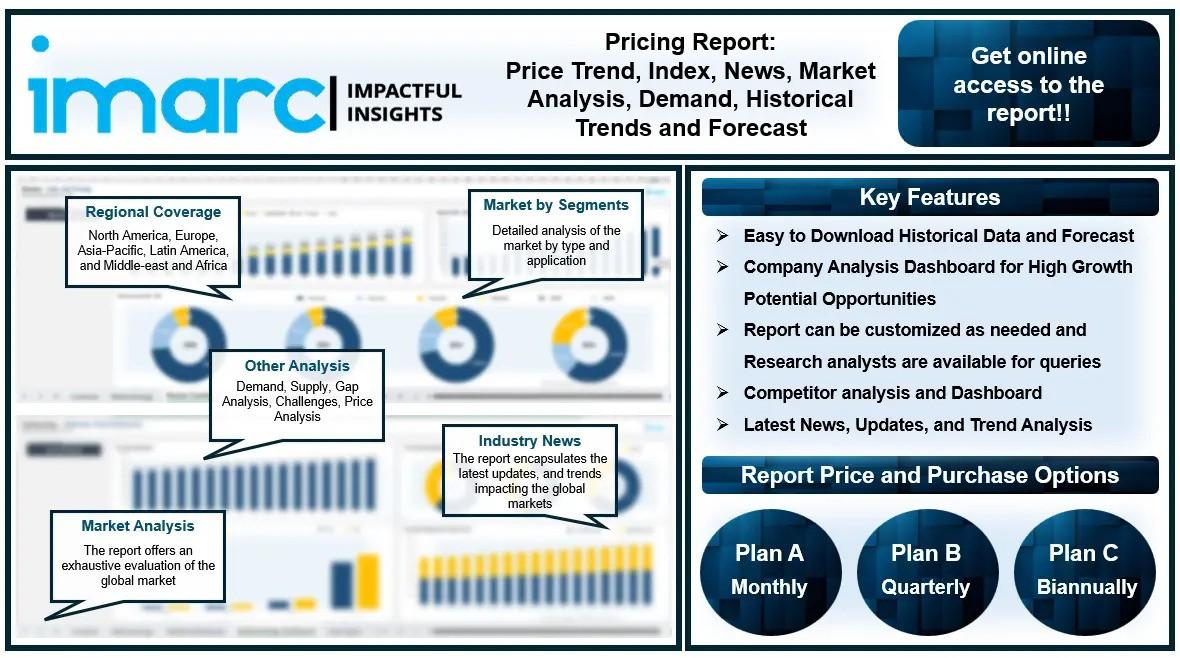

The latest report by IMARC Group, titled "Metal Silicon Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of metal silicon prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Metal Silicon Prices December 2023:

- United States: 3570 USD/MT

- China: 2070 USD/MT

- Europe: 2510 USD/MT

- South East Asia: 2980 USD/MT

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting metal silicon price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/metal-silicon-pricing-report/requestsample

Metal Silicon Price Trend- Q4 2023

The metal silicon market is experiencing robust growth, driven by increasing demands in the electronics, solar energy, and automotive industries. Metal silicon, primarily used as a semiconductor in electronic devices due to its excellent thermal stability and conductivity, is integral to manufacturing computer chips, transistors, and diodes. Additionally, the solar industry's expansion has surged the demand for high-purity silicon, used to produce photovoltaic cells that are essential for solar panels. Furthermore, as the automotive industry continues its shift towards electric vehicles (EVs), the need for metal silicon in battery materials and electronic components has significantly risen. The global push towards sustainable and renewable energy sources, coupled with technological advancements in electronics and automotive sectors, is thus propelling the metal silicon market forward. These trends are expected to continue as technological innovation opens new applications for silicon and as industries worldwide seek more efficient, durable, and cost-effective materials.

Metal Silicon Market Analysis

The global metal silicon market size reached 492.2 Million tonnes in 2023. By 2032, IMARC Group expects the market to reach 859.6 Million tonnes, at a projected CAGR of 6.40% during 2023-2032. In North America, the metal silicon market in Q4 2023 witnessed robust dynamics. Focusing on the USA, end September witnessed stagnation with concerns over downstream demand and the looming auto strike, adding to the market’s stability. A discerning examination revealed a 2% price divergence between the initial and latter halves of the quarter, capturing the nuanced evolution of market forces. The quarter-ending price of silicon metal (4-4-1) CFR Illinois Port in the USA stood at USD 2220/MT. On the other hand, APAC, particularly China, revealed a 2% pricing distinction between the initial and latter halves of the quarter. The quarter-ending price of silicon metal (4-4-1) FOB Shanghai in China stood at USD 2054/MT. Similarly, Germany, located in Europe, exhibited a 2% price fluctuation, standing at USD 2180/MT.

Overall, in the last quarter, metal silicon prices have been significantly influenced by a confluence of factors, including global economic policies, supply chain disruptions initially triggered by the COVID-19 pandemic, and varied industry demands. As markets began to stabilize, metal silicon prices temporarily softened, only to rise again due to increased demand from the tech and automotive sectors, compounded by a slow rebound in production capabilities. Geopolitical tensions and trade restrictions, notably between major producers like China and consumers in the West, have tightened the market and pushed prices up. Additionally, high energy costs and stringent environmental regulations have led to production cutbacks, further straining supply. The demand surge from burgeoning sectors like electronics, driven by remote work and 5G expansion, alongside the growing solar energy sector, continues to elevate metal silicon prices. These dynamics highlight the importance of continuous monitoring of these factors for future price trend predictions in the metal silicon market.

Browse Full Report: https://www.imarcgroup.com/metal-silicon-pricing-report

Key Points Covered in the Metal Silicon Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Metal Silicon Prices

- Metal Silicon Demand

- Metal Silicon Demand & Supply

- Metal Silicon Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Metal Silicon Price Analysis

- Metal Silicon Industry Drivers, Restraints, and Opportunities

- Metal Silicon News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports By IMARC Group:

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology