Propylene Oxide Market2024 Trends, Growth, and Forecast by 2031

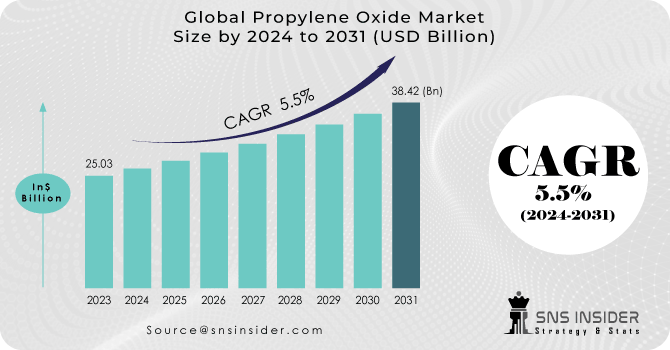

The Propylene Oxide Market, starting at USD 25.03 billion in 2023, is expected to expand to USD 38.42 billion by 2031, growing at a steady CAGR of 5.5%. Growth drivers include increasing utilization in automotive and construction sectors for polyurethane foams, technological innovations in production, and wider applications in chemical and pharmaceutical sectors.

The Propylene Oxide Market is poised for steady growth over the next decade, with its valuation increasing from USD 25.03 billion in 2023 to an anticipated USD 38.42 billion by 2031. This growth reflects a compound annual growth rate (CAGR) of 5.5% over the forecast period from 2024 to 2031, according to the latest comprehensive research report titled "Propylene Oxide Market Size, Share & Segment By Application (Polyether Polyols, Propylene Glycol, Glycol Ether, Other), By Process (Chlorohydrin Process, Styrene Monomer Process, Hydrogen Peroxide Process, TBA Co-Product Process, Cumene-Based Process), By End-Use Industry (Automotive, Building & Construction, Textile & Furnishing, Chemical & Pharmaceutical, Packaging, Electronics, Others), And By Region | Global Market Forecast 2024-2031."

Get Full Free PDF @ https://www.snsinsider.com/sample-request/1503

Market Dynamics

The impressive growth in the Propylene Oxide Market is driven by several key factors:

Rising Demand for Polyurethane: The primary application of propylene oxide is in the production of polyether polyols, a key component in the manufacturing of polyurethane foams. The increasing demand for polyurethane in automotive, construction, and furniture industries is a significant driver for the market.

Expanding Automotive and Construction Industries: Growth in the automotive and construction sectors, particularly in emerging economies, is boosting the demand for propylene oxide. The material’s use in producing flexible foams, coatings, adhesives, and sealants is essential in these industries.

Technological Advancements: Innovations in production processes, such as the development of more environmentally friendly methods like the hydrogen peroxide process, are enhancing the efficiency and sustainability of propylene oxide manufacturing.

Increasing Use in Chemical and Pharmaceutical Industries: Propylene oxide is a critical intermediate in the production of various chemicals and pharmaceuticals, including propylene glycol and glycol ethers. The expansion of these industries further supports market growth.

Segment Analysis

Application: Propylene oxide finds extensive application in polyether polyols, propylene glycol, glycol ether, and other chemical products. The polyether polyols segment dominates the market due to its significant use in producing polyurethane foams.

Process: The market is segmented by production processes, including the chlorohydrin process, styrene monomer process, hydrogen peroxide process, TBA co-product process, and cumene-based process. The hydrogen peroxide process is gaining traction due to its environmentally friendly nature and efficiency.

End-Use Industry: The end-use industries for propylene oxide include automotive, building & construction, textile & furnishing, chemical & pharmaceutical, packaging, electronics, and others. The automotive and building & construction sectors are the largest consumers, driven by the extensive use of polyurethane products.

Regional Insights

The report provides a detailed analysis of the market across different regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America: The region is expected to hold a significant market share, driven by substantial demand from the automotive and construction industries. The presence of major manufacturers and ongoing technological advancements contribute to market growth.

Europe: Europe is another prominent market, with countries like Germany, France, and the UK leading in automotive production and construction activities. The region's stringent environmental regulations are also fostering the adoption of more sustainable production processes.

Asia Pacific: This region is projected to exhibit the highest CAGR during the forecast period, attributed to rapid industrialization and urbanization in countries like China, India, and Japan. The expanding automotive and construction sectors, along with growing chemical and pharmaceutical industries, are key drivers.

Latin America and Middle East & Africa: These regions are gradually embracing the use of propylene oxide, with increasing investments in automotive and construction industries, along with rising awareness about the benefits of polyurethane products.

Industry Trends

Sustainability Focus: There is a growing emphasis on developing sustainable and environmentally friendly production processes. The hydrogen peroxide process, which reduces greenhouse gas emissions and waste, is gaining popularity among manufacturers.

R&D Investments: Companies are investing significantly in research and development to improve the efficiency and cost-effectiveness of propylene oxide production. Innovations in catalyst technologies and process optimizations are ongoing.

Market Expansion Strategies: Leading players are focusing on expanding their production capacities and geographic presence through strategic partnerships, mergers, and acquisitions. This helps them cater to the increasing global demand and enhance their market position.

Increased Use in Emerging Applications: Beyond traditional applications, propylene oxide is finding new uses in emerging sectors such as electronics and renewable energy. Its properties make it suitable for innovative applications, further driving market growth.

Conclusion

The Propylene Oxide Market is set for steady growth, driven by rising demand in key industries, technological advancements, and a growing focus on sustainability. With diverse applications and regional market dynamics, the industry presents significant opportunities for stakeholders across the value chain.

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Read Related Reports:

High Performance Plastics Market Size

Isoparaffin Solvents Market Size

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology