Insect Farming Market Challenges: Overcoming Consumer Barriers and Regulatory Hurdles

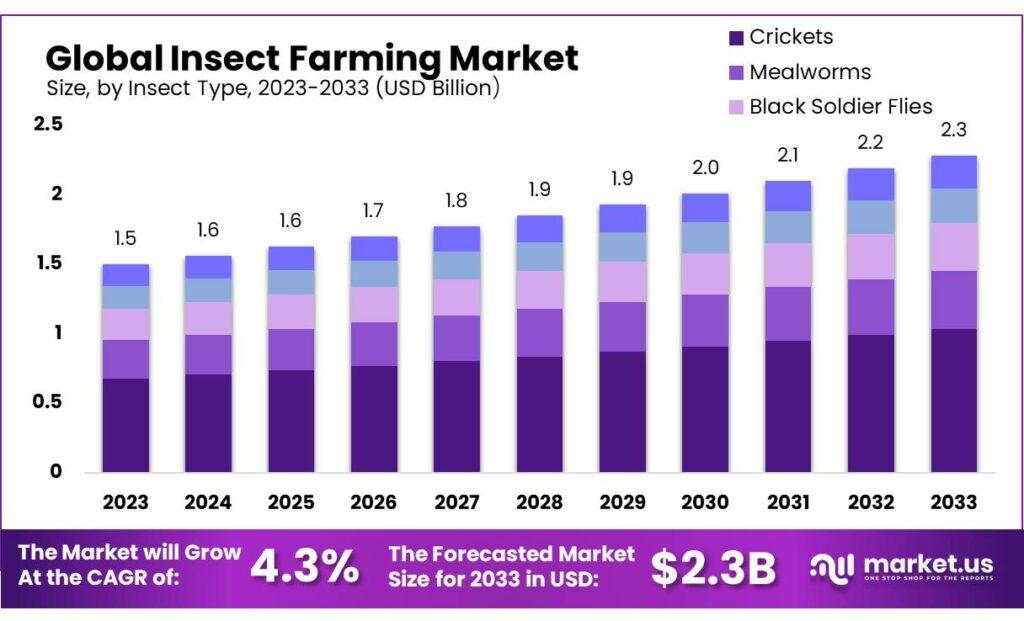

The global Insect Farming Market size is expected to be worth around USD 2 billion by 2033, from USD 1.5 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The insect farming market refers to the industry dedicated to breeding and cultivating insects for various purposes, including human consumption, animal feed, and agricultural applications. This market is driven by the increasing demand for sustainable and alternative protein sources, as insects offer a highly efficient and eco-friendly option compared to traditional livestock. Insect farming supports environmental sustainability by reducing greenhouse gas emissions, land use, and water consumption associated with conventional animal farming. The market includes various sectors such as edible insects for direct human consumption, insect-based animal feed, and bioconversion processes where insects are used to recycle organic waste. Innovations in farming techniques, advancements in insect processing, and growing acceptance of insects as a viable food source contribute to the market's expansion and development.

Market Key Players:

-

Bayer

-

Ynsect

-

Beta Hatch

-

Farmers Business Network

-

Flourish Farm

-

Bioag Pty Ltd

-

Innovafeed

-

Hargol

-

Growmark

-

Walters Gardens, Inc

-

Grubbly Farms

-

Hexafly

-

Protenga

-

Aspire Food Group

Click here for request a sample: https://market.us/report/insect-farming-market/request-sample/

By Insect Type:

In 2023, crickets dominated the insect farming market with over 46.7% market share due to their high consumer acceptance and use in snacks, flour, and protein bars. Mealworms are also significant, valued for their versatility in human food and animal feed, offering rich protein and fat content. Black Soldier Flies (BSF) are gaining popularity for their waste management capabilities, converting organic waste into high-quality protein for animal feed and fertilizers. House Flies are utilized for waste reduction, converting animal waste into usable biomass.

By Application:

Insect farming in 2023 saw Animal Feed as the leading application, capturing more than 37.5% of the market. Insects are used as a sustainable, high-protein feed alternative. Fertilizer applications are growing, with insect waste enriching soil as an organic alternative to chemical fertilizers. The Protein segment processes insects into powders and meals for human nutrition and supplements, while Biofuels explore converting insect biomass into renewable energy, reducing fossil fuel reliance.

By End-use:

In 2023, the Food and Feed segment led the market with over 41.6% share, utilizing insects for both human food and animal feed due to their nutritional benefits and lower environmental impact. The Agricultural segment uses insects for pest management and soil enrichment. Pharmaceuticals research insects for compounds with potential therapeutic uses, while Biotechnology explores their use in genetic research and protein production for enzymes, vaccines, and other biologically important proteins.

Key Market Segments:

By Insect Type

-

Crickets

-

Mealworms

-

Black Soldier Flies

-

House Flies

-

Others

By Application

-

Animal Feed

-

Fertiliser

-

Protein

-

Biofuels

-

Others

By End-use

-

Food and Feed

-

Agricultural

-

Pharmaceuticals

-

Biotechnology

-

Others

Drivers:

The insect farming market is primarily driven by sustainability and environmental benefits. Insects offer an eco-friendly alternative to traditional livestock by requiring less feed, emitting fewer greenhouse gases, and using minimal water. Their ability to convert organic waste into high-quality protein and fertilizers further supports sustainable agriculture. Additionally, the lower production costs and rising demand for sustainable protein sources enhance the economic viability of insect farming.

Restraints:

The main challenges for the insect farming market are consumer acceptance and regulatory hurdles. Cultural biases and the ‘yuck factor’ associated with eating insects pose significant barriers, necessitating extensive education to shift consumer perceptions. Regulatory frameworks are also complex and vary by region, impacting the approval and market entry of insect-based products. The lack of standardized regulations and limited research on long-term health effects add to the difficulties in expanding the market.

Opportunity:

A major opportunity for the insect farming market lies in expanding into alternative protein markets. Insects, with their high feed conversion efficiency and low environmental footprint, present a sustainable solution to the growing demand for protein. They can be used in human diets, pet foods, and livestock feed, and also in non-food products like biofuels and bioplastics. The scalability of insect farming and a more favorable regulatory environment further support this market potential.

Trends:

The insect farming market is increasingly integrating technology and automation to enhance efficiency and sustainability. Advanced systems for climate control, automated feeding, and robotic harvesting are reducing manual labor and production costs. Data analytics and IoT technologies are optimizing growth conditions, while AI is improving breeding patterns and genetic selection. This trend towards technological advancement supports the scalability of insect farming and aligns with global sustainability goals.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology