Savory Snacks Market: Exploring the Demand for Nutrient-Rich Snacks

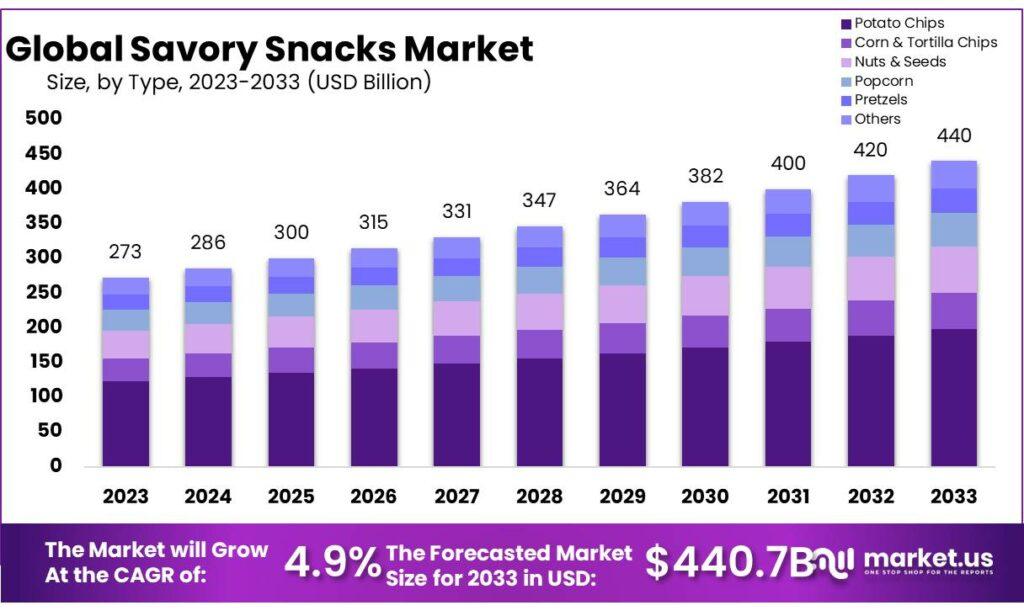

The Savory Snacks Market size is expected to be worth around USD 440 billion by 2033, from USD 273 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The savory snacks market refers to the segment of the food industry that focuses on the production, distribution, and sale of salty and flavorful snack foods. These snacks, characterized by their savory taste profiles, include products such as potato chips, corn and tortilla chips, nuts and seeds, popcorn, pretzels, and a variety of other regional or specialty items. The market is driven by factors such as the global expansion of retail infrastructure, particularly in developing countries, and changing consumer preferences towards more convenient and tasty snack options. However, it also faces challenges from health concerns related to ingredients like salt, sugar, and artificial additives, prompting a shift towards healthier alternatives. The dynamic nature of the market offers significant opportunities for innovation, particularly in the creation of nutritious snacks that cater to the growing demand for wellness-oriented food choices. Despite the competition from local manufacturers, the savory snacks market continues to evolve, adapting to meet diverse consumer needs across different regions.

Key Market Players:

-

PepsiCo

-

The Kellogg Company

-

Kraft Heinz Company

-

Conagra Brands Inc.

-

ITC Limited

-

ConAgra Foods

-

Kellogg Co.

-

General Mills Inc.

-

Hain Celestial

-

Blue Diamond Growers

Click here for request a sample : https://market.us/report/savory-snacks-market/request-sample/

Product Analysis:

In 2023, Potato Chips dominated the Savory Snacks market, capturing over 68.2% of the share. These thinly sliced, deep-fried or baked potato slices are seasoned with various flavors, offering a crispy texture and a wide range of taste options. Corn & Tortilla Chips, made from corn masa, are popular for pairing with dips like salsa and guacamole. Nuts & Seeds provide a crunchy, nutrient-rich option, available in varieties like peanuts, almonds, and cashews. Popcorn, heated until fluffy and crunchy, is often enjoyed with salt or seasonings, sometimes coated with caramel or cheese. Pretzels, baked dough twisted into knots, are typically salted and crispy. Other savory snacks include items like pita chips, vegetable chips, and regional or specialty snacks.

By Flavor:

In 2023, Barbeque flavors led the savory snacks market with over 35% share, beloved for their smoky, tangy taste. Spice flavors also captured a significant share, appealing to those who enjoy a fiery twist. Salty flavors remained a classic favorite, while Plain/Unflavored options continued to attract consumers preferring simplicity. Other flavors added diversity with unique and innovative combinations, catering to niche preferences and adventurous snackers. Barbeque flavors, however, reigned supreme, captivating taste buds and dominating the market.

Distribution Channel Analysis:

In 2023, hypermarkets & supermarkets were the leading distribution channels for savory snacks, holding over 62% of the market share. These stores offered a wide variety of brands and flavors, attracting consumers with their comprehensive selections and promotions. Convenience stores catered to on-the-go consumers with limited but popular snack options. Online platforms grew in popularity, providing a vast array of choices, home delivery, and exclusive deals. Other channels included specialty snack shops, vending machines, and local grocery stores with specific snack ranges.

Key Market Segments:

Product

-

Potato Chips

-

Corn & Tortilla Chips

-

Nuts & Seeds

-

Popcorn

-

Pretzels

-

Others

By Flavor

-

Barbeque

-

Spice

-

Salty

-

Plain/Unflavoured

-

Others

Distribution Channel

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

Drivers:

The global expansion of the retail industry significantly boosts sales of savory snacks. In developed regions like the US, Canada, the UK, France, and Australia, supermarkets and hypermarkets play a crucial role in delivering these snacks to consumers. Similarly, developing nations such as India, China, and Brazil are seeing a surge in modern retail formats as retailers invest heavily to meet the growing demand for snack products. This expanding retail infrastructure provides a significant opportunity for manufacturers and suppliers to increase their market reach in these fast-growing economies.

Restraints:

Health concerns about ingredients commonly used in savory snacks, such as wheat, corn, vegetable oil, salt, sugar, and artificial additives, are a major restraint on market growth. These ingredients, while essential for taste and production, raise health concerns, prompting consumers to opt for healthier alternatives. As health awareness increases and regulatory bodies encourage healthier eating habits, the market faces challenges in meeting consumer demands for nutritious options while maintaining taste.

Opportunity:

The shift in dietary habits towards snacking, driven by globalization and changing lifestyles, presents a significant opportunity for healthy snacks. With a growing awareness of the impact of food choices on health, consumers are increasingly seeking snacks that offer essential nutrition to reduce the risks of chronic illnesses. This demand for healthier snack options reflects a broader trend towards wellness-oriented lifestyles, prompting manufacturers to innovate and introduce nutritious snacks that cater to these evolving preferences.

Challenges:

The growing demand for ready-to-eat snacks has intensified production needs, especially in fragmented markets like Asia and Europe. Local manufacturers, often using lower-cost equipment, produce snacks infused with local flavors and spices, which are priced lower and cater to specific regional tastes. This creates stiff competition for established brands, challenging them to maintain product quality and innovate to meet local consumer preferences. Navigating this competition requires larger companies to continuously enhance their strategies, product offerings, and understanding of local tastes to maintain a competitive edge in these fragmented markets.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology