Payment Gateway Market 2023 | Present Scenario and Growth Prospects 2032 MRFR

Payment Gateway Market: An In-depth Analysis

Market Overview

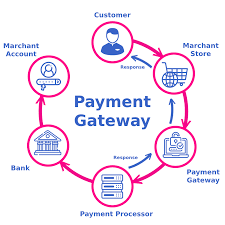

The payment gateway market is a critical component of the digital economy, enabling secure and efficient processing of online transactions. Payment gateways serve as intermediaries between merchants and financial institutions, facilitating the transfer of payment information. As e-commerce and online services continue to grow, the demand for robust and reliable payment gateways is increasing rapidly. The global payment gateway market is driven by the rise of digital payments, advancements in technology, and the need for secure and seamless transaction processes. Payment Gateway Market Size was valued at USD 22.3 Billion in 2022.

Payment gateways support various payment methods, including credit and debit cards, digital wallets, bank transfers, and even cryptocurrencies. They provide merchants with the tools to accept payments from customers worldwide, ensuring secure and smooth transaction experiences. The market is characterized by intense competition and continuous innovation, with key players constantly enhancing their offerings to meet the evolving needs of businesses and consumers.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/18853

Key Market Segments

The payment gateway market can be segmented based on several criteria, including type, enterprise size, end-user, and region.

By Type

-

Hosted Payment Gateways: These gateways redirect customers to a payment service provider's page to complete transactions. They are easy to integrate and maintain but offer limited customization.

-

Self-Hosted Payment Gateways: Also known as non-hosted gateways, these allow merchants to handle the payment processing on their own websites. They offer greater customization and control but require more technical expertise and maintenance.

-

API/Non-Hosted Payment Gateways: These provide APIs that merchants can integrate directly into their websites or mobile apps. They offer flexibility and seamless user experiences but require technical resources for integration.

-

Local Bank Integrates: These gateways are tailored to work with local banks, providing localized payment solutions and enhancing trust among local customers.

By Enterprise Size

-

Small and Medium Enterprises (SMEs): Increasing adoption due to the rise of e-commerce and the need for cost-effective, easy-to-integrate payment solutions.

-

Large Enterprises: Utilize advanced payment gateways to handle high transaction volumes, ensure security, and provide comprehensive analytics.

By End-User

-

Retail and E-commerce: The largest segment, driven by the rapid growth of online shopping and the need for secure and efficient payment processing.

-

Travel and Hospitality: Uses payment gateways to manage bookings, reservations, and other online transactions.

-

Healthcare: Adopts payment gateways for processing payments for online consultations, medical services, and health insurance.

-

Education: Utilizes payment gateways for fee payments, online course enrollments, and other educational services.

-

Others: Includes sectors like utilities, government services, and entertainment that require secure online payment solutions.

By Region

-

North America: Leading market due to advanced technological infrastructure and high adoption rates of digital payment solutions.

-

Europe: Significant growth driven by increasing e-commerce activities and supportive regulatory frameworks.

-

Asia-Pacific: The fastest-growing market, fueled by rapid digitalization, increasing internet penetration, and growing e-commerce industry.

-

Latin America and Middle East & Africa: Emerging markets with increasing adoption of online payment solutions and improving digital infrastructure.

Industry Latest News

The payment gateway market has seen several notable developments recently:

-

Technological Innovations: Integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) to enhance fraud detection and provide personalized payment experiences. For example, ABC Payments recently launched an AI-powered fraud prevention system that reduces false declines and improves transaction security.

-

Regulatory Changes: New regulations are shaping the payment gateway landscape. The European Union's Revised Payment Services Directive (PSD2) mandates strong customer authentication (SCA), enhancing security and consumer protection. Similarly, new regulations in India require multi-factor authentication for online transactions, driving changes in gateway solutions.

-

Strategic Partnerships: Companies are forming alliances to expand their reach and enhance their service offerings. XYZ Gateway partnered with DEF Bank to offer integrated payment solutions to small businesses, combining banking and payment services into a single platform.

-

Market Expansion: Providers are expanding their services to new regions. GHI Payments announced its entry into the African market, aiming to leverage the region's growing mobile payment ecosystem and address the demand for digital payment solutions.

-

Service Diversification: Payment gateways are expanding their range of services to include features like recurring billing, subscription management, and advanced analytics. JKL Solutions recently introduced a subscription billing platform, enabling businesses to manage recurring payments and improve customer retention.

Payment Gateway Companies

Several key players dominate the payment gateway market, each contributing to its growth through innovation and strategic initiatives:

-

PayPal Holdings Inc.: A global leader in online payment solutions, known for its user-friendly platform and extensive merchant network.

-

Stripe Inc.: Renowned for its developer-friendly payment gateway and robust API integrations, catering to businesses of all sizes.

-

Square Inc.: Offers a comprehensive suite of payment solutions, including a popular point-of-sale system and online payment gateway.

-

Adyen NV: Provides a unified payment platform that supports various payment methods and currencies, favored by large enterprises and global merchants.

-

Authorize.Net: A subsidiary of Visa Inc., known for its reliable and secure payment gateway solutions, particularly for small and medium-sized businesses.

-

Amazon Pay: Leverages Amazon’s vast customer base, providing a seamless payment experience for Amazon users across various merchant websites.

Market Drivers

Several factors are driving the growth of the payment gateway market:

-

Rise of E-commerce: The global surge in online shopping is a primary driver, as businesses seek secure and efficient payment solutions to handle increasing transaction volumes.

-

Digital Transformation: The shift towards digital business models and the adoption of online services are fueling the demand for payment gateways that support seamless transactions.

-

Mobile Payments: The growing use of smartphones and mobile wallets is driving the need for mobile-friendly payment gateways, enabling users to make purchases on the go.

-

Security Concerns: The increasing threat of cyber-attacks and fraud is pushing businesses to adopt advanced payment gateways with robust security features to protect customer data.

-

Regulatory Compliance: Compliance with regulations such as PSD2, GDPR, and PCI DSS is essential for businesses, driving the adoption of compliant payment gateway solutions.

-

Consumer Preferences: Consumers' preference for convenient and quick payment methods is encouraging merchants to integrate versatile payment gateways that offer multiple payment options.

Ask for Customization - https://www.marketresearchfuture.com/ask_for_customize/18853

Regional Insights

North America

North America is a significant market for payment gateways, driven by advanced technological infrastructure and high adoption rates of digital payment solutions. The region's robust e-commerce sector and supportive regulatory environment further propel market growth.

Europe

Europe is experiencing significant growth in the payment gateway market, driven by the increasing adoption of e-commerce and digital payments. The region’s stringent data protection regulations, such as GDPR, and directives like PSD2 are promoting the adoption of secure and compliant payment solutions.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market for payment gateways, fueled by rapid digitalization, increasing internet penetration, and the burgeoning e-commerce industry. Countries like China, India, and Japan are leading the charge, with significant investments in digital payment infrastructure and innovations in mobile payments.

Latin America and Middle East & Africa

These regions are emerging markets for payment gateways, with increasing adoption of online payment solutions and improving digital infrastructure. The growth in these regions is driven by the rising number of internet users, expanding e-commerce activities, and government initiatives to promote digital payments.

Conclusion

The payment gateway market is poised for significant growth, driven by the rise of e-commerce, digital transformation, and the increasing demand for secure and efficient payment solutions. Key players in the market are continuously innovating and forming strategic partnerships to enhance their offerings and expand their reach. With supportive regulatory frameworks and ongoing technological advancements, the future of the payment gateway market looks promising, offering immense opportunities for businesses across various regions.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology