India Foreign Exchange Market 2024-2032: Industry Growth, Share, Size, Key Players Analysis and Forecast

India Foreign Exchange Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

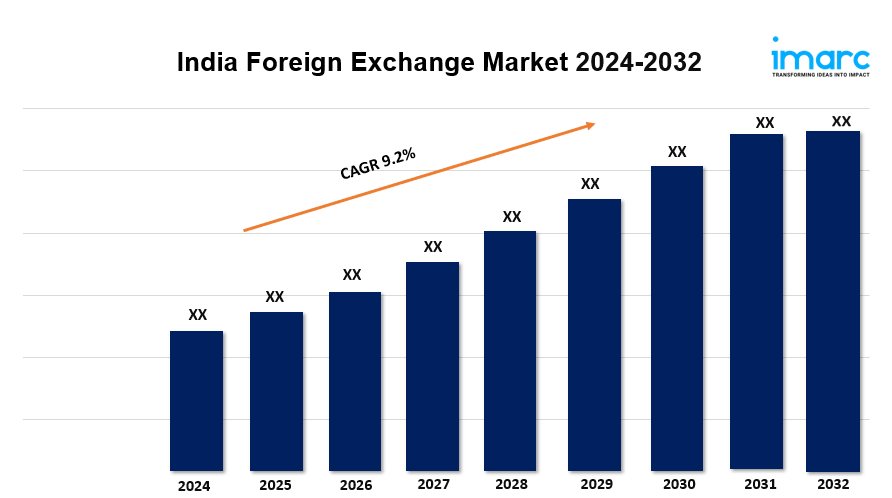

Market Growth Rate: 9.2% (2024-2032)

The India foreign exchange market facilitates currency trading, driven by economic factors, foreign investments, and global trade dynamics. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 9.2% from 2024 to 2032.

India Foreign Exchange Market Trends and Drivers:

The expanding international trade along with high investment activities, making foreign currency transactions essential for businesses and investors, are the factors responsible for the growth of the India foreign exchange market. Additionally, the market is propelling as India experiences significant foreign exchange demand, particularly in sectors like energy, IT services, and pharmaceuticals.

The increasing popularity of foreign direct investment (FDI) and portfolio investments in India also boost the forex market. Besides this, the rising number of Indian companies expanding globally and the growing need for foreign currencies for travel, education, and remittances contribute to the growth of the market. Favorable government policies, such as liberalized norms for foreign investments and trade, further drive forex activity in India.

A key trend in the India foreign exchange market is the adoption of advanced technologies, including online trading platforms and digital payment solutions, which have made forex trading more available and efficient for individuals and businesses. The rise of algorithmic trading with artificial intelligence (AI) is transforming the forex landscape by enabling faster and more accurate transactions.

Furthermore, the initiatives by the Reserve Bank of India (RBI) to promote currency hedging tools and derivatives are helping businesses manage currency risks effectively. Another emerging trend is the growing interest in cryptocurrencies and blockchain technology, which are being explored as potential tools for cross-border payments and reducing transaction costs. These trends, along with the expanding role of fintech in providing forex solutions, are expected to further accelerate the growth of the India foreign exchange market in the coming years.

Request for a sample copy of this report: https://www.imarcgroup.com/india-foreign-exchange-market/requestsample

India Foreign Exchange Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Counterparty:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Breakup by Type:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Breakup by Region:

- South India

- North India

- West & Central India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9345&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- IT, Cloud, Software and Technology