Blockchain Insurance Market: By End-user, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

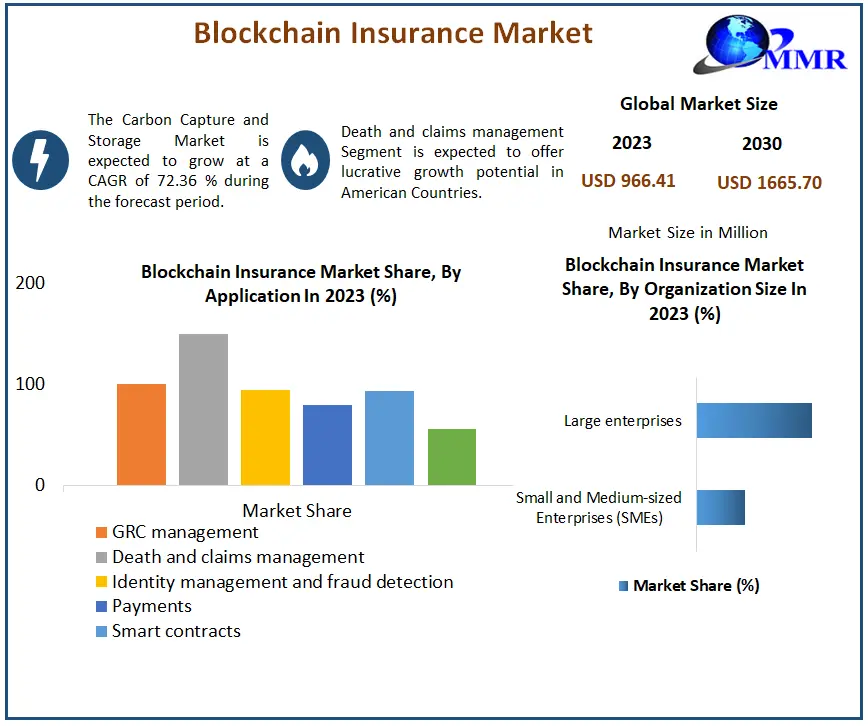

The Blockchain Insurance Market size was valued at USD 966.41 Million in 2023 and the total Blockchain Insurance revenue is expected to grow at a CAGR of 72.36 % from 2024 to 2030, reaching nearly USD 1665.70 Million by 2030.

Blockchain Insurance Market Overview:

The latest study from Maximize Market Research, Global Blockchain Insurance Market , is beneficial for understanding the market's competitors. The study offers a wide and fundamental evaluation of the market, as well as an examination of subjective aspects that may provide readers with critical business insights. The study offers a market overview, including the value chain structure, regional analysis, applications, market size, and forecast . The study will be used to make a more accurate evaluation of the existing and future circumstances of the global Blockchain Insurance market.

Immediate Delivery Available | Buy This Premium Research Report : https://www.maximizemarketresearch.com/request-sample/11489/

Market Scope:

Throughout the projected time, the research gives an analytical picture of the business by evaluating numerous aspects such as global Blockchain Insurance market growth, consumption volume, market trends, and corporate pricing structures. Extensive research is included in the report to investigate the market's intricacies. The study gives an overview of the global Blockchain Insurance market, including market characteristics, market segmentation analysis, market size, the customer landscape, and the geographical landscape. In its research, the study takes into account growth drivers, current trends, innovations, prospects, and the competitive landscape. This market has been investigated in a number of ways, including productivity and manufacturing base.

Drivers:

Blockchain Insurance Market drivers influence demand, guide innovation, and steer competitive strategies, all of which shape the dynamics of distinct sectors. Technological developments, shifting consumer preferences, legislative changes, and economic situations are all significant causes. As technology advances, it encourages the development of new products and services, while variations in customer behavior require firms to adapt and innovate. Depending on their design and implementation, regulatory rules can either help or hinder market growth. In addition, economic factors such as inflation, employment rates, and GDP growth have a considerable impact on market patterns. Understanding these drivers is critical for businesses looking to maintain a competitive advantage and achieve long-term success in an ever-changing environment.

Segmentation:

by Provider

Application and solution provider

Middleware provider

Infrastructure and protocols provider

by Application

GRC management

Death and claims management

Identity management and fraud detection

Payments

Smart contracts

Others (content storage management and customer communication)

by Organization Size

Small and Medium-sized Enterprises (SMEs)

Large enterprises

by Component

Solution

Service

Key Players:

It then goes into great detail about the main competitors in the global Blockchain Insurance market, as well as emerging players, including market share based on revenue, demand, high-quality product producers, sales, and service providers. Furthermore, the study evaluates capacity utilisation, raw material sources, import-export, the value chain, pricing structure, and the industrial supply chain. The following players are featured in this report:

North America:

1. Lemonade

2. MetLife

3. AXA XL

4. State Farm

5. Liberty Mutual

Europe:

1. B3i (Blockchain Insurance Industry Initiative)

2. Allianz

3. Generali

4. Mapfre

5. Swiss Re

Asia-Pacific:

1. Ping An Insurance

2. Bajaj Allianz General Insurance

3. Sompo Japan Nipponkoa Insurance

4. Tokio Marine & Nichido Fire Insurance

5. QBE Insurance

Buy Now Full Report : https://www.maximizemarketresearch.com/market-report/blockchain-insurance-market/11489/

Regional Analysis:

The report has analyzed the global Blockchain Insurance market in the following regions:

- America, North (the United States, Canada, and Mexico)

- European Union (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

- Asia-Pacific region (China, Japan, Korea, India, Southeast Asia, and Australia)

- Latin America (Brazil, Argentina, Colombia, and Rest of South America)

- Africa and the Middle East (Saudi Arabia, UAE, Egypt, South Africa, and Rest of the Middle East & Africa)

The study includes in-depth insights into multiple development possibilities and difficulties in the aforementioned regions, depending on various types of commodities, applications, end-users, and nations, among others. The study also contains essential aspects of the global Blockchain Insurance market, such as sales growth, product pricing and analysis, growth potential, and recommendations for addressing market difficulties in the provided areas.

COVID-19 Impact Analysis on Blockchain Insurance Market:

COVID-19 is a worldwide public health disaster that has touched virtually every firm, and the long-term effects are projected to have an impact on industry growth during the forecast period. Our ongoing research broadens our research methods to address core COVID-19 problems as well as prospective future steps. The study sheds light on COVID-19 by taking into consideration changes in consumer behavior and demand, purchasing patterns, supply chain re-routing, the dynamics of modern market forces, and significant government efforts. The updated research includes insights, analysis, estimates, and predictions based on COVID-19's market impact.

Key Questions Answered in the Blockchain Insurance Market Report are:

- Who are the leading players in the Blockchain Insurance market?

- In terms of the region, what is the potential market for Blockchain Insurance?

- In the next five years, which application area of Blockchain Insurance is likely to develop at a substantial rate in the market?

- What opportunities exist for new market entrants?

- How big will the Blockchain Insurance market be in 2024?

- What are the Blockchain Insurance market's growth prospects?

- What is the base year taken into account in the Blockchain Insurance market report?

- In the Blockchain Insurance market, which region has the biggest market share?

- What are the variables that are expected to boost the Blockchain Insurance market?

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology