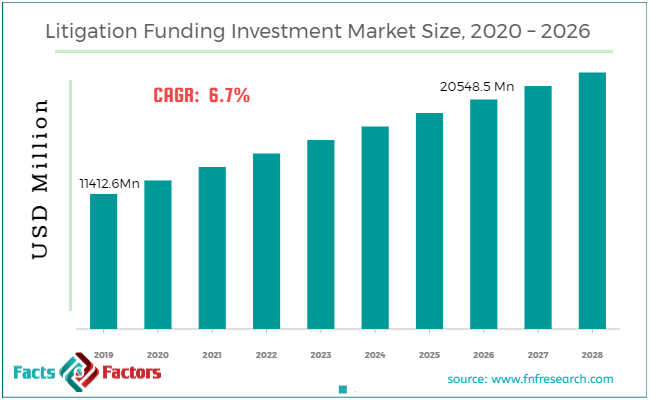

Global Litigation Funding Investment Market Size, Share, Trends, Opportunities Analysis Forecast Report by 2028

The most recent research study provides a thorough investigation of the worldwide Litigation Funding Investment Market for the years 2022-2028, which is useful for Apex Litigation Finance Limited, Deminor, Longford Capital Management, LP, Augusta Ventures Ltd., VALIDITY FINANCE LLC, Woodsford Litigation Funding Ltd., Pravati Capital LLC, IMF Bentham Limited, Harbour Litigation Funding Limited, Burford Capital, SWIFT Financial, Balance Legal Capital LLP of any size regardless of their sales. This survey investigation takes into account the significant market and industry strategy for COVID-19 in the years to come. The research that Litigation Funding Investment conducted on the market contains statistics and information on the development of the investment structure, technological advancements, industry trends and developments, capabilities, and specific information on the market's most important rivals. In addition to this, the report provides a rundown of several tactics for the global market that have been put into action in consideration of the current and projected condition of the industry.

The research begins with a concise analysis of the Litigation Funding Investment market, including topics such as the current market landscape, key market players, industry trends, product type, application, and geography. We also discuss the impact that COVID-19 has had on global Litigation Funding Investment market trends, future forecasts, growth prospects, end-user industries, and market rivals. In addition, the Litigation Funding Investment market provides historical data as well as existing and future market situations and insights.

*** NOTE: Our team of market researchers is currently conducting research on Covid19 and its impact on the Litigation Funding Investment market. The results of this study will be used to inform our use of the Covid-19 footmark, which will help us gain a deeper understanding of both the market and the industries. If you need any additional information, please get in touch with us as soon as you can. ***

This study provides a comprehensive summary of the market value, including information on product pricing, demand, gross margin, and supply for the Litigation Funding Investment business sector. A comprehensive picture of the market share analysis of the major rivals in the industry is presented in the section of the study devoted to competitive viewpoints.

The major vendors covered:

- Apex Litigation Finance Limited

- Deminor

- Longford Capital Management

- LP

- Augusta Ventures Ltd.

- VALIDITY FINANCE LLC

- Woodsford Litigation Funding Ltd.

- Pravati Capital LLC

- IMF Bentham Limited

- Harbour Litigation Funding Limited

- Burford Capital

- SWIFT Financial

- Balance Legal Capital LLP

Research analysts examine the level of consumer need as well as the overall size of the market. These analysts then consult with industry experts to validate their findings. Control is also exercised over the instruments, raw materials, and demand analysis further down the supply chain. The researchers focused their attention on the new purposes of the market and did an in-depth analysis of the conditions that already existed in the market.

The Litigation Funding Investment market research report will have empathy for the following:

- Opportunities for New Investments

- It is recommended to approach investors as well as private equity firms.

- Planners and analysts of businesses that use extreme caution

- Distributors, Manufacturers, and Suppliers of Intelligent Network Security that is intelligent

- Organizations within the public sector and academic research institutes

- End-use industries, speculation, the Business Research League, and many other organizations also participated.

Litigation Funding Investment Market Segments Evaluated in the Report:

Competitive Spectrum – Top Companies Participating in the Litigation Funding Investment Market are:

- Apex Litigation Finance Limited

- Deminor

- Longford Capital Management

- LP

- Augusta Ventures Ltd.

- VALIDITY FINANCE LLC

- Woodsford Litigation Funding Ltd.

- Pravati Capital LLC

- IMF Bentham Limited

- Harbour Litigation Funding Limited

- Burford Capital

- SWIFT Financial

- Balance Legal Capital LLP

Litigation Funding Investment Product Overview:

Application

Class Action Lawsuit Funding, Insolvency Litigation Funding, International Arbitration, Commercial Litigation Funding, Intellectual Property Litigation Funding, Patent Litigation Funding, Consumer Disputes, Labor Lawsuit Funding

Classified Applications of Litigation Funding Investment :

End-User

Subsegment2

Key regions divided during this report:

- The Middle East and Africa Litigation Funding Investment Market (Saudi Arabia, United Arab Emirates, Egypt, Nigeria, South Africa)

- North America Litigation Funding Investment Market (United States, Canada, Mexico)

- Asia Pacific Litigation Funding Investment Market (China, Japan, Korea, India, Southeast Asia)

- South America Litigation Funding Investment Market (Brazil, Argentina, Colombia)

- Europe Litigation Funding Investment Market (Germany, UK, France, Russia, Italy)

The objectives of the Litigation Funding Investment market study are:

- Litigation Funding Investment: Current Market Situation and Projections for the Years 2022 through 20278

- The Litigation Funding Investment Market report addressed new product developments, collaborations, mergers, and acquisitions. It also mentioned research and development projects.

- Litigation Funding Investment Market Specifics, Including Information Regarding Opportunities and Obstacles, Limitations and Dangers, Market Drivers, and Obstacles.

- A general overview of the competitive landscape, including the primary market participants, their expansion goals, and any relevant agreements.

- Detailed analysis of the Litigation Funding Investment market, including information on key players' most recent accomplishments, sales, and revenues as well as their market share.

- In order to do research and analysis on the Litigation Funding Investment market according to geographies, types of businesses, and application areas.

Experts in both primary and developed statistics are consulted for the Litigation Funding Investment market study, which also contains qualitative and quantitative information. The analysis comes from Experts from manufacturers who monitor present conditions, including COVID-19, potential financial reversals, the effects of a slowdown in trade, the significance of export and import restrictions, and all other factors that may accelerate or delay market growth throughout the projected period.

Read Our Other Reports@

Global Baby Wipes Market Size Extensive Demand and New Developments in Upcoming years 2024-2032

Tattoo Market [Newest Report] Size Booming Insights and Latest Innovations to [2032]

Smart Fleet Market [Newest Report] Size Booming Insights and Latest Innovations to 2032

Plant-Based Ingredients Market [Newest Report] Size Booming Insights and Latest Innovations to 2032

Nitrogen Market Size: Growth Share and Future Trends Unveiled for 2028

Tocotrienol Market [Newest Report] Size Booming Insights and Latest Innovations to 2028

Online Travel Booking Market Size Extensive Demand and New Developments in Upcoming years 2020-2028

Global Smart Fleet Management Market Size, Share and Trend Analysis 2023-2028 | DeaLea Photography

Global Industrial Hemp Market Size, Growth, Trends, And Forecasts 2023-2028 | DeaLea Photography

Global Fiberglass Yarn Market (new report) poised for huge global growth from 2023 to 2030

TOC Highlights:

Chapter 1. Introduction

The research and analysis carried out on Litigation Funding Investment provide a brief introduction to the market on a global scale. This section includes viewpoints from significant participants, an audit of the Litigation Funding Investment industry, predictions for key regions, and financial services, and a comprehensive discussion of the myriad challenges that the Litigation Funding Investment market is currently facing. The Scope of the Study and the Report Guidance will both have an impact on this aspect.

Chapter 2. Outstanding Report Scope

The market is broken up into segments, which are discussed in the second most important chapter, which also includes a definition of Litigation Funding Investment. It lays out the parameters of the Litigation Funding Investment study and provides an overview of the many facets that are covered in it.

Chapter 3. Market Dynamics and Key Indicators

Key market dynamics such as market drivers [Globally Growing Litigation Funding Investment Prevalence and Increasing Investments in Litigation Funding Investment], market restraints [High Cost of Litigation Funding Investment], opportunities [Emerging Markets in Developing Countries], and emerging trends [Consistent Launch of New Screening Products] as well as growth hurdles, and influence factors discussed in this report are covered in this chapter.

Chapter 4. Type Segments

This Litigation Funding Investment market study illustrates the expansion of the market for a variety of product categories that are offered by the most all-encompassing firms.

Chapter 5. Application Segments

The examiners of the report evaluated future prospects and calculated the market potential of significant applications in detail.

Chapter 6. Geographic Analysis

Each regional market is analyzed in great detail in order to ascertain its current and projected levels of growth and development as well as demand scenarios.

Chapter 7. Impact of COVID-19 Pandemic on the Global Litigation Funding Investment Market

7.1 North America: Insight On COVID-19 Impact Study 2022-2028

7.2 Europe: Serves Complete Insight On COVID-19 Impact Study 2022-2028

7.3 Asia-Pacific: Potential Impact of COVID-19 (2022-2028)

7.4 Rest of the World: Impact Assessment of COVID-19 Pandemic

Chapter 8. Manufacturing Profiles

The study provides data on the leading firms operating in the Litigation Funding Investment market, including topics such as market size, markets served, products, applications, geographical expansion, and other aspects of the business environment.

Chapter 9. Pricing Analysis

This chapter presents an examination of pricing points broken down by region, in addition to additional forecasts.

Chapter 10. Research Methodology

The following primary points are covered in the chapter on the research methodology:

10.1 Coverage

10.2 Secondary Research

10.3 Primary Research

Chapter 11. Conclusion

Thanks for reading this article; you’ ll also get an individual chapter wise section or region-wise report versions like North America, Europe, Asia Etc.

Contact Us:

Facts & Factors

2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology