coated steel market Supply-Demand, Growth, End User Analysis, Raw Materials and Outlook

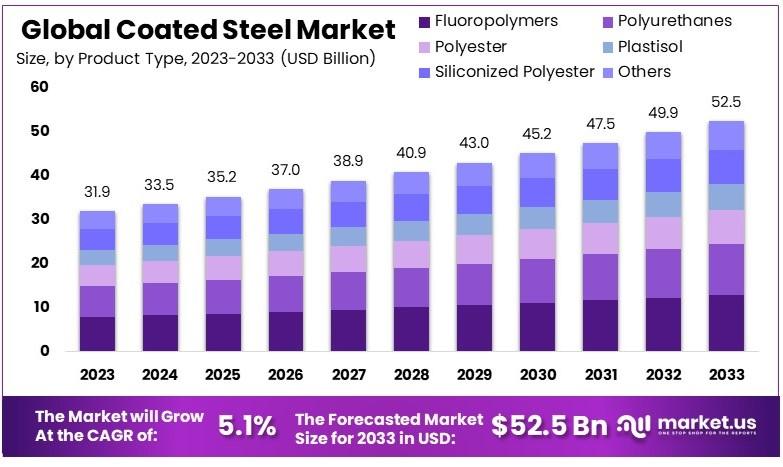

The Global Coated Steel Market size is expected to be worth around USD 52.5 Billion by 2033, from USD 31.9 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The Coated Steel Market encompasses the global industry involved in the production, distribution, and application of steel that has been coated with protective layers such as zinc, aluminum, or organic coatings to enhance durability and resistance to corrosion. This coated steel is widely used in various sectors, including construction, automotive, and appliances, due to its strength, longevity, and aesthetic appeal. The market is driven by increasing demand for durable and sustainable building materials, advancements in coating technologies, and growing applications in emerging markets, particularly in infrastructure and construction projects.

Market Key Players:

-

ArcelorMittal

-

Baosteel Metal Products Co., Ltd

-

DONGKUKSTEEL MILL CO., LTD.

-

KOBE STEEL, LTD.

-

JSW Steel, Coated Products Limited

-

SEVERSTAL

-

BlueScope Steel Limited

-

ThyssenKrupp Steel Europe

-

NIPPON STEEL CORPORATION

-

J. K. Steel Strips LLP

-

United States Steel Corporation

-

NLMK

-

NSAIL

Click here for request a sample : https://market.us/report/coated-steel-market/request-sample/

Product Type Analysis:

In the Coated Steel Market, fluoropolymers lead with a 24.6% market share due to their superior resistance to chemicals, UV radiation, and extreme weather conditions. These properties make fluoropolymers ideal for use in harsh environments, particularly in industrial and infrastructure projects. Other significant coatings include polyurethanes, known for flexibility and durability in automotive and construction applications, and polyester coatings, favored for their cost-effectiveness in roofing and siding. Plastisol and siliconized polyester coatings also hold market shares, each offering unique benefits in specific applications.

Process Analysis:

The coil coating process dominates the Coated Steel Market with a 45.2% share, valued for its efficiency and high-quality output. This automated process applies coatings to continuous metal strips, making it ideal for large-scale production in construction and automotive industries. Extrusion coating, used for thicker and complex shapes, holds a smaller share, while hot dip galvanizing, known for its excellent corrosion resistance, is favored for outdoor and marine applications but is less automated, limiting its market share.

Form Analysis:

Liquid coatings hold a dominant 72.6% share in the Coated Steel Market due to their versatility and ease of application across various methods, making them suitable for industries like construction, automotive, and consumer goods. Liquid coatings offer excellent adhesion and protection against corrosion. Powder coatings, though environmentally friendly and cost-effective, are less versatile in application methods and surface finishes, resulting in a smaller market share compared to liquid coatings.

End-Use Analysis:

The building and construction industry leads the Coated Steel Market with a 42.9% share, driven by the demand for durable, corrosion-resistant materials in residential, commercial, and infrastructure projects. Coated steel is widely used in roofing, siding, and structural components. The automotive sector follows, with coated steel essential for vehicle manufacturing. Consumer goods and appliances represent a smaller segment, focusing on durable and aesthetically pleasing products. The protective and marine segment, though smaller, is crucial in high-corrosion environments like marine and oil industries.

Key Market Segments:

By Product Type

-

Fluoropolymers

-

Polyurethanes

-

Polyester

-

Plastisol

-

Siliconized Polyester

-

Others

By Process

-

Coil

-

Extrusion

-

Hot Dip Galvanizing

By Form

-

Liquid

-

Powder

By End-Use

-

Building & Construction

-

Automotive

-

Consumer Goods & Appliances

-

Protective and Marine

-

Others

Driving Factors:

Urbanization and Infrastructure Development:

Rapid urbanization and infrastructure development globally are significantly boosting the demand for coated steel. Its durability and corrosion resistance make it ideal for use in construction, including residential, commercial, and infrastructure projects like bridges and transportation systems. The growing construction sector, especially in emerging economies like China and India, drives coated steel's demand, with the global construction industry expected to grow at a CAGR of 5.4% from 2021 to 2026.

Automotive Industry Growth:

The automotive industry heavily relies on coated steel for body panels, structural components, and various parts due to its superior corrosion resistance and durability. The rising demand for vehicles, including electric vehicles, particularly in emerging markets like China, India, and Brazil, fuels the growth of the coated steel market. Coated steel's ability to withstand harsh conditions makes it crucial for producing long-lasting, high-quality vehicles.

Renewable Energy Sector Expansion:

The shift towards renewable energy sources, such as solar and wind power, is increasing the demand for coated steel. Coated steel is used in solar panel mounts and wind turbines for its strength and environmental resistance. Investments and policies promoting renewable energy in countries like the U.S., Germany, and China are driving the coated steel market, as durable materials are essential for reliable infrastructure in renewable energy projects.

Restraining Factors:

Environmental Concerns and Regulations:

Stringent environmental regulations and concerns over the ecological impact of certain coatings can hinder the coated steel market. Compliance with regulations like the EU’s REACH can increase production costs and disrupt supply chains, reducing profitability and slowing market growth.

Raw Material Price Volatility:

Fluctuations in raw material prices, such as iron ore, coal, and zinc, impact the coated steel market. Price increases and supply disruptions can elevate production costs and affect profitability. Events like the COVID-19 pandemic have exacerbated these challenges, potentially leading to market stagnation.

Growth Opportunities:

Innovative Coating Technologies:

Advanced coating technologies, including self-healing coatings, present significant growth opportunities for the coated steel market. Innovations that enhance corrosion resistance and durability can expand coated steel applications across various industries. The market for such advanced coatings is expected to grow at a CAGR of 5.6% from 2023 to 2033, driven by high-performance material demands.

Sustainability and Recycling Initiatives:

The focus on sustainability and recycling offers growth opportunities for the coated steel market. Coated steel’s recyclability aligns with the global push towards a circular economy. Promoting sustainability and incorporating recycled materials can drive demand, as evidenced by the U.S. steel recycling rate of over 88% in 2020.

Trending Factors:

Lightweight and High-strength Coated Steel:

There is a growing demand for lightweight, high-strength coated steel, especially in the automotive sector, where reducing vehicle weight is crucial for fuel efficiency and emissions reduction. Advanced coated steel products with superior strength-to-weight ratios are increasingly important, with the automotive lightweight materials market projected to grow significantly from 2023 to 2033.

Smart Coatings and Intelligent Monitoring:

Smart coatings and intelligent monitoring systems are emerging trends in the coated steel market. These technologies can detect corrosion and other environmental factors, providing real-time data for predictive maintenance. The integration of smart coatings enhances the durability and functionality of coated steel products, making them attractive for high-tech applications.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology