Future | Trends and Growth of Hemostats Market

The COVID-19 outbreak has significantly impacted the availability of hospital resources worldwide. This has been primarily managed by dramatically reducing inpatient and outpatient services for other diseases and implementing infection prevention and control measures.

With the WHO officially declaring the outbreak of COVID-19 a pandemic, a mix of established pharmaceutical and biopharmaceutical companies and small startups has stepped forward to develop treatments and vaccines that target the infection caused by the novel coronavirus.

According to the Heart and Circulatory Disease Statistics 2019 from the British Heart Foundation (UK), there has been a significant increase in the number of cardiac surgical procedures such as angioplasty and aortic valve replacement in the UK over the last decade, and this trend is expected to continue in the coming years.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9571619

The number of hospitals and surgical centers is increasing in both developed and emerging countries. The demand for surgical equipment (including medical devices such as hemostats) is high in these newly established surgical centers and hospitals, owing to the increasing patient population base.

According to the Commonwealth Fund in 2018, China has approximately 12,000 public hospitals and 21,000 private hospitals. Similarly, in June 2019, the Indian Ministry of Health and Family Welfare announced the opening of 22 new AIIMS across the country. The significant growth in the number of hospitals and surgical centers is expected to support the growth of the market, as these are key end users of the hemostats market.

Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of these products. For instance, the Association of American Medical Colleges (AAMC) projects a shortage of about 122,000 physicians by 2032 in the US. Of these, a shortage of 12,000 medical specialists and 23,400 surgeons and 39,100 other specialists such as neurologists and radiologists is expected to occur by 2032.

The technology landscape and application areas of hemostats products are changing rapidly, owing to technological advancements in this field.

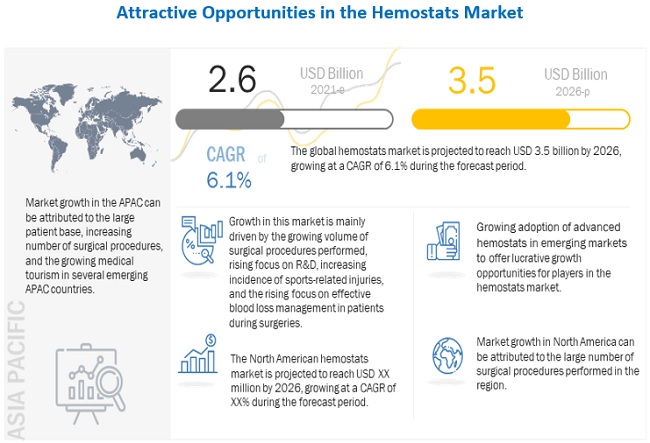

Based on the region, Hemostats market is segmented into five major regional segments, namely, North America, Europe, Asia Pacific, Latin America and Middle East & Africa. In 2020, North America accounted for the largest share of the market, followed by Europe.

The growing geriatric population, increasing incidence of sports injuries, and the growing prevalence of lifestyle disorders (such as arthritis, osteoporosis, and obesity) are some of the major factors responsible for the growing number of orthopedic surgeries performed globally. However, the reconstructive surgery segment is expected to grow at the highest CAGR during the forecast period.

The company has a strong geographic presence across the US, Asia, Europe, Middle East and Africa, & the Americas. Moreover, the company’s strong brand recognition and comprehensive product portfolio in the Hemostats market is its key strength.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology