Thailand BNPL Services Market Trends and Forecast Analysis till 2033: SPER Market Research

"Buy now pay later" (BNPL) services are financial services that allow clients to make advance purchases and then pay later. Credit evaluation, repayment plans, payment options, retail partners, application procedures, and interest expenditures are only a few of its phases and components. BNPL payments are widely used to pay for consumer items, clothing, furniture, autos, travel, housing, and internet shopping. Customers can use this really useful service to purchase premium, luxurious goods, promoting ease, reducing financial constraints, and granting them financial independence.

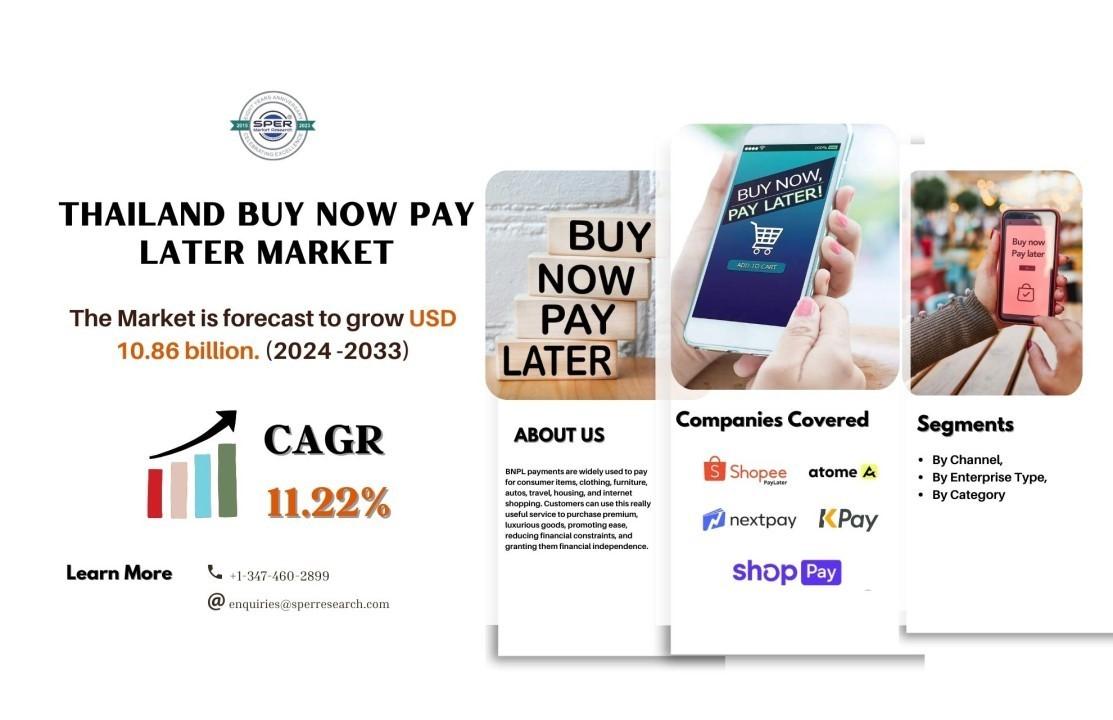

According to SPER market research, ‘Thailand Buy Now Pay Later Market Size- By Channel, By Enterprise Type, By Category – Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ state that the Thailand Buy Now Pay Later Market is predicted to reach USD 10.86 billion by 2033 with a CAGR of 11.22%.

Drivers of Growth: There are several key elements driving the growth of Thailand's Buy Now Pay Later (BNPL) market. For starters, the BNPL sector's expansion has been significantly supported by the economy's rapid digitization. The convenience and versatility of BNPL solutions have risen in popularity as more clients use online purchasing and e-commerce platforms. Furthermore, as internet usage and smartphone penetration have expanded throughout Thailand, BNPL services have become more accessible, leading to increased adoption.

Furthermore, BNPL providers profit substantially from Thailand's younger demographic, particularly millennials and Gen Z, who are more comfortable managing their funds digitally and prefer digital payment methods.

Challenges: The primary impediments to expansion are low service awareness and an availability of payment choices. There are several options for financing the payment, including postdated chequeens, credit and debit cards, and others. Many emerging markets, like Brazil, India, and Asia, are unaware of the BNPL service. Prior to using BNPL services, clients' credit ratings must be confirmed.

Request For Free Sample Report @ https://www.sperresearch.com/report-store/thailand-buy-now-pay-later-market.aspx?sample=1

Impact of COVID-19 on Thailand Buy Now Pay Later Market

COVID-19 has had a huge impact on Thailand's buy now pay later (BNPL) market. The health crisis, like that in many other countries, caused widespread economic insecurity and altered consumer spending habits. When people were accustomed to lockdowns and other forms of social isolation, there was an early surge in internet shopping; but, the accompanying economic crisis forced them to be more frugal with their money. Customers seeking flexible payment options to manage their money in the aftermath of income reductions and job losses boosted demand for BNPL services. This trend was especially noticeable among younger generations and those who had limited access to standard credit lines.

Thailand Buy Now Pay Later Market Key Players:

Additionally, Some of the market key players are SpayLater, Pay Next, Atome, K PAY LATER.

Thailand Buy Now Pay Later Market Segmentation:

By Channel: Based on the Channel, Thailand Buy Now Pay Later Market is segmented as; Point of Sale, Online.

By Enterprise Type: Based on the Temperature Type, Thailand Buy Now Pay Later Market is segmented as; SMEs, Large Enterprises.

By Category: Based on the Category, Thailand Buy Now Pay Later Market is segmented as; Banking, Financial Services and Insurance, Consumer Electronics, Fashion & Garment, Healthcare, Retail, Media and Entertainment, Others.

By Region: This research also includes data for Eastern Region, Western Region, Southern Region, Northern Region.

This study also encompasses various drivers and restraining factors of this market for the forecast period. Various growth opportunities are also discussed in the report.

For More Information, refer to below link:-

Thailand Buy Now Pay Later Market Share

Related Reports:

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant – U.S.A.

SPER Market Research

+1-347-460-2899

- Thailand_Buy_Now_Pay_Later_Market

- Thailand_BNPL_Market

- Startup_BNPL_companies_in_Thailand

- Thailand_Buy_Now_Pay_Later_Market_Growth

- Thailand_Buy_Now_Pay_Later_Market_Trends

- Thailand_Buy_Now_Pay_Later_Market_Size

- Thailand_Buy_Now_Pay_Later_Market_Share

- Thailand_Buy_Now_Pay_Later_Market_Revenue

- Thailand_Buy_Now_Pay_Later_Market_Demand

- Thailand_Buy_Now_Pay_Later_Market_Challenges

- Thailand_Buy_Now_Pay_Later_Market_Competition

- Thailand_Buy_Now_Pay_Later_Market_Report

- Thailand_Buy_Now_Pay_Later_Market_Segmentation

- Thailand_Buy_Now_Pay_Later_Market_Future_Outlook

- Thailand_Buy_Now_Pay_Later_Companies

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology