HVAC Systems Market Research: Identifying Key Growth Drivers and Barriers

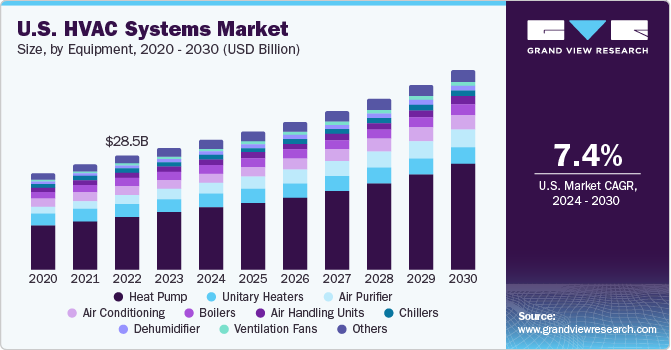

The global HVAC systems market size is anticipated to reach USD 382.66 billion by 2030, according to a new study by Grand View Research Inc. The market is expected to expand at a CAGR of 7.4% from 2024 to 2030. The rising adoption of energy-efficient and renewable energy products is anticipated to be a significant driving factor for HVAC demand. Demand for eco-friendly systems, and advanced technology usage in products including software and automation, are a few key factors contributing to the industry’s success. The growing usage of ACs in homes, as well as offices, has favored the HVAC industry over the years. To further boost this demand, rising incomes and standard of living in several emerging economies have also driven business profitability in recent years.

The growing popularity of ductless HVAC(Heating, ventilation, and air conditioning) is also gaining traction and will create avenues for market growth over the mid-term. Installing ACs in buildings without ducts is an impossible task and this is where ductless systems come to save the day. These compact units can be installed almost anywhere devoid of ducts. Apart from new product development energy-efficient and tech-savvy products are also carving a niche for themselves in the market. For instance, products that work on geothermal technologies or renewable energy sources are helping consumers cut energy costs while benefitting OEMs meet sustainability targets.

Access the HVAC Systems Market Size, Share & Trends Analysis Report By Equipment (Heat Pump, Air Purifier), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2024 - 2030

Apart from efficiency, technology is also making this a lucrative market. Building automation systems are popular among contractors and architects. Therefore, the demand for Building Automation Systems (BAS) is gaining traction, as such creating avenues for the market. Further, ACs are no longer operated manually but can be controlled remotely with a smartphone, PC, or tablet. This functionality and smart feature is also emerging as a popular trend in the market creating revenue streams for manufacturers.

HVAC Systems Market Report Highlights

· The heat pump equipment segment led the market and accounted for a share of 37.8% in 2023. The demand for heat pumps is experiencing a notable surge driven by a growing emphasis on energy efficiency, environmental sustainability, and a shift toward renewable heating solutions.

· The demand for air purifiers is witnessing a robust increase as concerns about indoor air quality and respiratory health grow worldwide. Driven by factors, such as rising pollution levels, allergens, and awareness of airborne viruses, consumers and businesses are increasingly investing in air purification technologies.

· Asia Pacific dominated the market and accounted for a revenue share of more than 46.5% in 2023. Rising temperatures and industrial growth in the region will favor demand over the forecast period

· Since the outbreak of coronavirus, key players operating in the market are focused on introducing products that can improve the air quality. In February 2020, Havells India Ltd. launched Grande heavy Duty Air conditioner under its brand Llyod. The AC features Catechine coated dust filter and Green Bio air filter along with anti-bacterial Eva Coils, which enhances the room air quality

Order your free sample copy of “HVAC Systems Market Report 2024 - 2030, published by Grand View Research

Key HVAC Systems Company Insights

To increase market penetration and cater to changing technological requirements from various end-uses, such as residential, commercial, and industrial, product manufacturers use a variety of strategies, such as joint ventures, mergers, acquisitions, new product launches, and geographical expansions. Manufacturers are undertaking strategic acquisitions to gain an edge in the industry and increase their geographic presence.

For instance, in May 2023, Carrier Corporation introduced i-Vu Pro v8.5 for upgrading controller firmware, improving serviceability for customers, and reducing downtime of connected HVAC equipment. The latest enhancements are expected to help customers with Internet of Things (IoT) connectivity, robust security, and leading serviceability features. Furthermore, in February 2022, Johnson Controls, Inc. launched commercial rooftop units (RTUs) with series, such as Johnson Controls, YORK, and TempMASTER. These products are certified by the DOE 2023 efficiency standards.

Key HVAC systems Companies:

The following are the leading companies in the HVAC systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these HVAC systems companies are analyzed to map the supply network.

· Carrier Corporation

· Daikin Industries, Ltd.

· Fujitsu

· Haier Group

· Havells India Ltd.

· Hitachi Ltd.

· Johnson Controls

· LG Electronics

· Lennox International Inc.

· Mitsubishi Electric Corporation

· Rheem Manufacturing Company

· SAMSUNG

· Trane

About Grand View Research:

Grand View Research, Inc. is a market research and consulting company that provides off-the-shelf, customized research reports and consulting services. To help clients make informed business decisions, we offer market intelligence studies, ensuring relevant and fact-based research across a range of industries, from technology to chemicals, materials, and energy. With a deep-seated understanding of varied business environments, Grand View Research provides strategic objective insights. For more information, visit www.grandviewresearch.com

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Email: sales@grandviewresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology